Gold shattered expectations this week, surging past $4,685 per ounce in what analysts are calling one of the most aggressive rallies in modern commodity history. The precious metal’s ascent comes as Asian markets prepare for Lunar New Year celebrations, creating unprecedented demand pressures.

A senior financial analyst at Nexymus examines the forces propelling this historic surge and whether investors should brace for a correction or buckle up for further gains.

Record Territory and What It Means

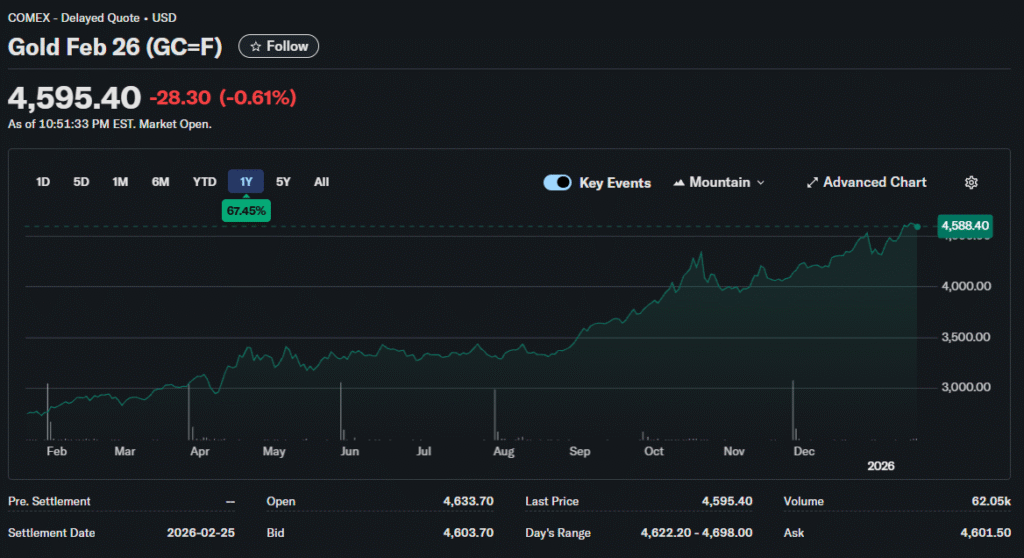

The yellow metal touched $4,685 per ounce late Thursday evening, marking a fresh all-time high that left even seasoned traders scrambling to adjust their models. The January contract settled at $4,588.40 on the New York Mercantile Exchange, representing a 2.2% weekly climb despite modest daily pullbacks that suggested profit-taking among short-term traders.

January alone has witnessed approximately 6% growth in gold pricing, a pace that historically precedes either continued momentum or sharp reversals. Silver prices amplified the precious metals narrative, jumping an astonishing 23% year-to-date to reach $95 per ounce. This parallel movement across precious metals reflects something deeper than simple speculation, it signals genuine anxiety about currency stability and persistent inflation pressures that monetary policy hasn’t fully addressed.

Asian Demand Fundamentally Reshapes Markets

Chinese investors drove much of the recent price action, with gold bullion trading at significant premiums in Shanghai compared to London benchmarks. This premium structure indicates genuine physical demand rather than paper speculation. Lunar New Year celebrations beginning February 17 have intensified purchasing activity as families traditionally gift gold jewelry and coins during this period.

Indian buyers contributed substantially to the frenzy despite their government’s attempts to moderate gold imports through taxation. Cultural traditions prioritizing gold ownership during weddings and festivals create inelastic demand that price increases struggle to dampen. Major metropolitan areas report jewelry stores extending hours to accommodate customer volume.

