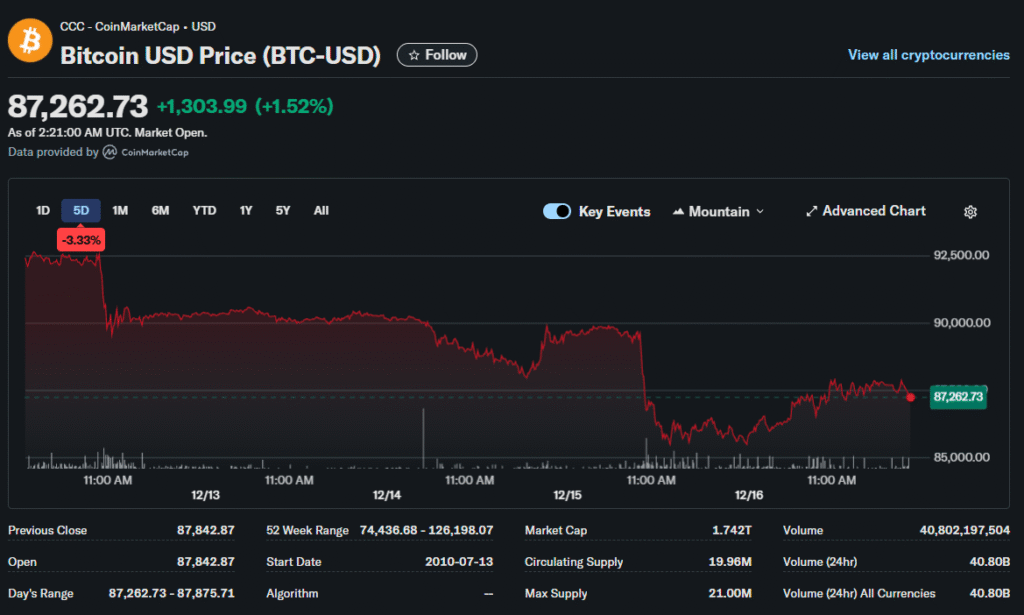

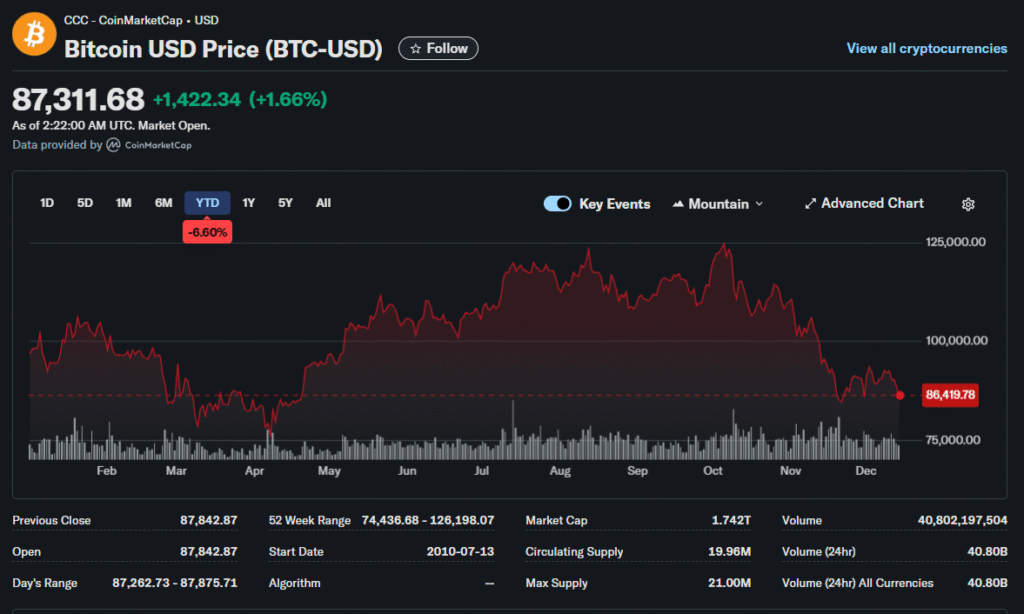

A lead financial expert at Rineplex breaks down how Bitcoin tumbled from its $126,000 October high to trade below $86,000 in mid-December, wiping out gains that took months to build. The cryptocurrency now faces questions about its role as digital gold and an inflation hedge.

The ETF Honeymoon Ends

Spot Bitcoin ETF launches in early 2024 will fundamentally change market dynamics. Initially, these products drove massive inflows and pushed prices to record territory. However, December 2025 brought sustained outflows as institutional money managers reassessed allocations.

The shift from on-chain to off-chain price discovery created new vulnerabilities. Traditional equity market correlations strengthened unexpectedly. Bitcoin started moving in lockstep with tech-heavy Nasdaq during risk-off episodes.

