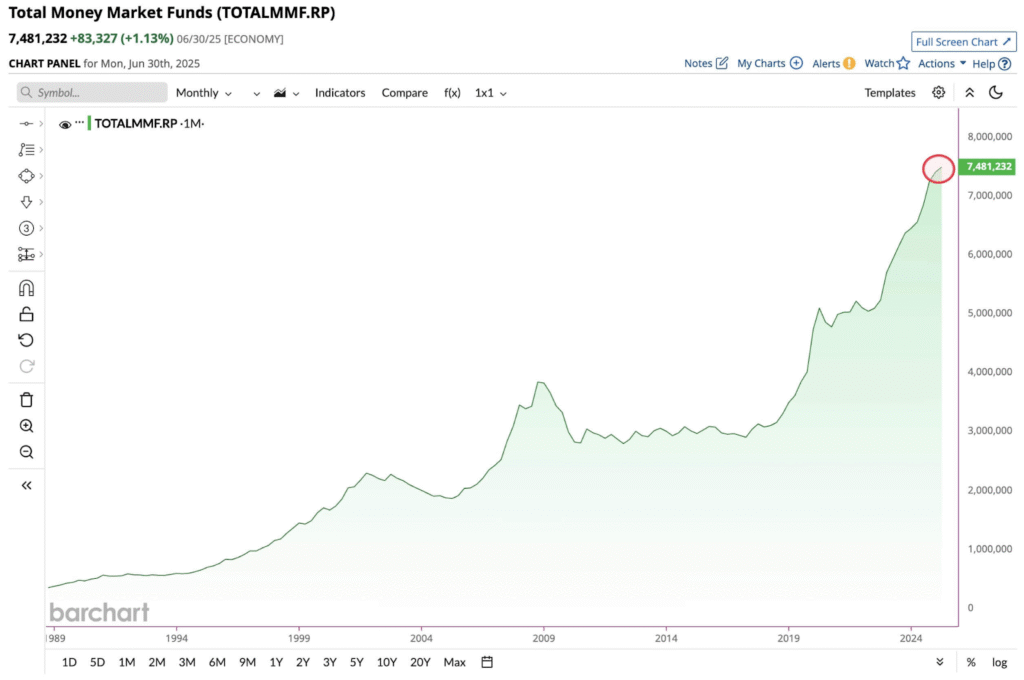

As interest rates continue to trend lower following multiple Federal Reserve cuts, savers are facing increasing pressure to make sure their cash is still working efficiently. While traditional savings accounts often lag behind inflation, money market accounts (MMAs) remain one of the few places where competitive yields are still available, at least for now.

According to data reviewed by brokers at Arbitics, money market accounts currently offer some of the highest risk-free yields available to everyday savers, making them worth a closer look as rate conditions shift.

Why Money Market Accounts Still Stand Out

Money market accounts (MMAs) remain a notable choice for savers, particularly as interest rates begin to adjust and the broader rate environment evolves. While they operate much like traditional savings accounts, MMAs often offer added flexibility, including check-writing privileges and debit card access, making it easier for account holders to access their funds when needed. This combination of liquidity and competitive yields makes money market accounts appealing for savers who want both convenience and return.

Perhaps the most important advantage is FDIC insurance. Money market accounts offered by banks are insured up to applicable limits, protecting deposits even if a financial institution fails. This built-in safety makes MMAs particularly attractive for conservative savers, as well as for individuals parking emergency funds or short-term savings.

In an environment where market volatility remains elevated, money market accounts offer a low-risk way to preserve capital while earning interest. For those prioritizing stability, accessibility, and peace of mind, MMAs remain a compelling choice in today’s savings landscape.

Today’s Best Money Market Account Rates

From a longer-term view, money market account yields remain relatively high, even as interest rates begin to trend lower. The FDIC reports the national average MMA rate at just 0.58%, yet several banks continue to offer APYs above 4%, putting these accounts on par with many high-yield savings options.

Below is a snapshot of some of the most competitive money market account rates available today:

| Account | APY | Minimum Opening Deposit | Minimum Balance to Earn APY |

| TotalBank Online Money Market Deposit Account | 4.26% | $25,000 | $2,500 |

| Quontic Bank | 4.25% | $100 | $0.01 |

| HUSTL Financial | 4.10% | None | $0.01 |

| Zynlo Money Market Account | 4.10% | $10 | $0.01 |

| Brilliant Bank Surge Money Market Account | 4.10% | $1,000 | $1,000 |

| First Foundation Bank Online Money Market Account | 4.00% | $1,000 | $0.01 |

| EverBank Yield Pledge Money Market Account | 4.00% | None | $10,000 |

These yields far exceed the national average, underscoring why savers may benefit from actively comparing accounts rather than relying on traditional bank offerings that pay minimal interest.

Are Money Market Account Rates Headed Lower?

Between July 2023 and September 2024, the Federal Reserve maintained a restrictive target range of 5.25%–5.50% for the federal funds rate. As inflation cooled, policymakers shifted direction.

Key rate changes include:

- 50 basis-point cut in September 2024

- 25-bp cut in November 2024

- 25-bp cut in December 2024

- Three additional rate cuts in 2025

As a result, the federal funds rate now stands at 3.50%–3.75%, and deposit account yields have already begun to decline.

This trend suggests that today’s 4%+ money market rates may not last much longer, making the current environment particularly relevant for savers looking to lock in competitive yields.

Is a Money Market Account Right for You?

Whether a money market account makes sense depends on your personal financial goals. Here are several factors to consider:

Liquidity Needs

Money market accounts typically allow easy access to funds through checks or debit cards, though some may limit the number of monthly withdrawals. If flexibility is important, MMAs can be more practical than certificates of deposit (CDs).

Short-Term Savings Goals

MMAs are well-suited for emergency funds, upcoming expenses, or short-term savings, offering better returns than most traditional savings accounts without market risk.

Risk Tolerance

For conservative savers, money market accounts provide principal protection through FDIC insurance. However, for long-term objectives like retirement, higher-risk investments are usually necessary to generate sufficient growth.

Final Thoughts

Despite a shifting rate environment, money market accounts remain one of the strongest low-risk tools available to savers today, with several institutions still offering APYs above 4% as of December 18, 2025.

As highlighted by Arbitics, the gap between average savings rates and top money market yields means savers who fail to compare options could leave meaningful returns on the table. While rates are likely to continue declining, now may represent one of the final opportunities to benefit from elevated yields while maintaining safety and liquidity.

For savers seeking a balance of security, accessibility, and competitive returns, money market accounts continue to deserve serious consideration.