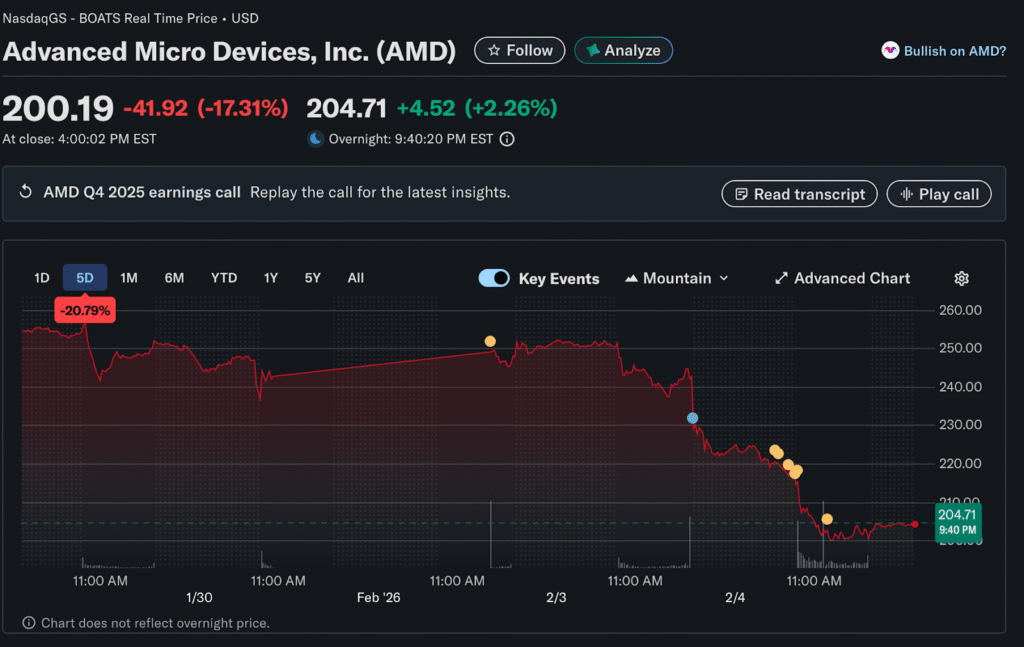

Advanced Micro Devices shares capsized after earnings guidance failed to please investors. Finance analyst at Auralyex takes a closer look at how the chipmaker’s stock plunged 17% despite fourth quarter results beating expectations handily.

AMD posted revenue of $10.27 billion for the quarter, above estimates of $9.67 billion. Data Center revenue surged 39% year over year to $5.4 billion. This exceeded analyst expectations of $4.97 billion for the segment.

The company’s MI300 AI accelerator and Instinct processors drove strong performance. EPYC processors also contributed to data center growth. However, first-quarter guidance fell short of analyst optimism.

Forward Outlook Sparks Selloff

AMD forecast first-quarter revenue at $9.8 billion, plus or minus $300 million. Wall Street sought $9.38 billion for the period. The midpoint guidance technically beat expectations but disappointed on the margin outlook.

The company called for a first quarter gross margin of about 55% on a non-GAAP basis. This landed roughly in line with the consensus estimate of 54.5%. Markets wanted to see margin expansion alongside revenue growth.

CEO Lisa Su defended the results in a CNBC interview on Wednesday. She stated the company has seen demand increase in recent months. AI is accelerating at a pace that she would not have imagined possible.

Chip Sector Faces Rotation Pressures

The selloff in AMD contributed to broader weakness in semiconductor stocks. Tech-heavy Nasdaq continued falling after Tuesday’s sharp losses. The index dropped 1.51% on Wednesday, extending recent declines.

Most tech shares traded in red territory, including Magnificent Seven names. Microsoft and Meta Platforms both fell more than 2% in the session. NVIDIA also slumped, with the AI bellwether dropping nearly 3%.

Software stocks continued their 2026 tumble alongside chip weakness. ServiceNow and Salesforce fell close to 7% each. The combined tech selloff weighed on broader market indices.

Investors Question AI Infrastructure Spending

Wall Street expressed concern about profitability despite high spending on AI infrastructure. Companies poured billions into data centers and accelerated computing. Returns on these massive investments remain uncertain.

AMD’s performance highlighted challenges even successful chip companies face. Strong revenue growth no longer guarantees stock appreciation in the current environment. Markets demand a clear path to sustained margin expansion.

The company competes directly with Nvidia for AI accelerator sales. While AMD gained market share, Nvidia maintains a dominant position. Customers increasingly deploy both companies’ products in data centers.

Data Center Strength Overshadowed by Caution

Data center segment performance significantly exceeded expectations for AMD. The 39% year over year growth demonstrated strong demand for AI processors. Enterprise customers continue upgrading infrastructure to support workloads.

