The AUD/JPY currency pair continues to attract attention as it trades modestly lower near 105.65 during Monday’s early European session. Despite short-term softness, the broader technical structure remains constructive, with the cross holding above key support levels. The brokers at Zeyphurs provide a comprehensive breakdown of this topic in this article.

The Japanese Yen (JPY) has found renewed strength amid verbal warnings of potential currency intervention from Japanese authorities, while the Australian Dollar (AUD) consolidates after its recent advance. Overall, price action suggests that the bullish bias remains intact above the 105.50 region, even as near-term risks linger.

Key Points

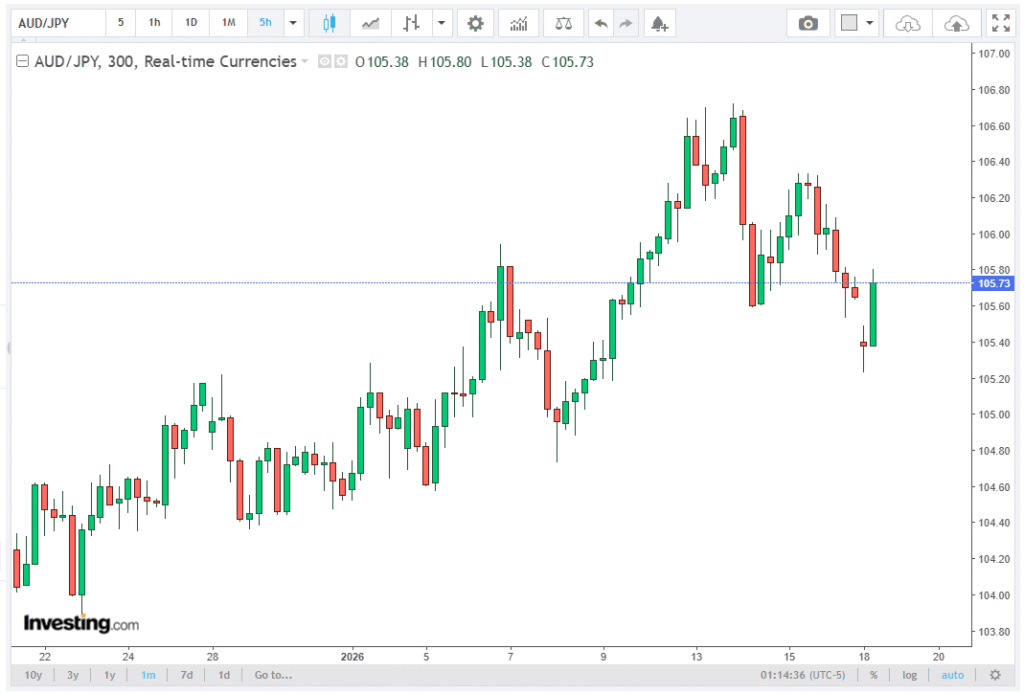

AUD/JPY eases to around 105.65 in early European trading on Monday, as potential Japanese intervention supports the Yen against the Aussie. On the technical side, resistance stands at 106.48, while support near 105.25 may offer near-term buying interest.

Fundamental Drivers: Yen Gains on Intervention Talk

The Japanese Yen strengthens modestly against the Australian Dollar as officials in Tokyo intensify their rhetoric on excessive currency weakness. On Friday, Japan’s Finance Minister Satsuki Katayama stated that she would not rule out any options to counter Yen depreciation, including coordinated intervention with the United States. Such comments typically trigger defensive buying of the JPY, particularly against higher-yielding currencies like the AUD.

Historically, intervention warnings tend to cap upside momentum in JPY crosses, as traders become cautious about pushing the Yen too far. This dynamic has weighed on AUD/JPY in the short term, explaining the mild pullback toward the 105.60–105.70 zone.

Political Uncertainty in Japan: A Double-Edged Sword

While intervention talk supports the Yen, political uncertainty in Japan could limit sustained JPY strength. Speculation surrounding a snap parliamentary election and aggressive fiscal spending plans introduces a layer of market risk. Japanese Prime Minister Sanae Takaichi is reportedly planning to dissolve parliament next week and seek a fresh mandate to push forward her spending agenda.

Such fiscal expansion could increase government borrowing, potentially weighing on the Yen over the medium term. As a result, traders face conflicting forces: short-term JPY support from intervention rhetoric versus longer-term pressure from fiscal and political risks. This balance helps explain why AUD/JPY remains resilient above key technical support, rather than breaking decisively lower.

