The Bank of England (BoE) is widely expected to cut its benchmark interest rate to 3.75% from the current 4% in its final monetary policy decision of 2025, scheduled for Thursday at 12:00 GMT.

Recent economic data pointing to weaker GDP growth, rising unemployment, and cooling inflation have prompted market expectations of a 25-basis-point rate cut, signalling a more dovish approach by the BoE. This article from Servelius provides readers with a clear and thorough explanation of the subject.

While Governor Andrew Bailey will not hold a press conference following the announcement, the BoE meeting minutes will provide critical insights into the committee’s discussions and potential policy trajectory.

UK Economic Outlook: Weak Growth and Rising Unemployment

The UK economy has shown signs of slowing growth, with the latest GDP report revealing a 0.2% expansion in Q3, down from 0.3% in Q2. November marked the second consecutive month of economic contraction, primarily due to weak services and construction output.

Simultaneously, the labour market is deteriorating. The unemployment rate rose to 5.1%, its highest level in nearly five years, while wage growth continues to moderate. Average Earnings Including Bonus increased by 4.7% in the three months to October, below prior months’ growth, signalling softening demand pressures in the labour market.

Inflation Trends Ease Pressure on the BoE

Inflationary pressures in the UK have cooled more than expected, according to the latest Consumer Price Index (CPI) data. In November, the year-on-year CPI grew by 3.2%, down from 3.6% in October and 3.8% in September. The slowdown was largely driven by a significant reduction in food prices.

This moderation in price pressures strengthens the case for a rate cut, as the BoE can act to support economic activity without the immediate risk of persistent above-target inflation.

Market Expectations: 3.75% Rate Cut

Markets are currently pricing in a 25-basis-point reduction, which would lower the BoE’s Bank Rate to 3.75%. Analysts anticipate that Governor Bailey may lean toward a dovish decision, given the combination of weaker GDP growth, higher unemployment, and easing inflation.

Previous meetings highlighted a divided Monetary Policy Committee (MPC), with four members voting for a cut at the November 6 meeting and Bailey casting the tie-breaking vote. The upcoming decision is expected to be similarly closely contested, though the softer economic indicators may tip the balance in favour of a rate reduction.

Labour Market and Inflation Dynamics

The UK labour market has been under pressure, with unemployment rising and wage growth moderating, reducing domestic consumption. Meanwhile, the cooling inflation trend provides room for the BoE to ease monetary policy without stoking fears of uncontrolled price rises.

PMI data from December indicates some resilience in business activity across manufacturing and services, providing a cautious positive note. However, these improvements are unlikely to shift BoE policy decisively, given the broader macro weaknesses.