Market depth metrics revealed troubling liquidity conditions. Order books around $568 million in late November represented shallow support compared to Bitcoin’s market capitalization. Large sell-offs could trigger cascading liquidations faster than in previous cycles.

Macro Headwinds Mount

The Federal Reserve’s December rate cut arrived pre-priced into markets. Traders expected more dovish guidance but received hawkish signals about 2026 policy paths. Higher-for-longer rate expectations hurt non-yielding assets disproportionately.

Bank of Japan’s emerging rate-hike stance compounded pressure. Yen weakness approaching 155-160 against the dollar historically triggered BOJ intervention. A policy tightening would unwind profitable carry trades that funded speculative crypto positions.

Chinese economic data disappointed repeatedly through the fourth quarter. Weak consumption figures from the world’s largest population suggested reduced appetite for alternative assets. Regulatory uncertainty in major Asian markets persisted despite occasional optimistic headlines.

Leverage Unwinds Violently

Nearly $700 million in leveraged positions were liquidated during a single December trading session. Exchanges forced closes into falling markets, accelerating declines beyond what fundamental sellers alone would cause. This leverage washout left traders nursing losses and rebuilding caution.

Retail investors who entered near peaks faced 25-30% paper losses heading into year-end. Social media sentiment shifted dramatically from euphoria to fear. The Crypto Fear & Greed Index plunged into extreme fear territory for extended periods.

Professional desks reduced exposure ahead of year-end reporting. Institutional allocations optimized for clean balance sheets rather than conviction buys. This seasonal pattern amplified normal volatility with additional selling pressure.

On-Chain Signals Flash Warning

Whale wallets initiated transfers to exchanges at rates not seen since early 2024. The Exchange Whale Ratio climbed significantly, suggesting large holders are prepared to distribute holdings. This behavior typically preceded further price weakness historically.

Long-term holders entered distribution mode after maintaining accumulation patterns through much of the year. The Hodler Net Position Change turned decisively negative. Veterans cashing out gains indicated waning conviction about near-term appreciation.

Mining economics deteriorated as prices fell while hashrate remained elevated. Smaller operations faced a margin squeeze that could force capitulation selling. However, public miners with deep pockets continued accumulating, creating conflicting signals about industry sentiment.

Historical Cycle Comparisons

Bitcoin’s four-year halving cycle historically drove price patterns. The 2025 correction mirrored late-stage pullbacks from 2015 and 2018 cycles. Sharp declines followed by extended consolidation preceded eventual new highs in those instances.

However, institutional participation in 2025 changed the market character fundamentally. Professional risk management practices meant faster exits during adverse conditions. The retail-dominated markets of previous cycles absorbed pain more slowly.

Active trading strategies based on halving event timing outperformed passive holding through past cycles. Technical analysts identified potential support around the $82,000-85,000 range, where multiple cost-basis metrics converged. Breaks below those levels could trigger capitulation selling toward $70,000.

The Inflation Hedge Mirage

Bitcoin’s performance relative to other assets disappointed inflation hawks. Gold easily outpaced the cryptocurrency in 2025, delivering steady gains without gut-wrenching volatility. Treasury bills provided positive real returns as inflation moderated.

Emerging market equities, US utilities, and corporate bonds all beat Bitcoin year-to-date. The diversification benefits once touted by crypto advocates failed to materialize. Correlations with risk assets increased rather than providing portfolio protection.

Options markets priced less than 5% probability of Bitcoin revisiting record highs before 2026. This pessimism contrasted sharply with the exuberance that characterized October trading. Implied volatility remained elevated, reflecting uncertainty about directional conviction.

Contrarian Signals Emerge

A financial analyst notes whale accumulation accelerated during the December selloff. Entities like MicroStrategy and El Salvador continued buying through weakness. This behavior suggested smart money saw value despite deteriorating sentiment.

US-listed Bitcoin ETFs recorded significant inflows even as prices fell. The divergence between price action and fund flows created classic “wall of worry” conditions that historically preceded reversals. Retail capitulation often marked cycle lows rather than tops.

2026 Crossroads

Bitcoin’s recovery depended heavily on macro variables outside crypto-native catalysts. Federal Reserve policy shifts and global capital flows would determine whether $80,000 represented a cyclical bottom or a mid-correction pause.

Technical analysts emphasized risk management over prediction in current conditions. Stop-loss placement and position sizing mattered more than conviction about directional bets. Market structure remained fragile enough that unexpected shocks could trigger additional volatility.

The digital asset’s resilience through multiple boom-bust cycles suggested premature obituaries remained unwise. However, bulls needed to demonstrate that sustainable demand could absorb continued selling pressure. December’s price action eliminated easy optimism from the conversation.