The Australian Dollar (AUD) weakened against the US Dollar (USD) on Friday, surrendering early gains as traders awaited the release of the University of Michigan Consumer Sentiment Index for December. In this article, Unirock Gestion brokers examine the key aspects of the topic with clarity.

Despite expectations of Federal Reserve (Fed) rate cuts, the AUD/USD pair traded lower, reflecting the resilience of the US Dollar (USD) and caution among investors in the lead-up to key economic data.

AUD Faces Pressure Despite Strong Credit Growth

The Australian economy showed robust signs in November, with Private Sector Credit rising 0.6% month-over-month (MoM), surpassing forecasts of 0.2%, though slightly down from October’s 0.7% increase. On a year-on-year (YoY) basis, credit growth accelerated to 7.4%, marking the fastest pace since January 2023.

Investor sentiment around the AUD remains cautious. Australia’s Consumer Inflation Expectations climbed to 4.7% in December, up from November’s three-month low of 4.5%, signaling continued inflationary pressures.

This backdrop reinforces the Reserve Bank of Australia’s (RBA) hawkish stance, suggesting that monetary tightening could remain on the table despite global easing trends.

US Dollar Gains Ground Amid Fed Speculation

The US Dollar Index (DXY), reflecting the strength of the USD versus six major currencies, rose to near 98.50. This upward move happened despite expectations of Fed rate reductions, following November’s US CPI report, which showed softer-than-anticipated inflation.

According to the US Bureau of Labor Statistics (BLS), headline CPI slowed to 2.7% YoY, below the consensus of 3.1%, while core CPI, excluding food and energy, rose 2.6%, missing the forecast of 3.0%. Both readings signal cooling inflation pressures, the slowest pace since 2021, and support expectations of a more dovish Federal Reserve stance.

Federal Reserve Governor Christopher Waller, under consideration to become the next Fed Chair, reiterated a patient approach: “Because inflation is still elevated, we can take our time – there’s no rush to get down.

We can steadily bring the policy rate down toward neutral.” Meanwhile, the CME FedWatch tool shows a 72.3% probability of rates being held in January, with a 27.7% chance of a 25-basis-point cut, reflecting uncertainty in the monetary outlook.

US Labor Market and Consumer Demand Signals

The US labor market is gradually cooling. November payrolls rose 64K, slightly above expectations, while October employment was sharply revised lower. The unemployment rate climbed to 4.6%, the highest since 2021. Retail sales remained flat monthly, further signaling a slowdown in consumer demand.

The mixed US economic data underscores the Fed’s challenge in balancing monetary policy. Traders anticipate two rate cuts next year, while some Fed officials see little need for further easing. This split contributes to the US Dollar’s strength, as market participants weigh both inflation trends and policy signals.

RBA’s Hawkish Outlook Supports AUD Fundamentals

In Australia, the RBA continues to maintain a hawkish stance. Analysts from the Commonwealth Bank of Australia and National Australia Bank now expect the RBA to start rate hikes sooner than previously projected, possibly in February 2026. Swaps markets price in a 28% chance of a February hike, rising to 41% in March, and a near-certain probability in August, reflecting persistent inflation and a capacity-constrained economy.

Economic data shows a mixed picture. S&P Global’s preliminary Manufacturing PMI edged up to 52.2 in December from 51.6, while the Services PMI slipped to 51.0 from 52.8. The Composite PMI fell to 51.1 from 52.6, highlighting uneven sectoral momentum.

Meanwhile, the Australian Bureau of Statistics (ABS) reported the Unemployment Rate steady at 4.3%, below forecasts, but Employment Change fell sharply to -21.3K in November from 41.1K in October.

Technical Outlook for AUD/USD

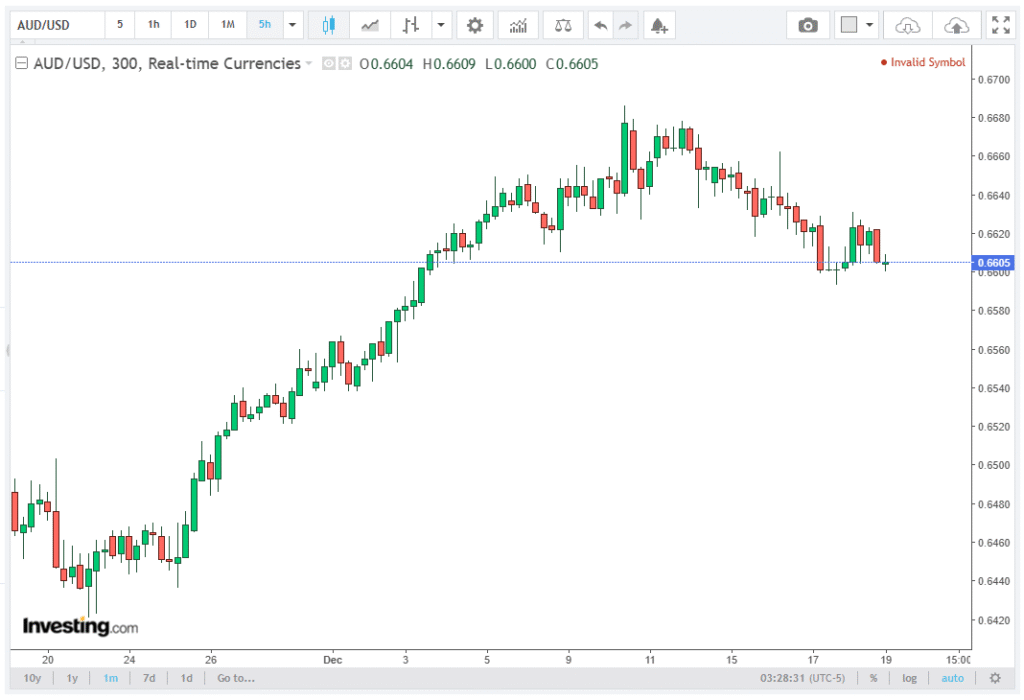

The AUD/USD pair traded below 0.6620, remaining under pressure from the stronger USD. Technical analysis of the daily chart shows the pair below the ascending channel trend, indicating a weakening bullish bias. The nine-day Exponential Moving Average (EMA) sits just above the spot, capping upward attempts.

The 14-day Relative Strength Index (RSI) at 56.76 suggests neutral-bullish momentum, confirming a modest uptrend despite recent pullbacks. A rebound toward the ascending channel could challenge the three-month high of 0.6685, with the next target at 0.6707, marking the highest level since October 2024. On the downside, psychological support is around 0.6500, while the six-month low of 0.6414 serves as a key barrier.

Conclusion

The Australian Dollar remains pressured as the US Dollar advances, driven by robust US economic fundamentals, dovish Fed signals, and soft CPI data. Meanwhile, Australian credit growth and rising inflation expectations support the RBA’s hawkish bias, keeping the AUD/USD trading within a key technical range.