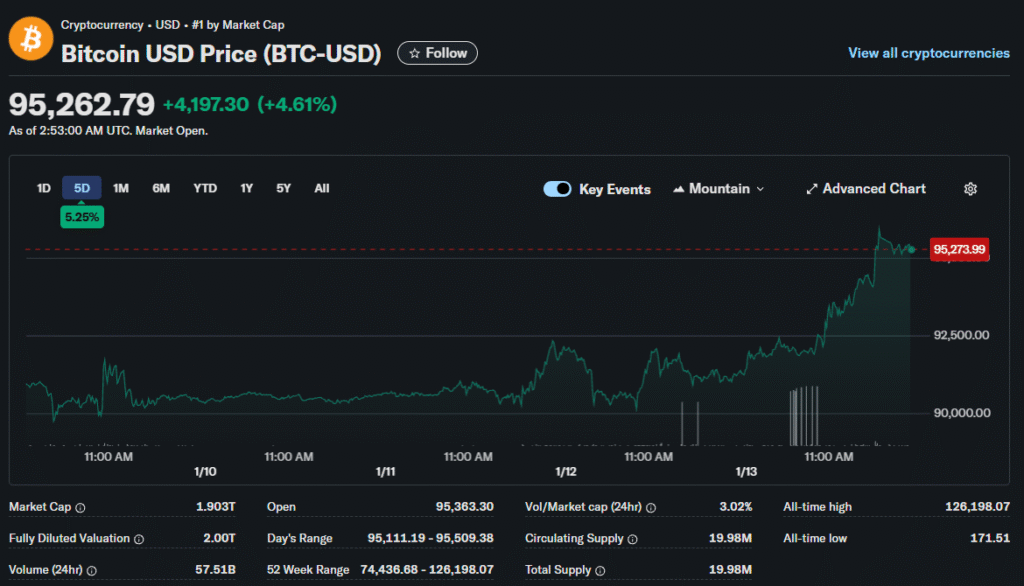

The anticipated Wednesday ruling could reshape presidential authority and trade regulation. Yet digital assets showed remarkable composure during the waiting period. Bitcoin maintained stability above $90,500 despite legal uncertainty surrounding tariff policies, notes Rivonsphere lead broker.

Supreme Court Stakes

The tariff case examines presidential powers under the International Emergency Economic Powers Act of 1977. This legislation originally addressed national security emergencies rather than broad trade policy. The court’s interpretation could limit executive authority over import duties.

A restrictive ruling might force Congress to approve future tariff implementations. The decision affects government revenue projections and corporate cost structures. Companies facing tariff charges could potentially seek refunds depending on the outcome.

International trade relationships hang in the balance as global partners watch closely. The ruling sets precedent for how future administrations approach trade policy. Market participants recognize the decision carries implications beyond immediate tariff disputes.

Crypto Market Detachment

Bitcoin’s muted response contrasts with traditional market volatility around policy uncertainty. The cryptocurrency traded in a tight range between $85,000 and $90,000 for two weeks. This consolidation period suggests investors await clearer directional catalysts.

Bollinger Bands narrowed to their tightest levels since July. Historical patterns show that similar squeezes often precede significant price movements. The direction remains uncertain but magnitude could be substantial.

Institutional Buying Patterns

Wall Street analysts maintained optimistic outlooks despite recent price weakness. Bernstein declared the $80,000 level from late November as the market bottom. The firm pointed to institutional demand as the primary driver for future appreciation.

