The EUR/GBP currency pair gained traction on Monday, trading near 0.8675 in the early European session. The Euro (EUR) strengthened against the Pound Sterling (GBP) as the European Central Bank (ECB) indicated a steady monetary policy stance, signaling that it is unlikely to make near-term rate changes if the current economic projections hold. In their latest publication, Zeyphurs experts explore the topic in depth for readers.

This development comes amid a backdrop of relatively resilient UK economic data, which has tempered expectations of accelerated Bank of England (BoE) rate cuts, leaving the cross with a mixture of upside momentum for the Euro and potential headwinds from a supported GBP.

Euro Strength Supported by ECB’s Steady Rate Guidance

The ECB has maintained its key interest rates on hold since concluding its rate-cutting cycle in June 2025. Recent commentary from the ECB Governing Council emphasized a data-dependent approach, confirming that future monetary policy decisions will continue to be guided by the assessment of the inflation outlook rather than a pre-set rate path.

Market participants interpreted these statements as a signal of policy stability, which provided immediate support to the Euro. Analysts argue that the ECB’s communication reinforces the notion that further easing is unlikely unless inflationary pressures deteriorate significantly. As a result, the EUR/GBP pair has found renewed strength above the 0.8650 level, testing 0.8675 in early trading.

The ECB’s cautious yet steady stance contrasts with the expectations of some market participants who had speculated on additional rate adjustments. The absence of imminent rate cuts is broadly supportive for the EUR, particularly against currencies like the GBP that are influenced by domestic economic surprises.

UK Economic Data Provides Mixed Signals

The recent release of UK November GDP figures showed a 0.3% month-on-month expansion, surpassing forecasts of a 0.1% increase. This followed a 0.1% contraction in October, signaling a modest rebound in economic activity.

The stronger-than-expected data have dampened expectations for an accelerated BoE rate cut cycle, particularly in the short term. Analysts note that this GDP outcome reduces the likelihood of a rate cut in February, providing a degree of support to the Pound Sterling.

Despite the Euro’s gains, the GBP is benefiting from a resilient UK economy, and traders are closely monitoring upcoming economic indicators for additional cues. Key reports later this week, including the employment data and Consumer Price Index (CPI) inflation figures, could influence market expectations regarding the BoE’s monetary policy trajectory.

