The AUD/USD currency pair is showing signs of weakness, creating a potential trading opportunity for sellers. Technical and fundamental factors indicate that the Australian dollar (AUD) may face further downside against the US dollar (USD).

This article by Orbisolyx professionals provides a detailed technical analysis, highlighting key resistance levels, risk factors, and potential trade setups for market participants.

Current Market Setup: Weakness in the Aussie

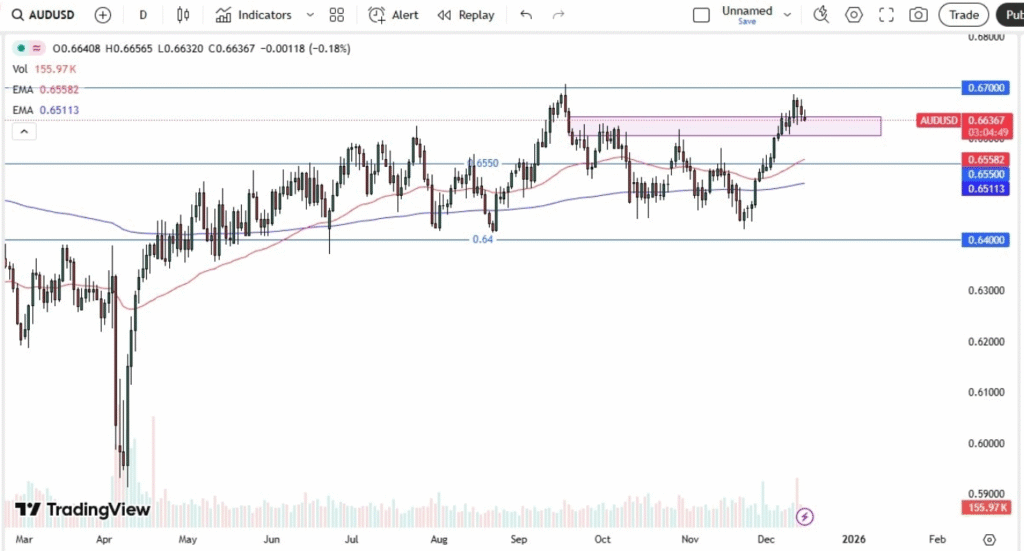

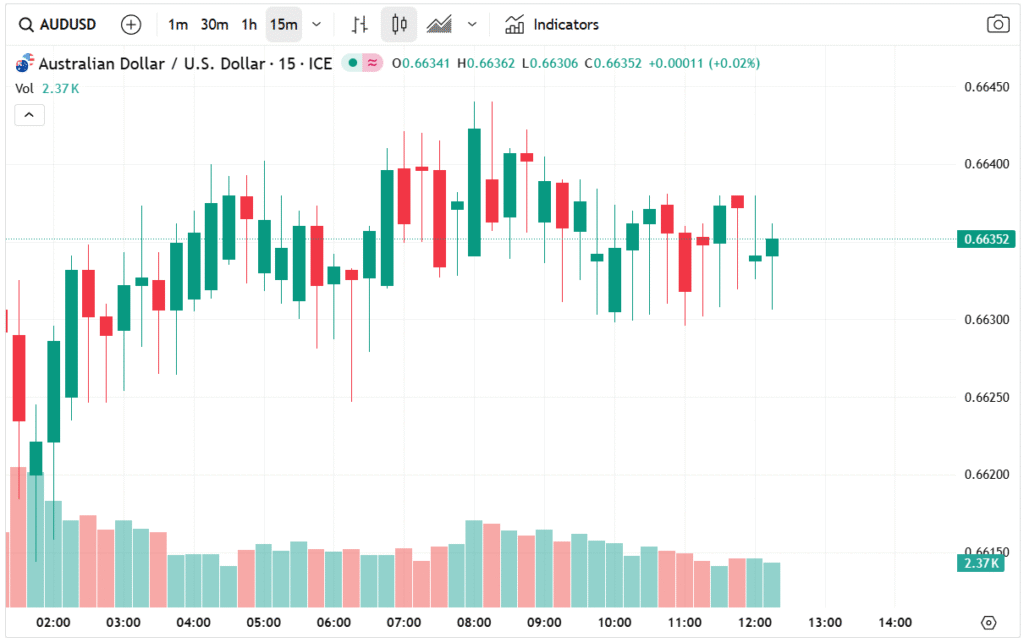

In Monday’s trading session, the Australian dollar initially attempted a rally, but those gains were quickly surrendered. The price action suggests that the AUD is struggling to sustain upward momentum, facing strong resistance near the 0.67 level.

