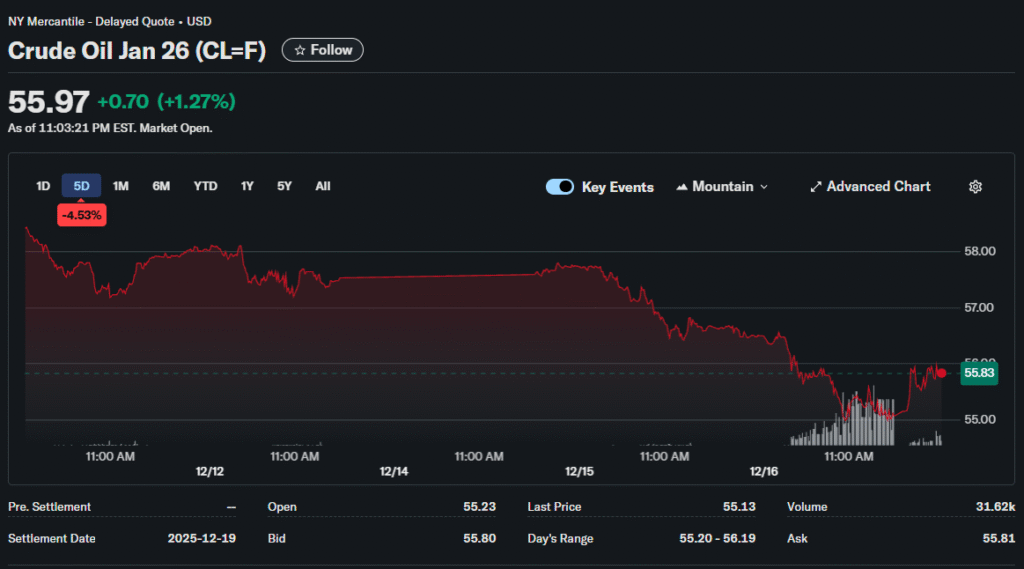

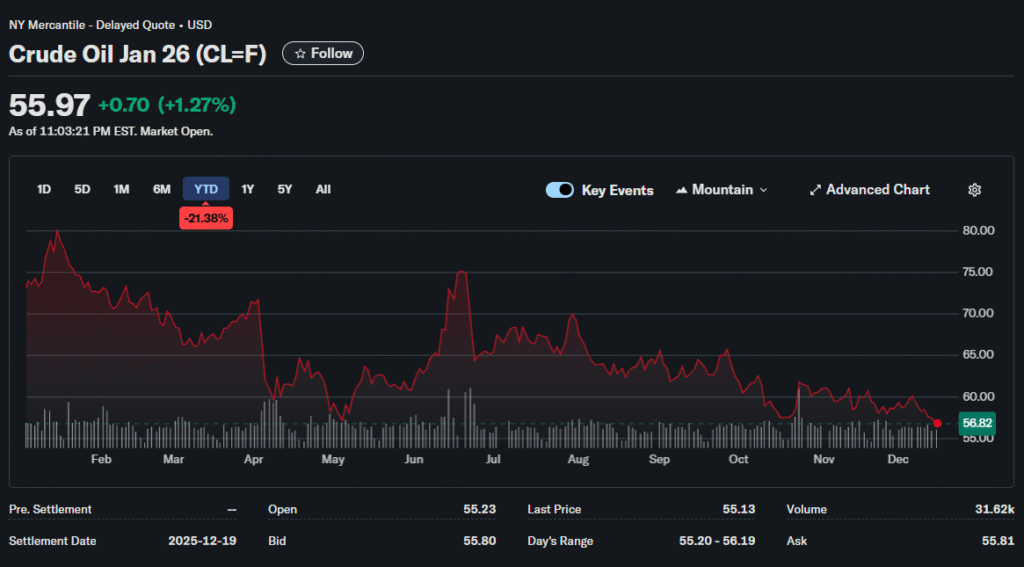

A financial analyst at Rineplex examines how crude oil collapsed to its weakest levels since early 2021, with WTI settling at $55.27 and Brent at $58.92 on December 16. The decline marked crude’s worst annual performance since 2018, down approximately 22% year-to-date.

The Glut Takes Shape

International Energy Agency projections painted a stark picture for 2026. Global oil supply growth would reach 2.4 million barrels daily, while demand increased by only 860,000 barrels. This massive imbalance created a projected surplus approaching 3.8 million barrels per day.

OPEC+ production restoration contributed significantly to oversupply concerns. The cartel brought previously idled capacity back online throughout 2025. Member compliance with output targets weakened as individual nations prioritized revenue over collective discipline.

