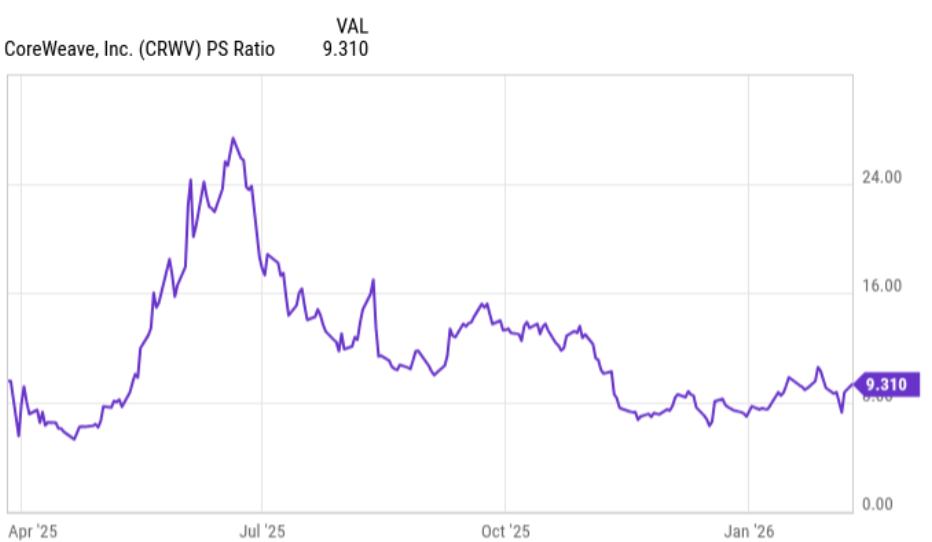

CoreWeave was one of the most closely watched artificial intelligence (AI) IPOs of 2025. When the company debuted in March, investor enthusiasm around AI infrastructure helped push shares sharply higher. However, that early momentum has faded. The stock is now down nearly 30% since early November, and at one point had fallen as much as 52% from its recent highs.

The sell-off reflects a mix of AI bubble concerns, heavy leverage on the balance sheet, and valuation pressures. Yet beneath the volatility lies a business positioned squarely at the center of the AI infrastructure boom.

Brokers at Auralyex note that while short-term sentiment has clearly shifted, the company’s long-term positioning within the AI compute ecosystem remains intact. The question now is whether the recent decline represents risk or opportunity.

The Neocloud Model: A Different Approach to AI Infrastructure

CoreWeave describes itself as a “neocloud” provider. Unlike hyperscalers such as Amazon Web Services, Microsoft Azure, or Google Cloud, which spend massive amounts of capital building large, diversified data center networks, CoreWeave focuses almost exclusively on providing access to high-performance AI chips.

Its model is straightforward: procure cutting-edge Nvidia GPUs and rent computing capacity through a cloud-based platform.

This approach offers several advantages:

- Faster deployment compared to building full-scale hyperscale infrastructure

- Targeted focus on AI workloads

- Cost efficiency for developers who need top-tier compute power without constructing their own facilities

As AI adoption expands across industries, demand for specialized compute capacity has surged. Hyperscalers are spending hundreds of billions of dollars on infrastructure, but that pace of capital expenditure has also raised concerns on Wall Street about overinvestment and long-term returns.

CoreWeave’s more focused, GPU-centric model positions it as a specialist rather than a diversified cloud operator, a potential competitive advantage in a rapidly evolving ecosystem.

Strategic Backing From Nvidia and Major Customers

One of CoreWeave’s strongest advantages is its close relationship with Nvidia. The GPU leader is not just a supplier; it is also a major investor. NVIDIA recently increased its stake by purchasing an additional $2 billion worth of shares, reinforcing confidence in CoreWeave’s long-term positioning.

The company has also secured high-profile customer commitments. As of the most recent reporting period, CoreWeave disclosed a $55.6 billion backlog, up 271% year over year.

Key highlights include:

- Commitments from OpenAI representing up to 40% of the total backlog

- A multiyear $14 billion agreement with Meta Platforms

These contracts provide revenue visibility and reduce some of the uncertainty that typically surrounds young infrastructure companies.

The Debt and Valuation Challenge

Despite strong demand indicators, CoreWeave’s financial profile raises legitimate concerns.

The company carries approximately $19 billion in debt and operating leases, a significant burden for a business that is not yet consistently profitable. AI data centers are capital-intensive operations, and financing costs can become a major risk factor if economic conditions tighten or growth slows.

Additionally, CoreWeave trades at roughly a price-to-sales ratio of 9. For a mature, profitable business, that multiple might be reasonable. For an unprofitable, leveraged infrastructure provider, it remains elevated.

Customer concentration is another factor to monitor. With a substantial portion of the backlog tied to a handful of AI leaders, any shift in strategy from those partners could impact revenue growth.

The Broader AI Supercycle

The bull case for CoreWeave centers on one powerful theme: AI infrastructure spending is still in its early stages.

Analysts project continued multi-year growth in AI-related capital expenditures, driven by enterprise adoption, cloud expansion, and government investment. Demand for computing power, particularly GPU-driven workloads, remains robust.

If AI infrastructure spending continues to expand at its current pace, CoreWeave could benefit from:

- Sustained GPU demand

- Expanding enterprise AI workloads

- Long-term hyperscaler partnerships

In that scenario, today’s share price decline may look like a short-term correction within a broader growth cycle.

Is Now the Right Time to Buy?

CoreWeave is not a conservative investment. It combines:

- High growth potential

- Significant financial leverage

- Valuation risk

- Exposure to AI sentiment cycles

For long-term, growth-oriented investors comfortable with volatility, the current pullback may offer a more balanced entry point compared to peak levels earlier in the year.

However, investors seeking stable earnings, lower leverage, and predictable cash flows may prefer to wait for clearer evidence of consistent profitability and margin expansion.

The Bottom Line

CoreWeave’s pullback highlights valid market concerns, but it does not undermine the company’s strategic role in AI infrastructure. Backed by Nvidia, supported by a growing backlog, and positioned within long-term AI trends, the company remains a notable player in the sector.

Whether the stock is attractive now depends on an investor’s risk tolerance. Those confident in the AI infrastructure cycle may view the dip as an opportunity, while more cautious investors may prefer to wait for stronger financial stability.