Bitcoin (BTC) trades lower on Tuesday, slipping nearly 3% over the past 24 hours to around $87,000, as traders turn cautious ahead of several high-impact macroeconomic releases.

Market participants are reassessing risk exposure as upcoming U.S. labor market data could reshape expectations around the Federal Reserve’s interest rate path, a critical driver for crypto assets. Servelius experts offer a detailed and insightful analysis of the subject in their latest piece.

The recent pullback reflects broader uncertainty rather than panic, with volumes thinning and price action tightening as investors await clarity. BTC remains sensitive to monetary policy expectations, especially after last week’s 25 basis point rate cut by the Fed.

NFP in Focus: Labor Market Weakness in the Spotlight

Attention is firmly on the U.S. nonfarm payrolls (NFP) report, scheduled for release at 13:30 GMT. The data is delayed, covering November along with partial October figures. Expectations point to 50,000 jobs added, a sharp slowdown compared with 119,000 in September. Meanwhile, the unemployment rate is forecast to remain steady at 4.4%.

Such figures would reinforce the narrative of a cooling U.S. labor market, supporting the Fed’s recent pivot toward easing. The central bank cited softening employment conditions as a key reason for last week’s rate cut, despite lingering concerns about sticky inflation.

According to the CEM FedWatch tool, markets are currently pricing in a 75% probability that the Federal Reserve will hold rates steady at the January meeting. However, a weaker-than-expected NFP print could revive rate-cut expectations, potentially acting as a tailwind for Bitcoin. Notably, there is one more jobs report before the January 28 Fed meeting, keeping uncertainty elevated.

Packed Macro Calendar Raises Volatility Risks

Beyond NFP, traders face a data-heavy week. U.S. retail sales and CPI inflation data are due on Wednesday and Thursday, respectively. These releases will offer deeper insight into consumer demand and inflation dynamics, both critical for shaping monetary policy expectations.

Adding to global uncertainty, the Bank of Japan (BoJ) rate decision is scheduled for Friday. Any shift in BoJ policy could ripple through FX markets, bond yields, and risk assets, indirectly impacting Bitcoin sentiment. With multiple catalysts lined up, volatility risks remain skewed to the upside.

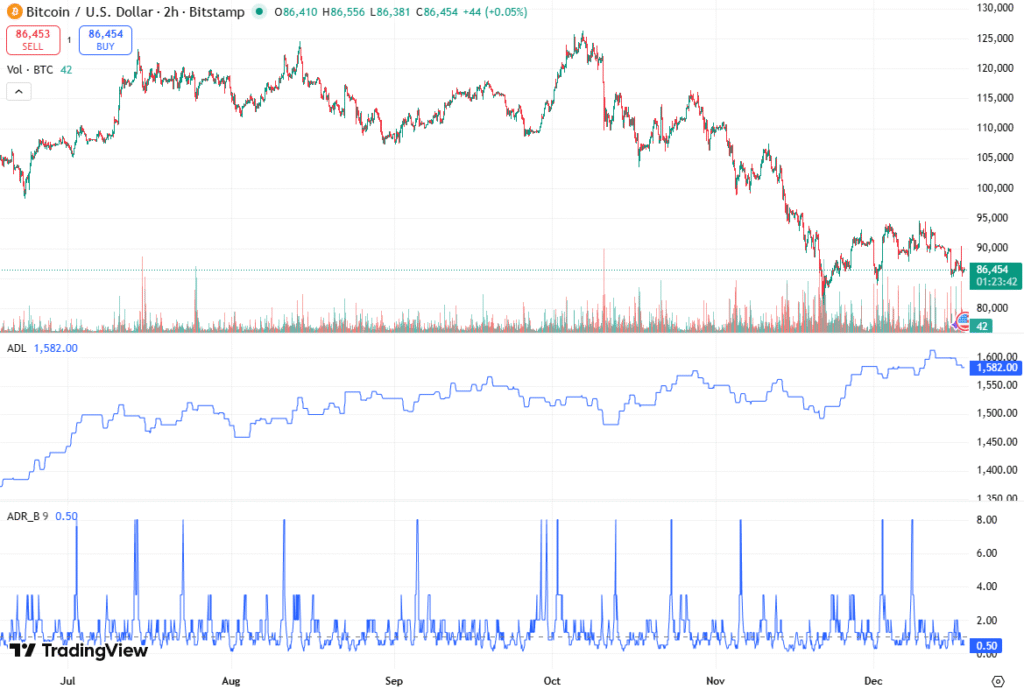

On-Chain Dynamics: Sharks Accumulate, Whales Distribute

On-chain data reveals a clear divergence in investor behavior. According to Glassnode, Bitcoin sharks, wallets holding between 100 and 1,000 BTC, have increased holdings by 54,000 BTC over the past seven days. Total shark holdings climbed from 3.521 million BTC to 3.575 million BTC, marking the most aggressive accumulation since 2012.