Non-OPEC producers, particularly in the Americas, ramped up output aggressively. US production touched an all-time high of 13.6 million barrels daily in December. Brazil and Guyana added substantial volumes from new offshore developments.

Peace Dividend Pressure

Ukraine-Russia negotiations advanced further than markets anticipated. The US administration provided security guarantees that moved talks past previous sticking points. Any agreement would likely lift sanctions on Russian oil exports relatively quickly.

Markets began pricing reduced geopolitical risk premiums. The threat of supply disruptions from Ukrainian drone strikes on Russian infrastructure would diminish post-settlement. Western sanctions targeting the Russian crude industry faced removal under peace scenarios.

However, territorial disputes remained unresolved. The timing of any final agreement carried significant uncertainty. Traders positioned cautiously, given the negotiations’ fragile nature and potential for sudden reversals.

China’s Demand Disappointment

Economic data from the world’s largest crude importer consistently underwhelmed expectations. Manufacturing PMI figures suggested ongoing contraction in industrial activity. Consumer spending indicators pointed to cautious household behavior.

China’s strategic petroleum reserve buildout slowed noticeably. The government accumulated inventory aggressively earlier in 2025 but pulled back as prices declined. This swing from buyer to neutral observer removed meaningful support.

Electric vehicle adoption in China accelerated beyond forecasts. Gasoline demand peaked earlier than traditional models predicted. The transition away from internal combustion engines permanently compressed oil consumption growth projections.

US Jobs Data Amplifies Concerns

November’s employment report showed 64,000 jobs added, while October recorded a revised 105,000 loss. The unemployment rate climbed to 4.6%, the highest since October 2021. These figures raised recession fears that would crater energy demand.

Falling oil prices could signal broader economic weakness ahead. Historical patterns showed crude often led equity markets lower during deterioration phases. Current price action suggested markets anticipated significant demand destruction.

Rineplex lead financial analyst notes that gasoline prices dropped below $3 per gallon nationally, the lowest in four years, according to AAA data. This consumer relief came at producers’ expense as refining margins compressed.

OPEC’s Dilemma Deepens

The cartel faced impossible choices entering 2026. Restoring more production would flood markets and crater prices further. However, keeping barrels offline meant surrendering market share to rivals with no production discipline.

Saudi Arabia historically played the swing producer role, adjusting output to stabilize markets. This strategy’s viability is questioned given the enlarged non-OPEC supply base. American shale operators quickly filled any gaps OPEC created through restraint.

Internal OPEC tensions surfaced publicly more frequently. Nigeria and Angola prioritized development over compliance. Iraq consistently exceeded quotas. UAE pushed for higher allocations, citing investment in capacity expansion.

Downstream Margin Squeeze

Refiners enjoyed a brief reprieve as product cracks widened to three-year highs in November. This reflected tight gasoline and diesel inventories despite ample crude supplies. However, the situation reversed quickly in December.

European Union restrictions on Russian product imports created temporary distortions. These bans forced refinery configuration changes and logistics route adjustments. Once implementation was completed, the supportive effects faded.

Refiners cut run rates responding to compressed margins. This reduced crude demand incrementally. The feedback loop of lower refining activity reducing oil purchases accelerated price weakness.

Storage Economics Deteriorate

Physical crude markets moved into contango, where future prices exceeded spot. This structure typically encouraged storage as a profitable carry trade. However, contango remained shallow enough that storage costs exceeded potential gains.

Oil on water reached near-record volumes as cargoes struggled to find buyers. Iranian barrels in particular accumulated at sea after Chinese refiners exhausted import quotas. This floating inventory overhang weighed on sentiment.

Land-based storage at key pricing hubs showed contradictory signals. Cushing, Oklahoma, inventories stayed relatively low while global stocks built. This disconnect reflected infrastructure constraints rather than genuine tightness.

WTI broke through $56-57 support, with the next support around the $50-52 range. Speculative positioning showed net long positions shrinking dramatically as hedge funds liquidated bullish bets. This capitulation selling often marked exhaustion phases historically, though catching exact bottoms remained treacherous.

Opportunity or Falling Knife

Contrarians argued that current prices factored in worst-case scenarios. Any supply disruption or demand surprise would catch markets wrong-footed. Energy equities suffered alongside crude prices.

Integrated majors’ dividends faced scrutiny if prices stayed depressed. The oil market’s structural transformation complicated traditional supply-demand frameworks as investors navigated both cyclical swings and the energy transition’s long-term implications.