Global energy markets face a supply tsunami that’s overwhelming tepid demand growth. The glut threatens producers while offering consumers rare relief from years of elevated fuel costs.

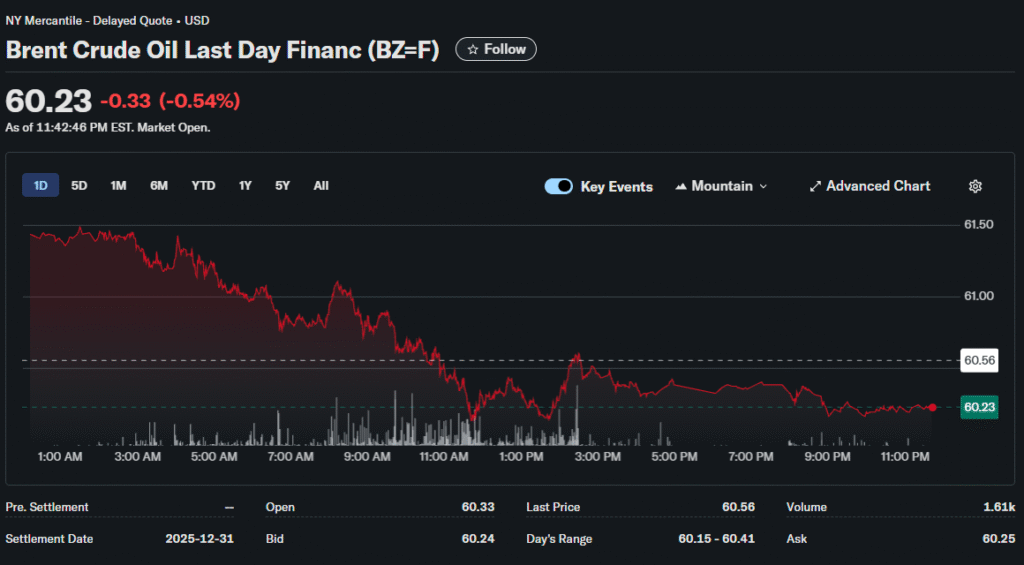

Fimatron‘s senior broker explains why crude oil prices collapsed below $57 per barrel, levels unseen since early 2021. Both WTI and Brent benchmarks declined more than 3% last week as evidence mounted that production growth far outpaces consumption.

The Supply Side Dominates

The International Energy Agency projects a record surplus stretching into 2026. Global oil supply jumped 3 million barrels daily in 2025, while demand increased just 830,000 barrels daily. This imbalance creates inventory builds that depress prices.

The United States, Brazil, and Guyana led production gains among non-OPEC countries. American output benefits from technological advances in shale extraction that lowered breakeven costs. Producers can maintain profitability even as prices slide toward $50 per barrel.

OPEC members face difficult choices. The cartel cut production by 1.5 million barrels daily from September’s record, yet prices continued falling. Further reductions mean sacrificing market share to higher-cost competitors, while maintaining output floods an already saturated market.

Russia Feels the Squeeze

Russian oil exports dropped roughly 400,000 barrels daily in November as sanctions bite harder. Urals crude prices plunged $8.20 per barrel to $43.52, the lowest since the Ukraine invasion began in February 2022.

Export revenues fell to $11 billion, down $3.6 billion from the previous year. These declines constrain Russia’s war financing while forcing difficult budget decisions. However, shadow fleet tankers and willing buyers in Asia limit sanction effectiveness.

Iran maintains loadings around 1.9 million barrels daily despite Western pressure. Chinese independent refiners pause buying as import quotas exhaust, causing Iranian oil on water to surge 40 million barrels since August. This floating storage represents potential supply overhanging markets.

Demand Disappoints

China’s economic slowdown weighs heavily on consumption forecasts. Industrial activity softened while the country increased renewable energy adoption for power generation. Solar and wind capacity additions reduce fuel oil demand from electricity producers.

The world’s largest crude importer shows structural changes beyond cyclical weakness. Electric vehicle penetration accelerates, reducing gasoline consumption. Petrochemical overcapacity limits feedstock needs. These trends suggest China’s oil demand may plateau sooner than expected.

Europe faces similar dynamics. High energy prices pushed conservation and efficiency investments that permanently reduced consumption. Natural gas substitutes for fuel oil in power generation wherever possible.

Geopolitical Wildcards

Ukraine continues striking Russian oil infrastructure, targeting refineries and storage facilities across multiple regions. These attacks disrupt production without eliminating capacity, creating volatility rather than sustained supply reductions.