From a technical perspective, the AUD/USD pair appears to be forming a double top pattern, a classic reversal formation, dating back to September highs. This pattern signals potential bearish continuation, as the currency fails to break above key resistance.

At present, a short position seems justified, with a stop loss set at 0.6720 and a target below 0.65, aligning with the 50-day exponential moving average (EMA). Traders should note that the AUD is highly sensitive to risk sentiment and remains exposed to global trade concerns, which could reinforce the bearish outlook.

Technical Analysis: Double Top and Resistance Levels

The double top pattern is significant because it indicates a failure of bullish momentum. When a currency cannot surpass prior highs, it often leads to consolidation or downside moves. In this case, the AUD has repeatedly failed to move above 0.67, creating a resistance ceiling.

Key technical levels to monitor for AUD/USD include resistance at 0.6720–0.6750, support near 0.6550 (close to the 50-day EMA), and an intermediate target around 0.65. The price action near these levels is critical. A break above 0.6750 could signal a long-term bullish reversal, but until then, the bearish bias dominates.

Traders should also note the market noise around the 0.67 area. This region has acted as both resistance and short-term consolidation, making breakout trades challenging. However, the larger trend since May shows that the AUD has been sideways, highlighting the importance of technical confirmation before initiating trades.

Fundamental Drivers: Risk Sensitivity and Global Trade

The Australian dollar is particularly sensitive to global risk appetite. In times of market uncertainty or risk aversion, the AUD tends to underperform, reflecting its commodity-linked and trade-dependent economy.

Key fundamental factors keeping the AUD bearish include global trade concerns, as Australia’s reliance on exports makes its currency sensitive to slower global trade growth; commodity demand, where strong commodity markets have not translated into equivalent economic growth at home; and US dollar strength, as the AUD often lags even when the USD is weak, reflecting structural constraints in the Australian economy.

Given these factors, the risk-reward setup favors selling AUD against USD until technical resistance is decisively broken.

Trading Strategy: Short AUD/USD

Based on current market conditions, the suggested trading plan for AUD/USD is to sell near current levels, with a stop loss placed at 0.6720 and a target around 0.65 or slightly above, near the 50-day EMA.

This strategy aligns with both technical and fundamental analysis, emphasizing risk management. The double top formation, combined with weak relative performance and global trade uncertainty, creates a favorable environment for sellers.

Traders should remain vigilant for breakout scenarios. A sustained move above 0.6750 could invalidate the bearish setup, potentially signaling a long-term bullish trend.

Long-Term Perspective: Why the AUD Remains Vulnerable

From a macro perspective, the AUD continues to underperform other currencies in risk-off environments. Historically, it has acted as a laggard even when the USD weakens, suggesting structural weaknesses.

Australia’s economy remains highly dependent on global trade and commodity exports, leaving the AUD exposed to external shocks. While commodities provide short-term support, they do not necessarily translate into sustainable currency strength.

In addition, the sideways price action since May indicates that the AUD has been in a prolonged consolidation phase, unable to sustain meaningful gains. This lack of momentum reinforces the bearish bias, supporting short positions near current levels.

Conclusion: Bearish Outlook Holds

The AUD/USD pair is showing clear signs of weakness, with technical and fundamental factors favoring sellers. The double top formation, resistance near 0.67, and risk sensitivity to global trade all contribute to a bearish outlook.

For traders, the preferred strategy remains a short AUD/USD position, with a stop loss at 0.6720 and a target near 0.65, aligning with the 50-day EMA. While a break above 0.6750 could shift the outlook to bullish, current conditions favor downside momentum.

The key takeaway: the AUD remains weak, and the market continues to struggle under external pressures, making this an opportune environment for short sellers to consider tactical entries.