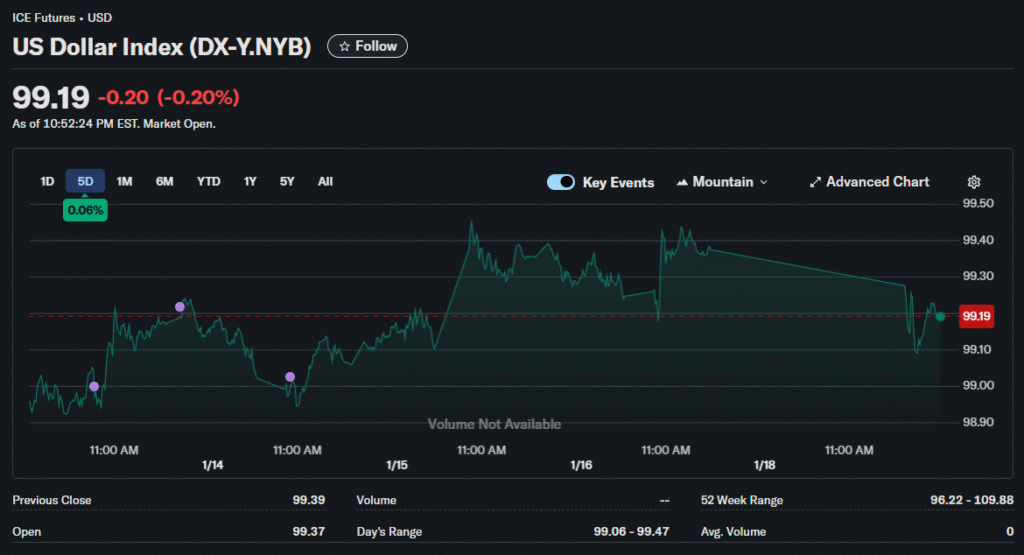

Central banks across Asia continue accumulating gold reserves at rates that suggest coordinated strategy rather than coincidental timing. They’re hedging against potential currency devaluation as U.S. dollar dominance faces questions it hasn’t confronted in decades. Japan’s central bank increased gold holdings by 8% in the fourth quarter alone. South Korea followed with similar moves.

Wall Street’s Crystal Ball Shows Higher Targets

Analyst forecasts suggest gold could rise 17% from 2025 levels, putting theoretical targets near $5,400 per ounce by year-end. Some predictions reach even higher into territory that seemed absurd just months ago. Swiss Asia Capital sees potential for $8,000 per ounce by 2028, based on monetary debasement models and geopolitical fragmentation scenarios.

These bullish targets stem from multiple converging factors. The U.S. dollar faces pressure from mounting deficits that Congress shows little appetite to address. Geopolitical tensions remain elevated globally, with flashpoints in multiple regions creating persistent uncertainty. Central bank policies continue favoring precious metal accumulation over increased dollar reserves.

Major investment institutions have set clear price targets that cluster around continued upward movement through 2026. Goldman Sachs recently revised its year-end forecast upward by $300 per ounce. JPMorgan followed with similar adjustments. However, these projections assume current conditions persist without major disruptions to either supply or demand dynamics.

The Danger Zone Few Discuss

Current market conditions show warning signs that prudent investors recognize even while participating in the rally. Speculative positioning appears stretched based on Commodity Futures Trading Commission data. The 23% silver rally this year suggests excessive enthusiasm beyond what fundamentals alone justify. Margin debt levels warrant close monitoring as they historically spike before corrections.

Federal Reserve policy represents the biggest variable determining gold’s path forward. Interest rate decisions directly impact precious metals pricing through multiple channels. Higher rates increase borrowing costs for speculators while strengthening the dollar and competing with gold for safe-haven flows. Lower rates generally support gold appreciation but signal economic weakness that creates its own uncertainties.

Inflation dynamics matter tremendously for gold’s medium-term trajectory. Core PCE inflation moderating toward 2.4% could reduce safe-haven demand as price stability concerns ease. Persistent inflation would likely support continued price strength as holders seek purchasing power protection. The Federal Reserve faces genuine challenges navigating between these outcomes.

What the Next Months Hold

The precious metal rally shows few immediate signs of exhaustion based on technical indicators and sentiment measures. Asian demand continues strong heading into Lunar New Year and beyond. Central bank buying persists across multiple countries with no policy shift signals. Geopolitical risks haven’t diminished meaningfully despite some diplomatic efforts.

Medium-term prospects depend heavily on Federal Reserve decisions at upcoming policy meetings. The January 28 rate announcement will provide important signals about the central bank’s inflation fight versus growth concerns balance. Economic data releases could shift market sentiment quickly as participants reassess recession probabilities.

Initial jobless claims remaining below 250,000 weekly would support continued economic strength narratives. GDP growth exceeding 2% quarterly would reduce recession fears that benefit gold. Conversely, weakening labor markets or contracting economic activity would likely drive additional safe-haven flows into precious metals.

Long-term trajectories remain genuinely uncertain despite confident predictions from various analysts. Gold could extend gains for multiple years if monetary instability persists or intensifies. Alternatively, a sharp correction could materialize rapidly on unexpected policy shifts or geopolitical resolution. Historical patterns suggest both possibilities exist with meaningful probability.