This activity signals strong bullish conviction among mid-sized holders, even as BTC experiences a 30% drawdown from recent highs. Historically, such accumulation phases have preceded longer-term recoveries.

However, this bullish signal is being offset by persistent sell pressure from institutions and large whales. BTC ETFs recorded $357.7 million in net outflows on Monday, the largest single-day outflow since November 20. December ETF outflows now stand at $158.8 million, following a hefty $3.48 billion in November.

Meanwhile, whales holding over 10,000 BTC, including OG whales and long-term holders, have driven much of the selloff over the past two months. Distribution at this scale has not been seen in years, suggesting profit-taking and risk reduction. Until this pressure eases, Bitcoin upside may remain capped.

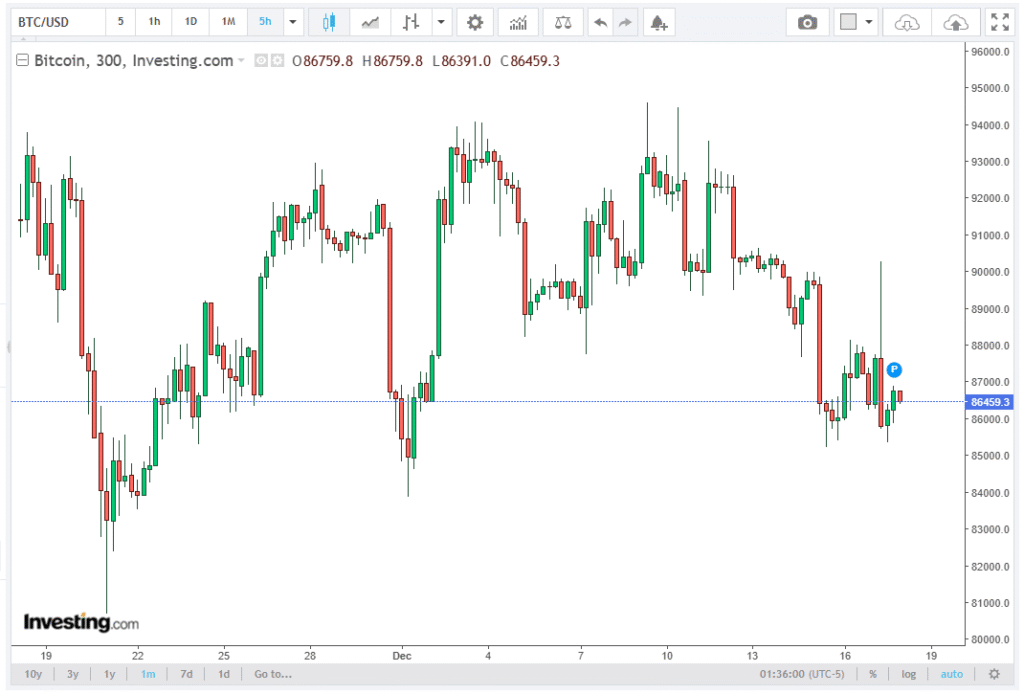

Bitcoin Technical Analysis: Bears Still in Control

From a technical perspective, BTC/USDT continues to trade within a falling channel that has been intact since early October. Price action remains below both the 50-day and 200-day simple moving averages (SMA), reinforcing the bearish trend structure.

BTC recently faced rejection near $94,000, before rolling over to test the 78.6% Fibonacci retracement at $85,000. The Relative Strength Index (RSI) remains below 50, indicating that sellers retain momentum.

A decisive break below $85,000 would likely open the door toward $80,000, a key psychological level, the November low, and the mid-point of the falling channel. Below this, attention turns to $74,400, the 2025 low, which would mark a deeper corrective phase.

On the upside, if $85,000 support holds, buyers could attempt a rebound toward $90,000. However, a break and close above $94,000, the 78.6% Fib level, is required to establish a higher high. Such a move would shift momentum and bring the $100,000 milestone back into focus.

Outlook: Macro Data Holds the Key

In the near term, Bitcoin’s direction hinges on macroeconomic signals, particularly NFP, CPI, and retail sales. While on-chain accumulation by sharks provides a constructive longer-term signal, whale and institutional selling, combined with fragile technicals, suggest continued caution. Until clarity emerges from the data, BTC is likely to remain volatile and range-bound, with risks finely balanced on both sides.