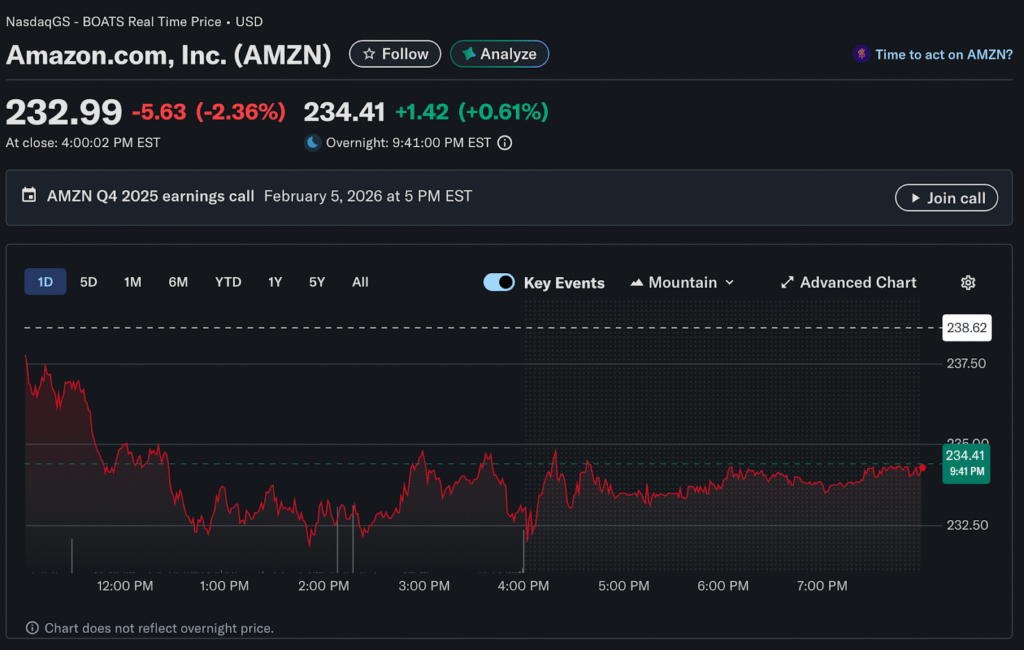

Cloud providers represent AMD’s largest customers for data center products. Amazon, Microsoft, and Google deploy AMD processors alongside Nvidia GPUs. This diversification reduces dependence on a single vendor.

Gaming and embedded segments showed more modest growth in comparison. PC market recovery remained slow despite some stabilization. Consumer demand has not rebounded to pre-pandemic levels.

Manufacturing Capacity Expansion Plans

AMD announced plans to increase manufacturing partnerships throughout 2026. The company relies on TSMC for advanced node production. Securing sufficient wafer capacity remains critical for meeting demand.

Investment in packaging capabilities also increased to support chiplet designs. Advanced packaging differentiates AMD products from competitors. The technology allows combining multiple dies into a single package.

Supply chain diversification efforts continued as geopolitical risks persist. AMD explored secondary foundry options beyond its primary TSMC relationship. This reduces concentration risk if disruptions occur.

Analyst Community Splits on Outlook

Some analysts view AMD’s guidance as conservative given recent demand trends. The company historically provides cautious forecasts that allow for upside surprises. Management may be protecting against execution risks.

Others worry that competition intensifies across product lines. Intel attempts a comeback in the data center market with new architectures. Chinese chipmakers also target segments where AMD competes.

The 17% single day decline wiped out months of gains for shareholders. AMD’s stock had performed well in early 2026 before guidance disappointment. Technical damage from the selloff will take time to repair.

Tech Rotation Favors Different Sectors

Investors rotated out of technology giants into sectors tied to economic improvement. Procter & Gamble, FedEx, and Union Pacific posted gains on Tuesday. Defensives and industrials attracted flows from fleeing tech investors.

This rotation reflects changing market leadership as 2026 progresses. Narrow tech leadership that worked in 2025 shows signs of breaking down. Broader market participation could emerge if the trend continues.

The challenge for investors involves identifying which tech names remain attractive. Not all software and semiconductor stocks face the same disruption risks. Selectivity becomes essential in navigating sector turbulence.

Long-Term AI Opportunity Remains

Despite near-term weakness, the long-term AI opportunity remains compelling for AMD. Data center upgrades will continue for years as workloads increase. The company maintains a strong competitive position in a growing market.

AMD’s custom chip design capabilities provide differentiation from pure GPU vendors. Partnerships with hyperscalers create sticky revenue streams. The product roadmap includes multiple generations of improved accelerators.

Wall Street must reconcile short-term guidance disappointment with long-term growth potential. Current valuation reflects pessimism that may prove overdone. Patient investors could find opportunity amid temporary weakness.