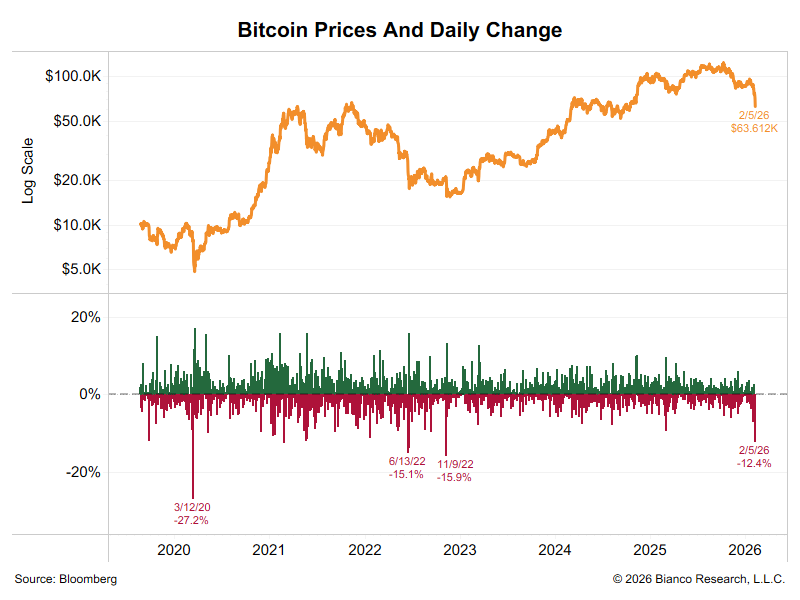

Bitcoin touched $60,008.52 on Friday morning, marking its lowest point since October 2024 and triggering widespread alarm across cryptocurrency markets. The plunge erased gains accumulated since the U.S. presidential election and exposed vulnerabilities in the digital asset’s supposed safe-haven status. Market strategists at Yureplex analyzed the breakdown as Bitcoin shed 16% for the week and 27% year-to-date.

The selloff coincided with a broader flight from risk assets as technology stocks crumbled and precious metals whipsawed. What makes Bitcoin’s collapse particularly striking is the context: political support, regulatory clarity, and institutional adoption were supposed to create a durable floor. Instead, the cryptocurrency behaved like a leveraged tech stock.

The Unwinding Begins

Chris Weston, head of research at Pepperstone, noted that crowded positions are liquidating rapidly. Bitcoin had been declining since October 2025, potentially serving as an early warning signal for broader market stress. Ether fared worse, dropping to a 10-month low of $1,751.94 before recovering slightly.