Venezuelan tensions escalated as the United States seized a sanctioned tanker. Caracas holds the world’s largest proven reserves but exports only 586,000 barrels daily, mostly to China. Political instability limits the country’s ability to expand output regardless of price incentives.

The Gulf of Oman saw Iran seize a foreign tanker over alleged fuel smuggling. These incidents remind markets that Middle East supply routes remain vulnerable to disruption, though risk premiums have largely evaporated given ample global inventories.

Price Forecast Divergence

The U.S. Energy Information Administration expects Brent to average $55 per barrel in the first quarter 2026. This forecast assumes OPEC maintains discipline and demand improves modestly as economic growth stabilizes.

J.P. Morgan projects similar levels, with Brent at $66 for 2025 full year and $58 for 2026. The bank notes the administration prioritizes lower oil prices to manage inflation, suggesting limited support if crude falls toward $50.

Other analysts see higher volatility with potential spikes from geopolitical events. The wide range of forecasts reflects genuine uncertainty about both supply discipline and demand trajectory.

Refinery Margin Paradox

Despite crude abundance, refined product markets showed unexpected tightness in November. Unplanned refinery outages created temporary shortages of gasoline and diesel that pushed margins to levels last seen after Russia’s Ukraine invasion.

Sanctions targeting refined products starting in first quarter 2026 will test global refining capacity. Removing Russian diesel and fuel oil from markets could tighten balances even as crude remains plentiful.

This disconnect between crude and product markets creates complexity. Refiners enjoy strong margins that incentivize higher utilization, but crude producers face weak prices that discourage investment. The system eventually rebalances, though the timeline remains unclear.

Consumer Impact

Lower oil prices translate to reduced gasoline and heating costs for households. American consumers particularly benefit given high vehicle dependence and longer commutes than most developed economies.

Cheaper fuel acts as a tax cut that boosts disposable income for other spending. This supports economic growth and corporate earnings across consumer-facing sectors. However, energy-producing regions face job losses and reduced investment.

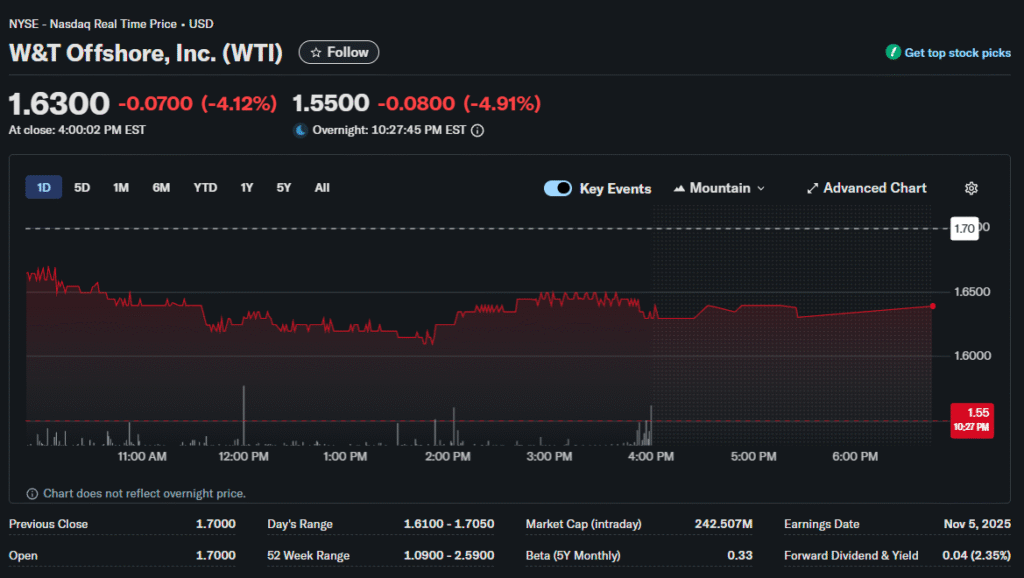

Investment Implications

Energy stocks face pressure from weak commodity prices despite strong cash flows. Companies balance shareholder returns through dividends and buybacks against maintaining capital spending for future production.

Integrated oil majors fare better than pure exploration companies. Refining and chemicals operations provide diversification that cushions upstream weakness. Renewable energy investments offer long-term positioning as the energy transition accelerates.

The sector trades at discounted valuations reflecting uncertainty about long-term demand. Climate policies and technological changes create existential questions about oil’s role in future energy systems. Short-term oversupply compounds these structural concerns.