Impact on GBP/USD

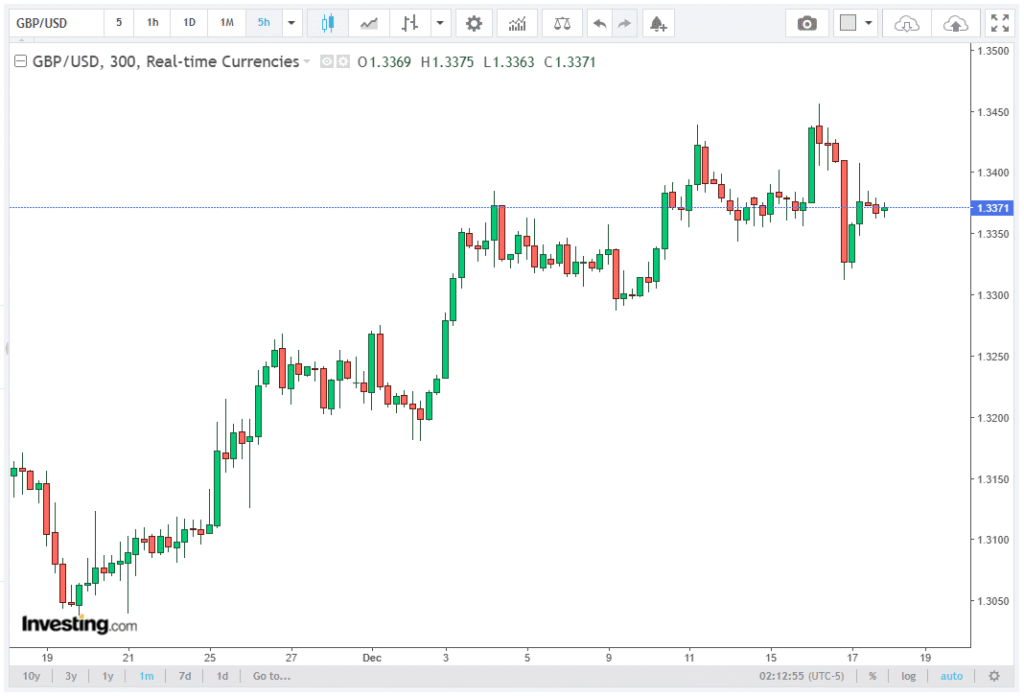

The GBP/USD currency pair has reacted sharply to recent data, retreating after UK inflation fell more than expected in November. Investors are now closely watching the BoE rate decision, particularly the vote split among MPC members, to gauge the likelihood of further rate cuts.

A dovish outcome, with fewer members supporting a steady rate, would likely weaken the Pound, while a more balanced committee split could provide temporary support.

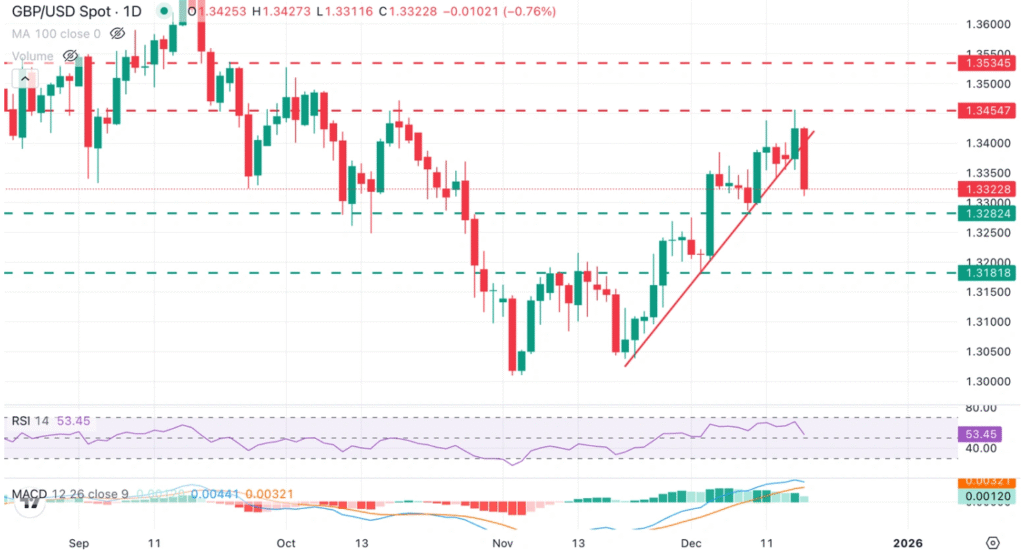

From a technical perspective, the GBP/USD is experiencing bearish pressure, with key support levels at 1.3280 and 1.3180, corresponding to the December 9 and December 2 lows, respectively.

On the upside, resistance lies at the broken trendline near 1.3400 and the December 16 high at 1.3455. Bullish confirmation above these levels could shift focus toward late September-early October highs around 1.3535, potentially easing downside pressure.

Guillermo Alcalá, FX Analyst at FXStreet, notes that “GBP/USD retreated sharply on Wednesday as the market braces for a BoE cut on Thursday,” highlighting increasing market sensitivity to monetary policy signals.

Conclusion: BoE Faces a Delicate Balance

The Bank of England enters its final monetary policy meeting of 2025 with a divided MPC, weaker GDP growth, rising unemployment, and easing inflation. These factors combine to make a 25-basis-point rate cut to 3.75%, the market consensus, aimed at supporting economic activity without igniting inflation risks.

Investors will monitor the meeting minutes closely, seeking insights into future rate trajectories and committee dynamics. The GBP/USD remains sensitive to the outcome, with technical levels providing clear markers for potential bullish or bearish movements.

As the BoE navigates this delicate policy balance, the global market watches, weighing the implications of UK monetary easing amid a sluggish economy and softening price pressures.