The EUR/CAD pair edged higher in early European trading on Friday, approaching 1.6160. The uptick comes as the Euro (EUR) outperforms major peers ahead of a series of European Central Bank (ECB) speeches scheduled later in the day.

In their latest publication, Unirock Gestion experts explore the subject in depth for readers. Traders are closely monitoring ECB commentary for potential signals on the interest rate outlook and monetary policy trajectory.

Euro Gains Momentum as ECB Holds Rates Steady

On Thursday, the ECB left its Deposit Facility Rate unchanged at 2%, in line with market expectations. The central bank refrained from signaling a pre-defined monetary policy path, emphasizing its data-dependent and meeting-by-meeting approach. This cautious stance reflects ongoing uncertainty over inflation trends across the Eurozone.

During the press conference, ECB President Christine Lagarde highlighted the importance of government expenditure on infrastructure and defense, noting that such measures should support investment growth.

The ECB also revised its Gross Domestic Product (GDP) growth forecasts for the Eurozone, raising projections for the current year to 1.4% and for 2026 to 1.2%, fueled by optimism about investment plans.

Investors interpreted the ECB’s neutral tone as broadly Euro-supportive, helping the EUR/CAD cross tick higher. Analysts suggest that traders are positioning ahead of further ECB speeches later in the session, looking for any forward guidance that might hint at future rate adjustments or monetary tightening.

Canadian Dollar Pauses Amid Retail Sales Anticipation

The Canadian Dollar (CAD) has paused its recent rally, following a strong upside move in recent trading sessions. The CAD has been supported by expectations that the Bank of Canada (BoC) will maintain its current interest rate of 2.25% in the near term, as inflation remains close to the 2% target. Additional support comes from positive labor market trends and a stable economic outlook.

Last week, the BoC highlighted that economic slack would roughly offset cost pressures linked to trade reconfiguration, underlining a neutral monetary stance for the moment. This cautious approach has helped stabilize the CAD, preventing a sharp pullback against major currencies, including the EUR.

Focus on Canadian Retail Sales

Market attention now shifts to Canadian Retail Sales data for October, scheduled for release at 13:30 GMT on Friday. Analysts forecast that month-on-month Retail Sales remained flat, following a 0.7% decline in September. Retail Sales are a key economic indicator, reflecting consumer spending trends, household demand, and broader economic momentum.

The EUR/CAD pair is likely to remain sensitive to the Retail Sales data. A positive surprise could bolster the CAD, applying downward pressure on the cross, whereas a weaker-than-expected reading may give the Euro additional gains as traders recalibrate risk sentiment and currency positioning.

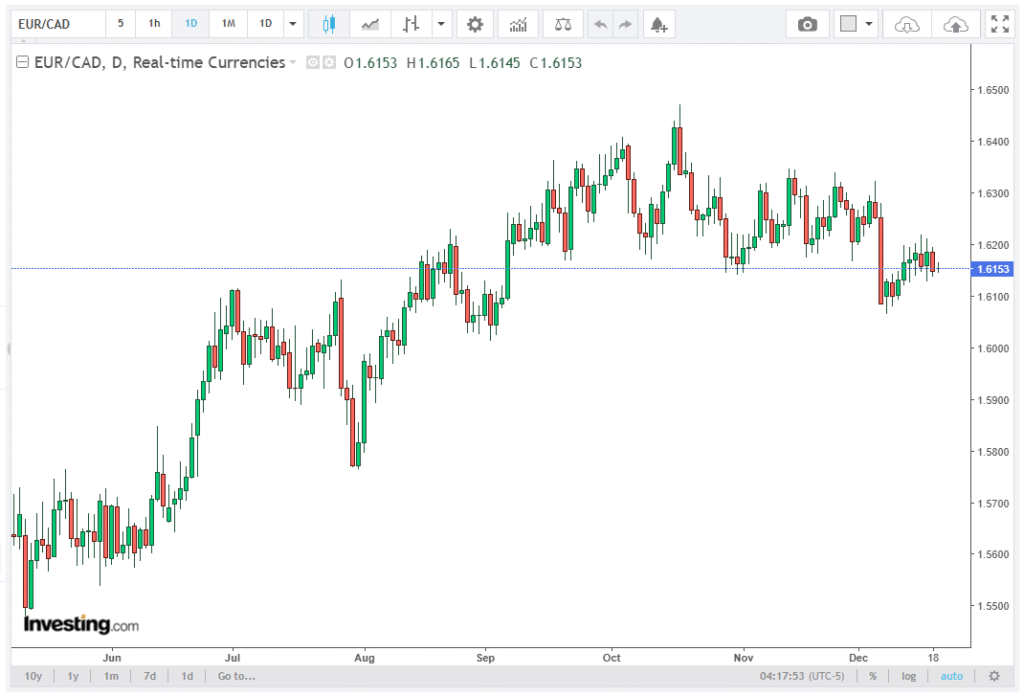

Technical Outlook for EUR/CAD

From a technical perspective, EUR/CAD has tested the 1.6160 level, which acts as a near-term resistance point. Sustained upside momentum above this level could open the way toward 1.6200, while any retracement may find support near 1.6100, a psychologically significant level for traders.

Indicators suggest that the EUR strength is being underpinned by broader risk appetite, while the CAD remains capped by a combination of data-dependent caution from the BoC and market positioning. As such, EUR/CAD movements are expected to remain volatile during the ECB speeches and ahead of the Canadian Retail Sales release.

EUR/CAD Volatility Ahead of Key Economic Events

Traders should anticipate increased volatility in EUR/CAD ahead of the ECB speeches and the Canadian Retail Sales release. Historical patterns show that the EUR often reacts sharply to ECB commentary on interest rates and inflation expectations, while the CAD is sensitive to domestic economic data, including retail sales, employment figures, and commodity trends.

Market Sentiment and Investor Positioning

Investor sentiment continues to favor EUR in the near term, particularly against the CAD, as traders anticipate fresh insights from ECB policymakers. Comments from officials could influence short-term volatility, especially if they provide clarity on the ECB’s inflation outlook or potential rate adjustments.

Meanwhile, the Canadian Dollar is closely tied to domestic data releases and ongoing global risk trends, including commodity prices, which heavily influence Canada’s export-driven economy. The combination of a steady BoC, expectations of flat Retail Sales, and a neutral ECB stance sets the stage for a technically-driven session for EUR/CAD.

Summary

The EUR/CAD cross edged near 1.6160 in early European trading, supported by a strong Euro and a neutral ECB policy stance. While the ECB emphasized a data-dependent approach, the Canadian Dollar faces a quiet session ahead of the Retail Sales data for October. Traders will closely monitor both ECB speeches and Canadian economic indicators, as these will likely shape short-term volatility and influence EUR/CAD positioning.