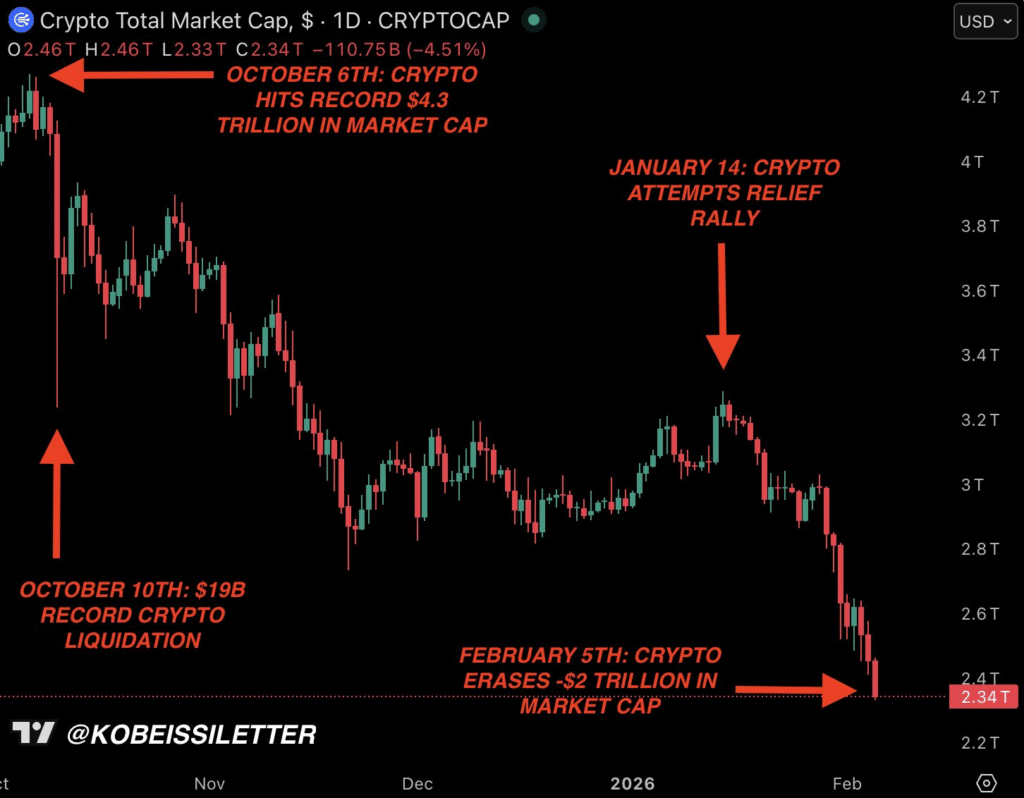

The global crypto market capitalization collapsed from $4.379 trillion in early October to roughly $2.379 trillion by Friday, destroying $2 trillion in value. More than $1 trillion evaporated in January alone, underscoring the brutal acceleration of losses.

Leverage Comes Home to Roost

Financial analysts point to leverage as the primary culprit. Treasuries and hedge funds treated Bitcoin as a one-way asset, borrowing heavily to amplify returns during the rally. Risk management took a backseat to momentum chasing.

Joshua Chu, co-chair of the Hong Kong Web3 Association, emphasized that Bitcoin’s approaching $60,000 doesn’t signal crypto’s death but rather the consequences of excessive leverage. When positions built on borrowed money and blind optimism unwind, corrections are swift and merciless.

The comparison to gold and silver proves instructive. These self-proclaimed safe havens also crashed when leverage ratios exceeded prudent levels. Narrative-driven investing without proper risk controls creates fragility regardless of the underlying asset.

ETF Outflows Tell the Story

January saw more than $3 billion flee U.S. spot Bitcoin ETFs according to Deutsche Bank figures, extending a troubling pattern that included $2 billion in December exits and $7 billion in November withdrawals. The sustained exodus contradicts earlier predictions that institutional products would stabilize Bitcoin prices through diversified, long-term holders.

Instead, ETFs appear to have channeled retail speculation into more efficient liquidation mechanisms. When sentiment sours, investors can exit positions instantly during market hours rather than navigating cryptocurrency exchanges. This liquidity cuts both ways, accelerating drawdowns as well as rallies.

Political Promises Meet Market Reality

The irony is impossible to ignore. Bitcoin’s surge followed promises to make America the crypto capital of the world. Regulatory approvals flowed, institutional products launched, and optimism peaked. Yet political support proved irrelevant when margin calls arrived.

Markets don’t care about presidential endorsements or regulatory frameworks when risk appetite evaporates. Bitcoin’s 50% decline from peak levels demonstrates that fundamental supply-demand dynamics ultimately govern prices. Hype creates rallies; liquidations create crashes.

Precious Metals Parallel

The simultaneous collapse in gold and silver provides context. These markets, far more mature than crypto, still suffered extreme volatility when speculative flows turned. Gold dropped the most since 2013, while silver saw its biggest daily decline ever on January 30.

If centuries-old safe-haven assets can crash this violently, expecting stability from a 15-year-old cryptocurrency seems naive. Bitcoin’s correlation with risk assets rather than defensive positions further undermines safe-haven narratives.

China’s Vanishing Bid

Chinese buying, which helped propel the January rally, disappeared last week. Shanghai Futures Exchange open interest hit year-low levels, signaling mass position exits. The Lunar New Year holiday, beginning February 1,6 compounds the problem as traders traditionally reduce exposure beforehand.

Chinese prices flipped to a discount against international benchmarks, eliminating arbitrage opportunities that previously supported prices. Without this source of demand, Bitcoin struggled to find buyers willing to defend the $60,000 level.

Volatility Feeds on Itself

Market makers widened spreads and reduced balance sheet commitments as volatility spiked. This behavior creates a feedback loop where thin liquidity enables larger price swings, which in turn scare away liquidity providers. The cycle continues until exhaustion or forced stabilization occurs.

Ole Hansen at Saxo Bank warned that volatility risks feed on themselves until order returns. The question is how much damage occurs before equilibrium emerges.

Lessons for Leveraged Believers

Investors who borrowed excessively or assumed prices would only rise now face harsh lessons in actual volatility. Paper losses become realized losses when leverage forces liquidations regardless of long-term conviction.

The crypto market has struggled for months since the October crash. Sentiment cooled as reality replaced euphoria. Institutional adoption and political support matter, but they don’t eliminate cyclical risk or justify ignoring fundamentals.

What $60,000 Means

The $60,000 level represents more than technical support. It’s the price where many institutional buyers first entered via ETFs. Breaking this threshold triggers psychological as well as financial damage.

If Bitcoin stabilizes and recovers, it validates the asset class’s resilience. If support fails decisively, a deeper capitulation may follow as remaining bulls reassess their thesis. Markets are testing which scenario plays out, and Friday’s action suggests the battle continues.