The AUD/USD currency pair has captured the attention of traders this week, as the Australian dollar (AUD) continues to show signs of weakness despite intermittent attempts at recovery.

Technical traders are closely watching recent price action, which suggests that the Aussie could be setting up for a downward move in the near term. The Tarillium team presents a structured and informative breakdown of this matter.

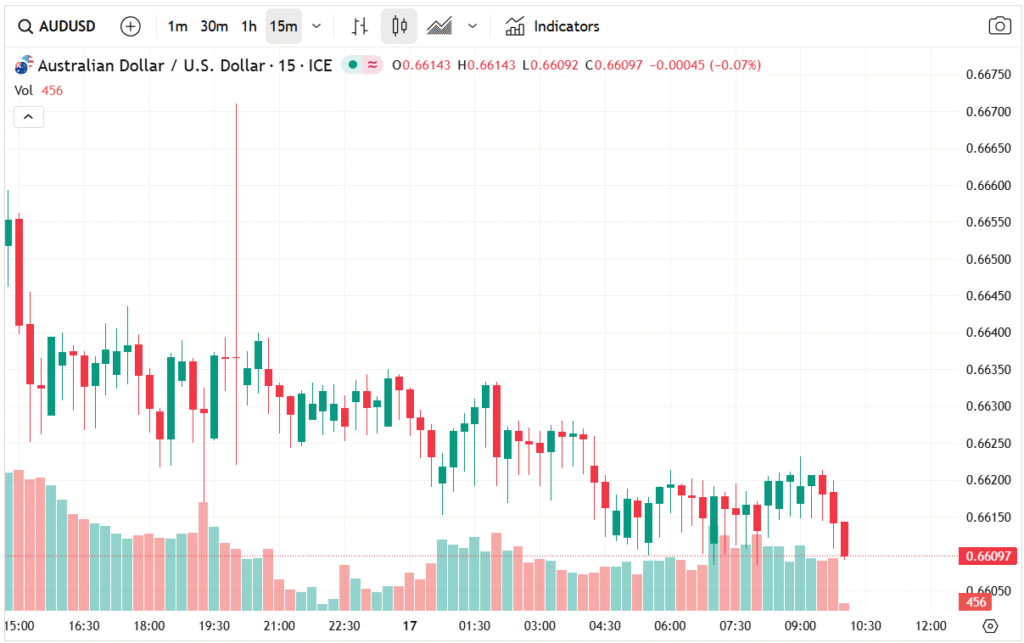

AUD Attempts Rally, But Quickly Reverses

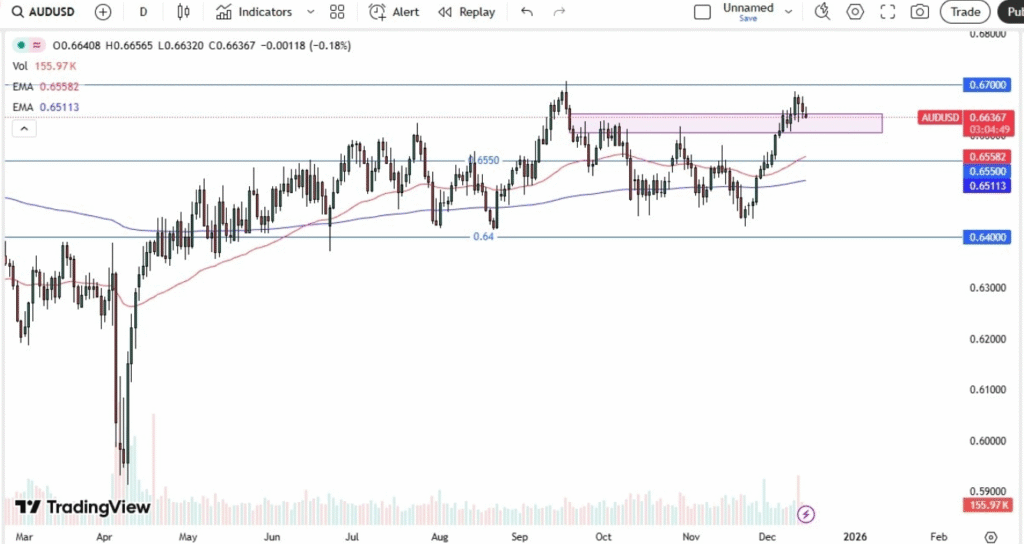

During Monday’s trading session, the AUD initially attempted a rally, testing recent resistance levels. However, these gains were short-lived, and the currency quickly gave back the advance. This price behavior has led to the formation of a potential double top, a technical pattern signaling that the AUD may face persistent resistance around current levels.

