The cryptocurrency market continues to display stark contrasts among its major players. While Bitcoin (BTC) maintains relative stability near key price levels, Solana (SOL) teeters on critical support thresholds, raising concerns among traders and investors.

This technical analysis explores market dynamics, price action, and the underlying forces shaping the crypto landscape. Aurudium professionals simplify complex ideas through a detailed and accessible analysis.

Market Overview

The crypto market capitalization has fallen to $2.91 trillion, down 2.4% over the past 24 hours. A surge at the start of the US trading session on Wednesday briefly lifted sentiment but ultimately fueled bearish pressure, driving the market to intraday lows of $2.89 trillion. By the end of the session, the market recovered slightly but remained near its weakest points.

Under this intense downward pressure, major altcoins, including Ethereum (ETH), XRP, and Solana (SOL), retreated to multi-month lows, losing roughly 4% in a single day. In contrast, Bitcoin has demonstrated a more resilient price action, trading near $87,000, effectively holding steady from the previous day.

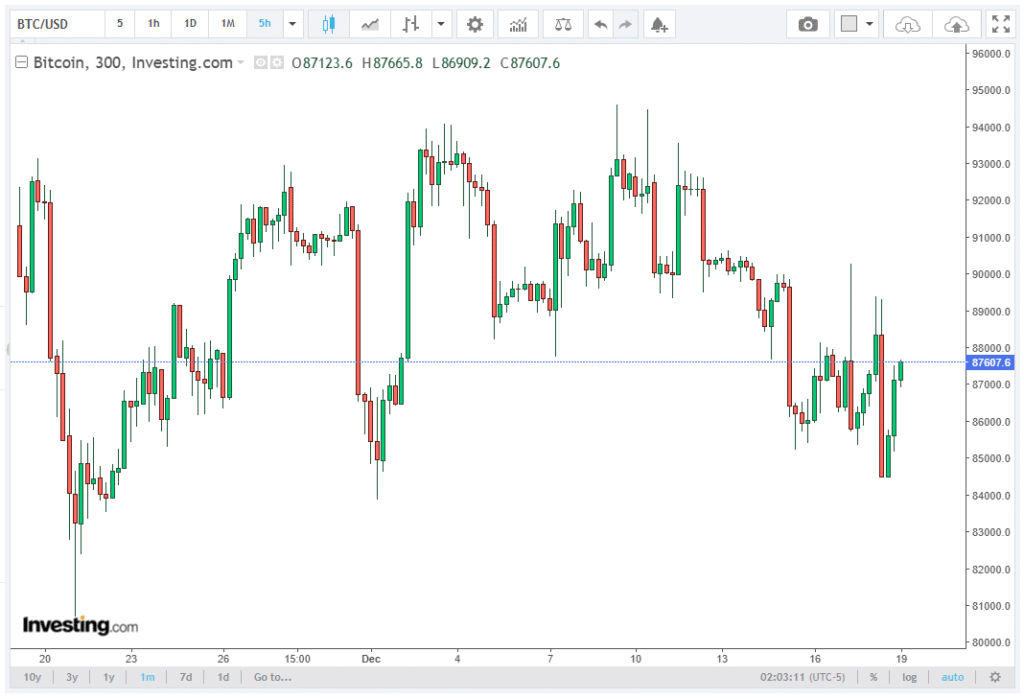

The crypto market is currently grappling with a resistance-congestion zone just above $90,000 for BTC, which halted the recent upward movement. Meanwhile, a strong support level around $85,000 has absorbed selling pressure, allowing Bitcoin to rebound after recent dips. Comparatively, altcoins are underperforming, with many trading significantly below their late-November highs, highlighting the divergence between BTC and the broader market.

Bitcoin Technical Outlook

Bitcoin has shown remarkable resilience in recent sessions. Following a sharp jump above $90,000, the asset encountered a wall of selling, establishing a short-term resistance line just above this round number. Interestingly, this level previously acted as support until 14 December, suggesting a key pivot point in the near term.

From a technical standpoint, BTC’s ability to hold above $85,000 demonstrates the strength of accumulated buying pressure. This price range has repeatedly absorbed selling, serving as a launching pad for potential rebounds. Moreover, Bitcoin remains well above its late November lows of $80,000, indicating its outperformance relative to major altcoins.

Additional bullish signals are emerging from institutional participation. Capriole reports that demand from institutional investors now exceeds miner inflows, a scenario not seen since November. This trend suggests that BTC supply is becoming more constrained, which could support price stability in the near term.