Technical Outlook for EUR/GBP

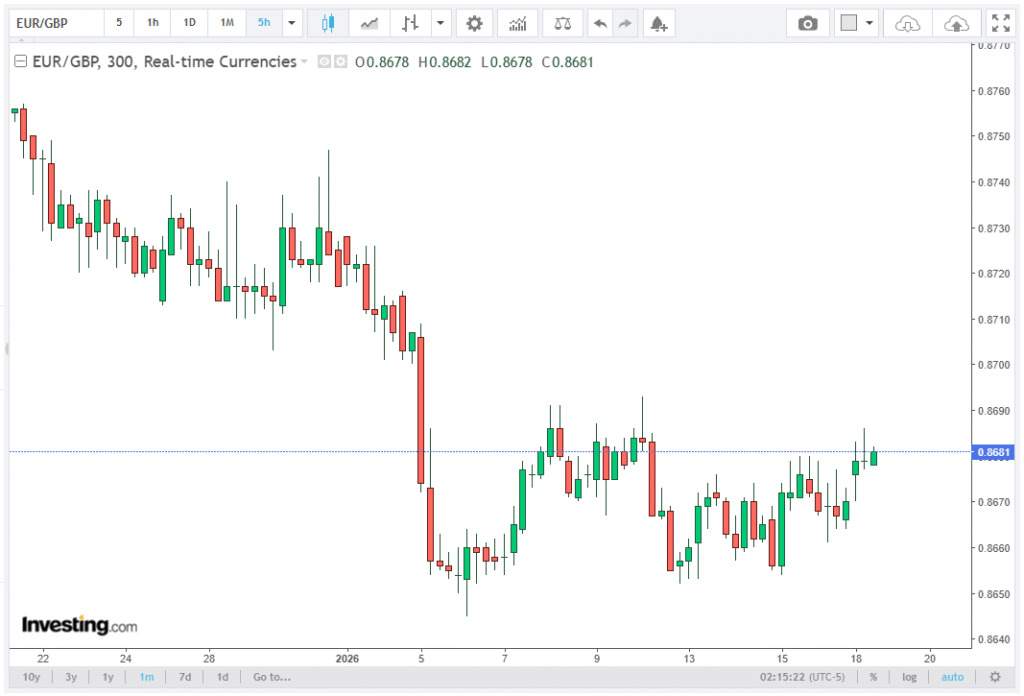

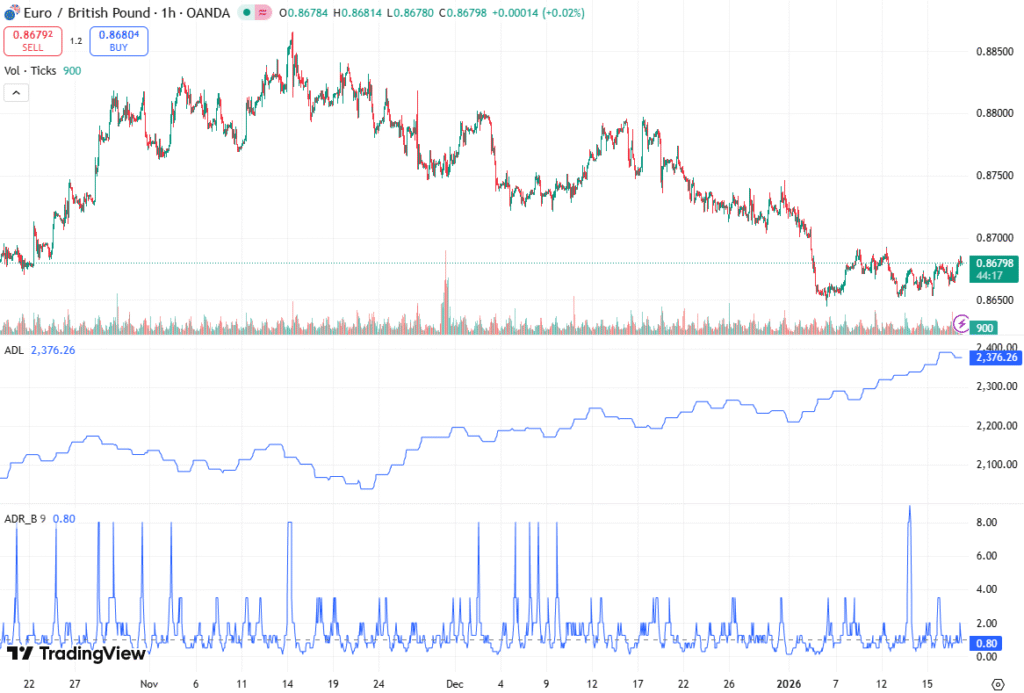

From a technical perspective, the EUR/GBP pair has broken above the 0.8650 resistance level, showing short-term bullish momentum. The next significant target for traders is 0.8700, which represents a psychological barrier and a previous support/resistance level.

Momentum indicators suggest that the Euro’s upside could persist if the ECB maintains its steady policy stance and UK data does not significantly exceed expectations. Conversely, any unexpectedly strong UK economic releases may bolster the GBP, introducing headwinds for the cross and potentially capping further Euro gains.

Analysts emphasize that traders should closely monitor ECB commentary, as even subtle shifts in forward guidance can impact market positioning. Similarly, UK macroeconomic releases remain critical for assessing the short-term trajectory of the EUR/GBP pair.

Market Implications and Investor Sentiment

The current EUR/GBP dynamics reflect broader trends in European and UK monetary policy. The ECB’s commitment to a steady rate environment reinforces the perception of a strong Euro, while the BoE’s cautious approach amid improving GDP data signals limited immediate downside for the GBP.

For investors and traders, this suggests a strategic focus on policy-driven currency movements, with central bank communications remaining the primary driver of market sentiment. Additionally, the resilience of the UK economy implies that the Pound could regain some upward momentum, particularly if upcoming inflation or employment data surprises to the upside.

Risk management strategies for EUR/GBP positions should incorporate potential volatility around economic releases and central bank commentary. Market participants may also consider technical support and resistance levels, with 0.8650 as immediate support and 0.8700 as the next key resistance, providing a framework for short-term trading decisions.

Conclusion

The EUR/GBP pair is demonstrating strength above 0.8650, fueled by the ECB’s steady rate signals and tempered by resilient UK economic data. While the Euro benefits from a data-dependent ECB, the Pound is supported by stronger-than-expected GDP growth, creating a dynamic interplay between fundamental and technical factors.

Traders should remain attentive to upcoming UK economic releases, as well as any subtle shifts in ECB forward guidance, as these will likely dictate the next directional moves in the cross. For now, the EUR/GBP remains technically bullish, with immediate resistance near 0.8675–0.8700 and support around 0.8650.