A senior finance analyst at Logirium goes over the dramatic lithium price spike triggered by Chinese supply disruption fears and what it means for electric vehicle economics.

Lithium prices rocketed higher on Wednesday following news that Chinese authorities plan to cancel 27 mining permits in Yichun, a major lithium production center. The announcement sent shockwaves through battery metal markets. Albemarle shares jumped approximately $5.72 in premarket trading as investors repriced supply constraints.

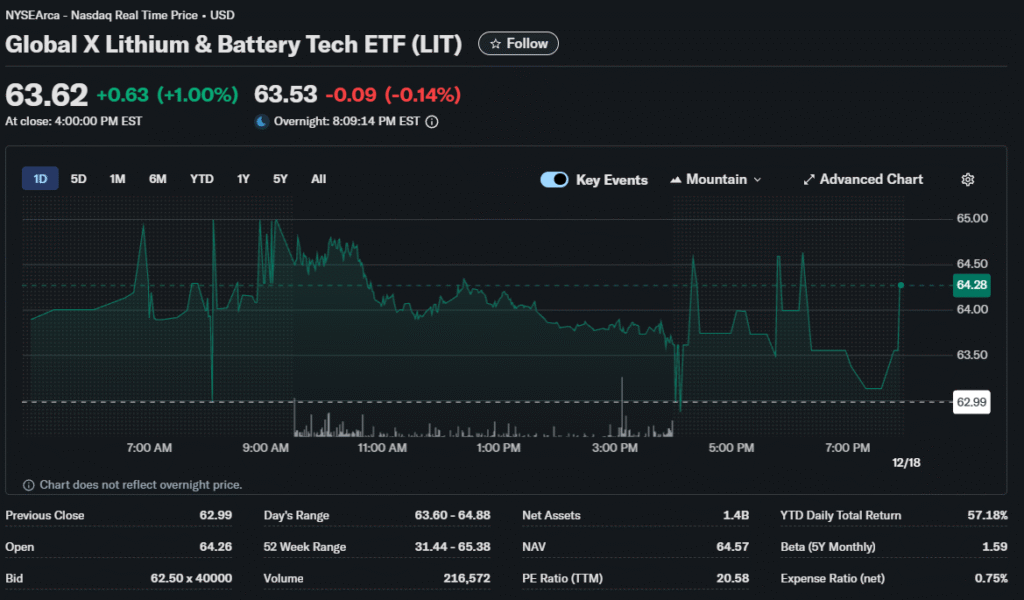

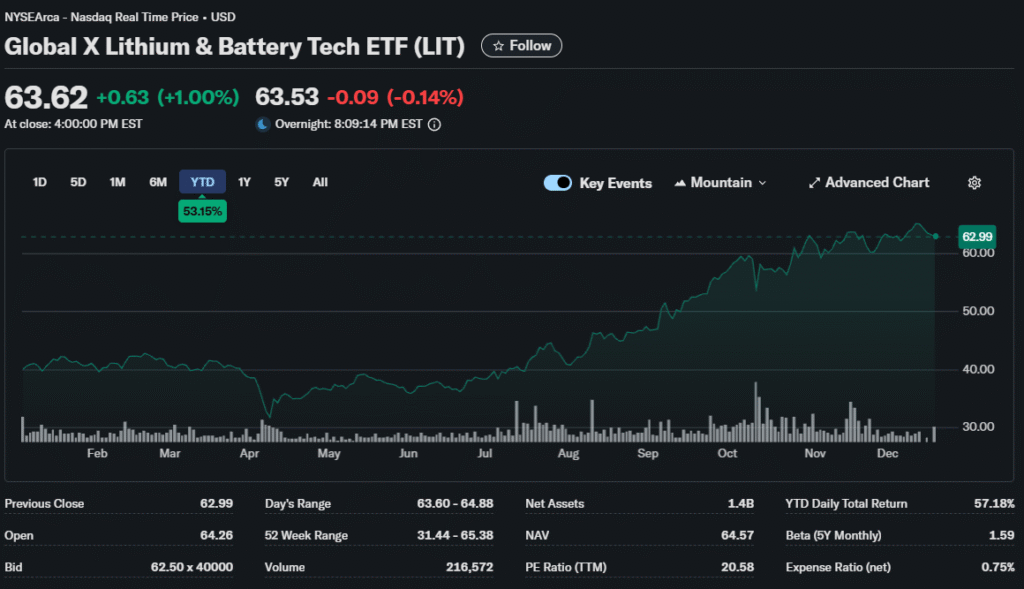

Sociedad Química y Minera de Chile gained $3.10 on the news. The Global X Lithium & Battery Tech ETF surged about $1.35 as the entire sector reacted to potential supply tightening. The moves represent sharp reversals for stocks that had languished amid oversupply concerns.