Solana Under Pressure

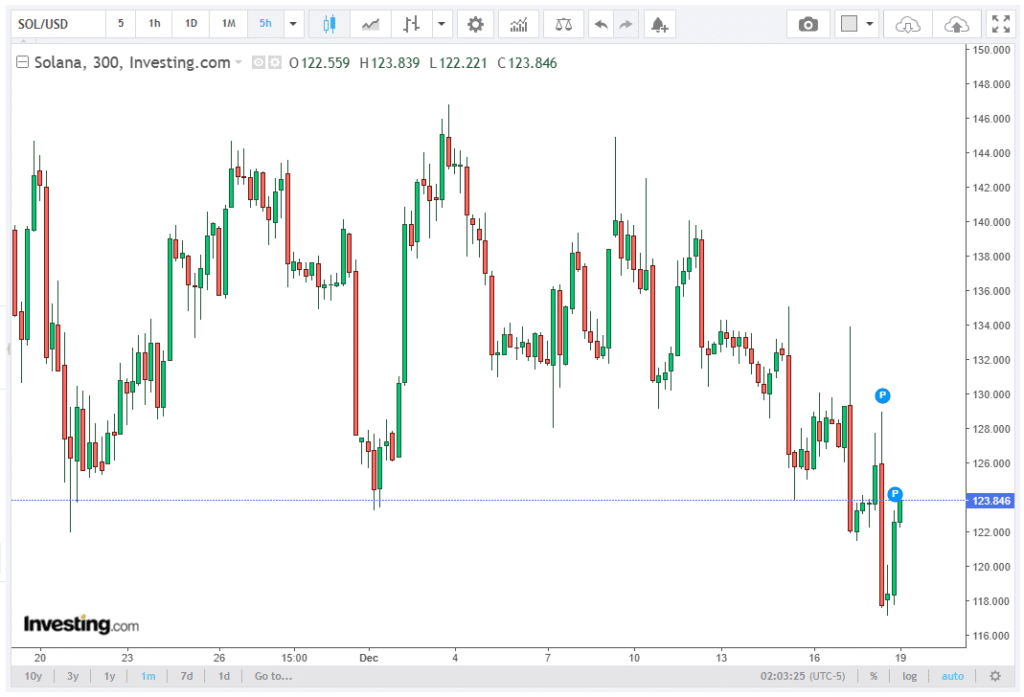

In contrast, Solana (SOL) faces a precarious situation. Its price recently declined to $123, testing a critical support area established in March 2024. Since its all-time high in September, SOL has lost 50% of its market value, reflecting both market-wide and project-specific weaknesses.

The technical rebound that began at the end of November has now ended, signaling that upward momentum has stalled. Should the $120 support level fail, the path toward $90 or even $70 opens up, highlighting the vulnerability of SOL compared to BTC and other major altcoins.

This downward trajectory is concerning for traders relying on momentum strategies, as SOL is approaching historically sensitive demand zones. The risk of further capitulation is increasing if buyers fail to step in at these levels.

News Background

Recent market research suggests reasons for the differing dynamics between BTC and altcoins. K33 Research notes that long-term Bitcoin holders have nearly completed their active selling phase, which could reduce downward pressure in the coming weeks. Over the past two years, 20% of the total supply has returned to the market, a process now approaching completion.

Institutional behavior further strengthens Bitcoin’s position. Strategy, a leading investment firm, has reportedly purchased 641 BTC daily in 2025, boosting its holdings by 223,800 BTC, a 50% increase in less than a year, according to Finbold Research. These accumulations illustrate strong conviction among institutional buyers, creating a floor for BTC prices.

Key Takeaways for Traders

Key Takeaways for Traders: Bitcoin remains resilient, trading above $85K with resistance near $90K. Long-term support levels and institutional accumulation suggest a potential stabilization period. Solana is at a critical juncture, testing $123 support; failure to hold this level may trigger further declines toward $90 or $70, making risk management essential for SOL traders.

Altcoins broadly underperform BTC, reflecting divergent market sentiment and concentrated interest in established digital assets. Market capitalization volatility highlights bearish pressure, though selective rebounds, especially in BTC, may offer short-term trading opportunities.

Conclusion

The current market environment underscores the divergence between Bitcoin and altcoins. While BTC demonstrates stability, institutional demand, and technical support, Solana’s sharp decline and failure to sustain rebounds highlight increased downside risk. Traders and investors should closely monitor support and resistance levels, particularly around $85K for BTC and $120 for SOL, as these will likely dictate near-term price action.

As market participants evaluate risk, Bitcoin’s resilient performance contrasts sharply with Solana’s precarious position, illustrating the evolving dynamics within the cryptocurrency market.