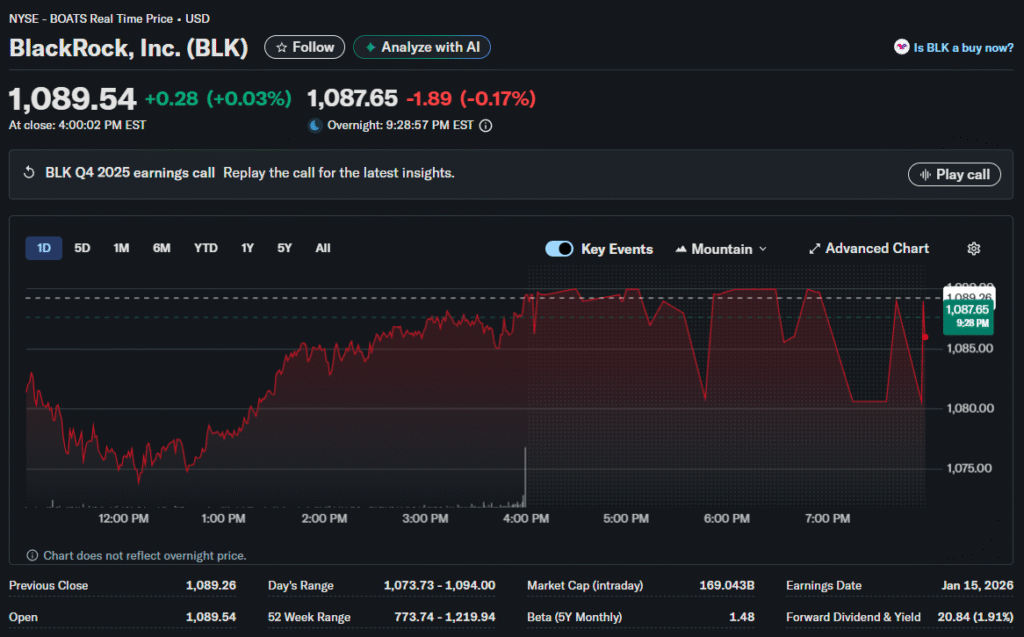

Traditional four-year cycle concerns were dismissed as outdated given structural market changes. Exchange-traded funds hold over $100 billion in Bitcoin-backed assets. BlackRock’s iShares Bitcoin Trust alone manages $67 billion in client funds.

This capital represents long-term strategic allocations rather than speculative trading positions. Professional asset managers conduct extensive due diligence before committing pension fund capital. Their participation signals maturation beyond retail speculation into mainstream financial infrastructure.

Exchange Flow Dynamics

On-chain data reveals significant Bitcoin withdrawals from centralized exchanges during recent weeks. Investors moved over 45,000 BTC into cold storage wallets signaling long-term holding intentions. This pattern typically precedes supply squeezes as available trading inventory diminishes.

Exchange balances declined to levels not seen since early 2025 when Bitcoin surged past six figures. Lower exchange inventory limits selling pressure during market stress periods. The metric suggests conviction among holders despite sideways price action.

Thursday saw investors sell another $400 million in exchange-traded funds backed by Bitcoin. However, this outflow pales compared to the $100 billion total assets under management. Short-term redemptions reflect profit-taking rather than fundamental sentiment shifts among institutional allocators.

Price Target Spectrum

Forecasts for 2026 range from $75,000 to $225,000 depending on analyst assumptions. Standard Chartered revised its target down to $150,000 from a previous $300,000 estimate. The bank cited reduced buying from digital asset treasury companies.

These entities face valuation pressures that limit further Bitcoin accumulation. Some analysts expect double-digit gains while others anticipate continued consolidation. Federal Reserve rate policies feature prominently in bullish scenarios.

Carol Alexander from University of Sussex predicts a high-volatility range between $75,000 and $150,000. She expects the center of gravity around $110,000 as markets digest institutional liquidity. Lower interest rates could support cryptocurrency prices by reducing opportunity costs.

Liquidity Dynamics

Federal Reserve balance sheet expansion and Treasury General Account drawdowns support optimistic cases. These technical factors inject liquidity into financial markets regardless of economic fundamentals. Bitcoin often responds positively to monetary expansion cycles.

The cryptocurrency’s fixed supply contrasts with expanding fiat currency bases. Daily trading patterns showed improved performance versus equities in early January. This relative strength suggests accumulation by informed participants.

Regulatory Crosscurrents

The Supreme Court tariff ruling carries indirect implications for cryptocurrency regulation. Limits on executive authority could affect how agencies approach digital asset oversight. Regulatory clarity remains a persistent concern for institutional adopters.

Legal frameworks influence allocation decisions by pension funds and endowments. Bitcoin’s status as a commodity provides some protection from securities laws. However, broader crypto market dynamics depend on evolving enforcement approaches.

Volatility Outlook

Tight trading ranges rarely persist indefinitely given Bitcoin’s historical price behavior. The current consolidation mirrors April 2025 conditions that preceded a surge above $126,000. Whether history repeats depends on catalyst timing and direction.

Geopolitical tensions and monetary policy remain primary drivers. Markets price in elevated uncertainty through options markets and derivatives positioning. Implied volatility suggests participants expect significant moves within coming weeks.

Traders positioned for breakouts in either direction as volatility compression reached extremes. Options activity shows bets on large moves without consensus about direction. This setup creates potential for rapid price acceleration once the consolidation breaks.

Market Structure Evolution

The shift from retail to institutional participation fundamentally changed Bitcoin’s market dynamics. Long-term strategic allocations provide stability compared to speculative trading flows. This maturation process reduces volatility while supporting higher baseline prices.

Professional investors bring different time horizons and risk management approaches than early adopters. Market infrastructure improvements enable larger position sizes with better execution quality. These developments support continued institutional adoption throughout 2026 and beyond.