Technical Analysis: Uptrend Remains Firm

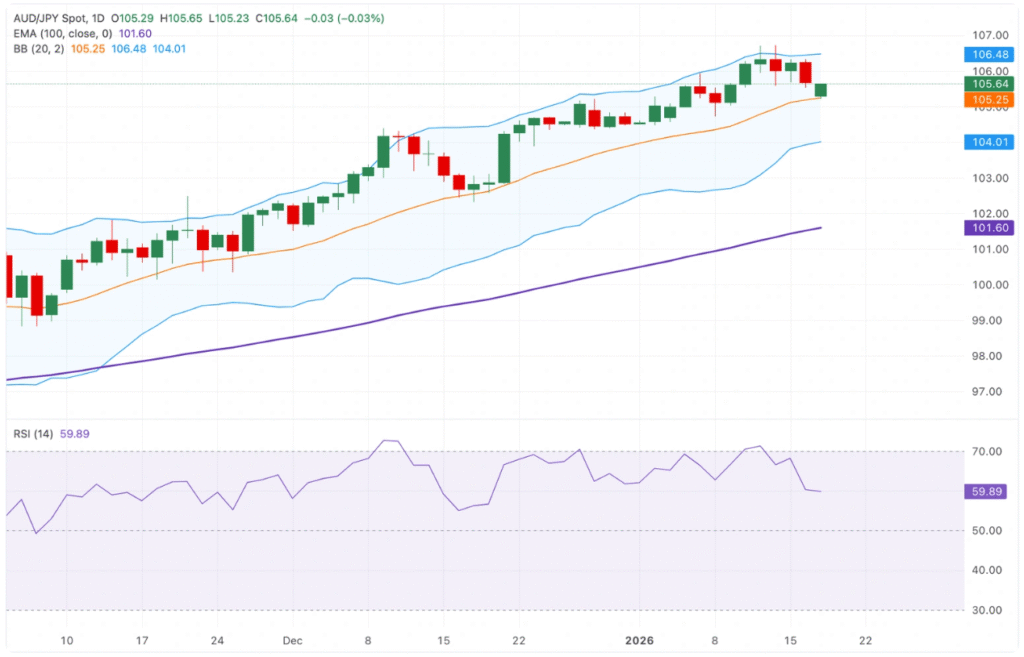

From a technical perspective, the daily chart continues to favor the bulls. The AUD/JPY pair is holding comfortably above the rising 100-day Exponential Moving Average (EMA) at 101.60, a critical level that defines the broader uptrend. The upward slope of the EMA reinforces the idea that buying on pullbacks remains the dominant strategy.

Momentum indicators also support this view. The Relative Strength Index (RSI) stands at 59.89, firmly in neutral-to-bullish territory. This reading suggests steady upside momentum without signaling overbought conditions, leaving room for further gains if resistance levels give way.

Bollinger Bands Signal Potential Breakout

The Bollinger Bands provide additional insight into current market conditions. Price action remains north of the middle Bollinger Band, which coincides with the 20-day moving average at 105.25. This level is particularly important, as it is expected to offer support on pullbacks and provide comfort to buyers looking to re-enter the market.

Notably, the Bollinger Bands have narrowed, a classic signal of reduced volatility. Such compression often precedes a breakout move, suggesting that AUD/JPY could be preparing for its next directional push. As long as the price holds above the middle band, the trend bias remains positive.

Key Resistance and Support Levels

On the upside, the first resistance level emerges at 106.48, which aligns with the upper Bollinger Band. A daily close above 106.48 would likely confirm a bullish breakout, potentially opening the door toward higher psychological levels and extending the broader uptrend.

On the downside, initial support is located at 105.25, followed by a more significant cushion near the lower Bollinger Band at 104.00. A decisive break below the middle band would signal a corrective phase, shifting focus toward the lower boundary of the range. However, unless the price falls below these supports, any dips are likely to be viewed as corrective rather than trend-reversing.

AUD/JPY Outlook: Cautiously Bullish Above 105.50

In summary, while AUD/JPY trades slightly lower near 105.65, the overall outlook remains constructive. Intervention rhetoric from Japan may generate short-term volatility, but technical indicators continue to favor the upside. As long as the pair holds above the 105.25–105.50 support zone, the positive bias remains intact.

A break above 106.48 would reinforce bullish momentum and signal renewed upside potential, whereas a drop below 105.25 would suggest a deeper consolidation. For now, the path of least resistance remains upward, with the broader uptrend firmly supported by moving averages and momentum indicators.