The double top formation effectively connects the September highs with the current trading range, suggesting that the 0.67 level remains a significant ceiling for the pair. Traders are therefore considering the short side of AUD/USD, targeting a decline toward 0.6550, where the 50-day EMA resides.

Technical Setup Favors AUD Shorting

From a technical perspective, the Australian dollar is struggling to maintain any meaningful upside momentum. The pair’s failure to break above 0.67 reinforces the notion that this resistance zone is proving difficult to overcome. Combined with the double top, this setup favors short positions for traders anticipating further downside risk.

The 50-day exponential moving average (EMA) at 0.6550 acts as a key support level. A break below this technical threshold could open the door for a more extended bearish trend, with the AUD potentially testing lower areas as global market risk sentiment remains fragile.

AUD Sensitivity to Risk Appetite

The Australian dollar is known for its high sensitivity to risk appetite, which has historically caused it to react strongly to global trade concerns and shifts in commodity demand. Despite generally strong commodity markets recently, the Aussie’s performance remains closely tied to external factors, including economic developments in China, global trade flows, and overall market risk sentiment.

This makes the AUD a laggard currency when compared to other majors, particularly the US dollar (USD). Traders often look to sell AUD against USD, especially when USD selling pressure is insufficient to stimulate a sustainable Aussie rally. Other risk-sensitive currencies, such as the New Zealand dollar (NZD), frequently behave in a similar manner due to comparable commodity exposure and economic reliance on global trade.

Longer-Term Perspective: Consolidation Dominates

Over the longer-term timeframe, AUD/USD has experienced a sideways consolidation since early May. While the pair rallied earlier in the year, gains have largely stalled, and price action has hovered in a narrow range.

This extended period of consolidation suggests that, although there is upside potential, the Aussie has struggled to gain meaningful momentum. Traders observing this pattern may see the current range as a capitulation zone, where selling pressure could increase as resistance persists.

I Still Don’t Like the AUD

From a trader’s standpoint, the AUD has not shown consistent strength relative to other major currencies. Even during periods of USD weakness, the Australian dollar tends to lag, making it a preferred shorting candidate.

It is important to recognize that Australia’s economic outlook is closely tied to global trade and commodity demand, rather than domestic economic growth. While commodity markets have supported the AUD at times, this is often decoupled from broader economic fundamentals, leaving the currency vulnerable to external shocks.

Key Levels to Watch

For traders considering short positions, the following levels are critical: Resistance Zone 0.67, a ceiling that has proven difficult to break; Key Support 0.6550, located near the 50-day EMA and serving as a potential target for short trades; and Breakout Level 0.6750, where a sustained break could trigger a longer-term bullish trend.

The market currently sits in a high-noise zone, with small fluctuations amplified by risk sentiment and speculative positioning. Therefore, careful attention to technical indicators such as moving averages, support/resistance levels, and trend patterns is essential for successful AUD/USD trading.

Outlook: Bearish Bias Prevails

Given the technical setup, sensitivity to global risk, and ongoing consolidation, the AUD/USD outlook remains bearish in the near term. Traders are likely to favor short positions until either the 0.6550 support is decisively broken, confirming further downside, or the 0.6750 resistance is breached, signaling a potential bullish reversal.

Until then, the Australian dollar appears constrained, making shorting opportunities more attractive than attempts to buy the Aussie.

Conclusion

The AUD/USD pair is exhibiting weakness amid a technical setup defined by a double top, stalled rallies, and sensitivity to global risk appetite. Key levels at 0.67 and 0.6550 will guide trading decisions, while the longer-term trend suggests a continued sideways consolidation.