Supply Shock Mechanics

The Bureau of Natural Resources of Yichun province initiated a public consultation period ending January 22. This procedural step typically precedes formal permit cancellations. Market participants are treating the announcement as a credible threat to supply.

Yichun represents a critical node in global lithium production. The region contains substantial spodumene deposits that feed Chinese processing facilities. Permit cancellations would remove meaningful capacity from already tight markets.

China dominates lithium refining regardless of where the ore originates. The country processes approximately 70% of the global supply into battery-grade chemicals. Any production disruption in Chinese regions cascades through entire supply chains.

Oversupply Narrative Challenged

Lithium prices had collapsed from 2022 peaks as new supply flooded markets. Many analysts predicted extended oversupply would pressure prices through 2026. Wednesday’s developments force reassessment of these bearish forecasts.

Electric vehicle sales growth has moderated from explosive rates but remains substantial. Battery manufacturers consume lithium at an accelerating pace. The gap between supply additions and demand growth had appeared comfortable until this week.

New mining projects face extended development timelines. Permitting processes often require years before production begins. This lead time means the supply can’t respond quickly to price signals.

Environmental Considerations

Chinese authorities increasingly scrutinize mining operations for environmental compliance. The Yichun permit cancellations may reflect tightening environmental standards. Similar pressures affect projects globally as regulators respond to sustainability concerns.

Lithium extraction carries a meaningful environmental footprint. Water usage in evaporation ponds and chemical processing creates local impacts. Communities near mining sites have grown more vocal about these effects.

The transition to electric vehicles paradoxically depends on mining expansion that faces environmental opposition. This tension creates uncertainty about long-term supply adequacy regardless of current price levels.

Investment Implications

Albemarle operates as the largest Western lithium producer. The company benefits directly from higher prices through improved margins. Recent stock weakness has created an opportunity for investors willing to bet on supply constraints.

The Chilean producer SQM provides significant global capacity. Its stock performance tracks lithium prices closely. Wednesday’s surge reverses months of underperformance relative to broader markets.

Junior miners with development projects saw dramatic percentage gains. These smaller companies often trade as options on lithium prices. Leveraged exposure to commodity moves creates outsized stock reactions.

Battery Cost Dynamics

Lithium represents roughly 15-20% of battery cell costs, depending on chemistry. Price increases flow through to electric vehicle economics with some lag. Automakers had benefited from falling battery costs throughout 2025.

Car manufacturers lock in battery supply through long-term contracts. These agreements provide some insulation from spot price volatility. However, contract renewal negotiations will reflect higher market prices.

The Inflation Reduction Act provides subsidies that cushion consumers from battery cost increases. However, these incentives face political uncertainty. Any reduction in support would compound lithium price impacts.

Technology Response

Higher lithium prices accelerate the development of alternative battery chemistries. Sodium-ion batteries offer a cheaper option for certain applications. Technology improvements continue to reduce costs despite inferior energy density.

Lithium iron phosphate batteries use less lithium than nickel-based alternatives. Chinese manufacturers have scaled this technology successfully. Market share gains for LFP batteries could moderate lithium demand growth.

Battery recycling economics improve as raw material prices rise. Recovering lithium from used batteries becomes more economically attractive. However, recycling capacity requires years to scale meaningfully.

Geopolitical Dimensions

Western nations seek to reduce dependence on Chinese lithium refining. Government support flows to domestic processing projects. These strategic initiatives face higher costs than Chinese operations.

Australia produces substantial lithium ore but ships most to China for processing. Developing local refining capacity could reshape trade flows. However, capital requirements and technical expertise are concentrated in China currently.

Chile and Argentina contain massive lithium reserves in salt flats. Political stability and investment climate vary considerably across jurisdictions. Mining companies balance resource quality against political risk.

Near-Term Outlook

The January 22 consultation deadline looms as a key catalyst. Actual permit cancellation would confirm supply constraints. Markets will parse regulatory announcements carefully for production impact estimates.

Winter weather typically slows lithium production in certain regions. Seasonal patterns combined with permit uncertainties could tighten near-term availability. First-quarter pricing will test whether Wednesday’s surge persists.

The disconnect between lithium equity performance and underlying commodity prices may narrow. Stocks had significantly underperformed lithium spot prices. Realignment could drive further equity gains independent of additional price increases.