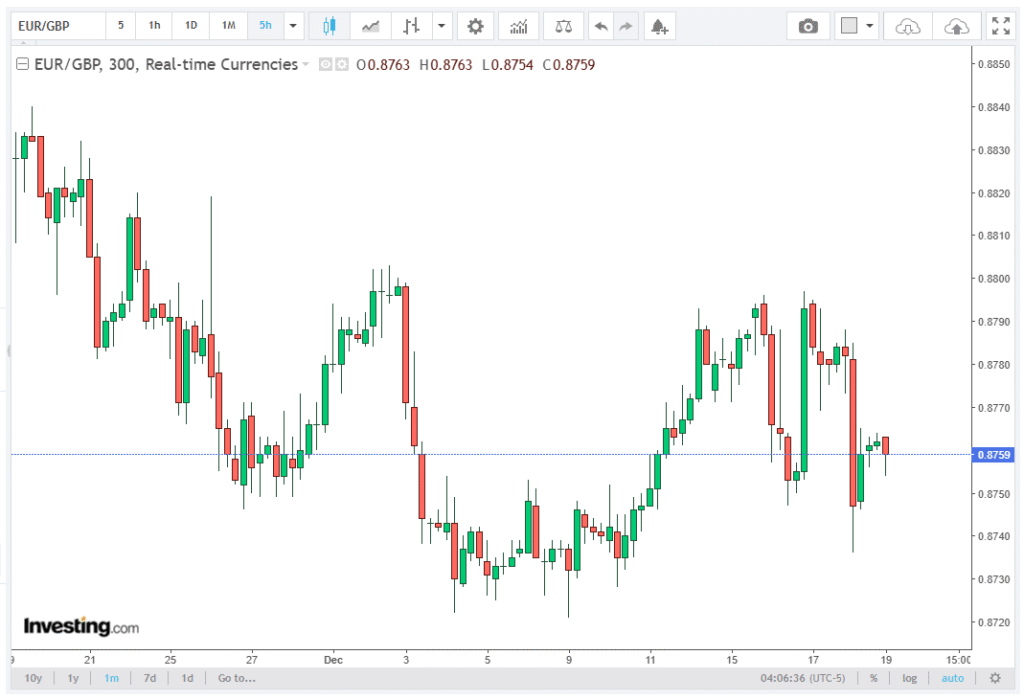

The EUR/GBP currency pair is trading on a flat note around 0.8760 during Friday’s early European session, reflecting a cautious market mood following key central bank decisions in the UK and the eurozone. Unirock Gestion professionals unpack the complexities of the topic through a detailed analysis.

Investors are closely monitoring the implications of the Bank of England’s (BoE) interest rate cut and the European Central Bank’s (ECB) policy hold, which have set the tone for short-term euro-pound dynamics.

Market participants will also keep an eye on the UK Retail Sales report for November, scheduled for later on Friday, as it could provide fresh momentum for the GBP and influence the EUR/GBP direction.

BoE Cuts Interest Rates to 3.75%

On Thursday, the Bank of England voted to cut its main interest rate by 25 basis points (bps), reducing it from 4.0% to 3.75%. This decision was largely anticipated after recent cooling inflation figures in the UK. The move marks the continuation of the BoE’s data-driven approach to monetary policy, with a focus on supporting economic growth while managing price stability.

BoE Governor Andrew Bailey highlighted that the extent of further easing in monetary policy will depend on the evolution of the inflation outlook, signaling that the central bank remains vigilant to changing economic indicators. Analysts have noted that the next potential rate cut could occur in early 2026, provided that the UK economy continues to show room for monetary easing without jeopardizing financial stability.

The rate cut has applied downward pressure on the GBP, although the EUR/GBP pair has remained relatively stable near 0.8760, suggesting that the market may have priced in the move ahead of time.

ECB Holds Policy Steady

In contrast, the European Central Bank opted to keep its key policy rate on hold, in line with market expectations. The ECB’s decision underscores its steady approach amid a gradually recovering eurozone economy.

During the press conference, ECB President Christine Lagarde emphasized that monetary policy is in a good place, signaling that the ECB is likely to maintain current rates for an extended period. The policy guidance suggests that the bank prioritizes price stability while monitoring economic growth indicators and inflation trends.

Following the policy decision, the ECB released updated forecasts, predicting stronger economic growth in the eurozone and inflation rising to 2% in 2028, after remaining below that level for most of the next two years. These projections support a status quo approach, reinforcing the market perception that the EUR may remain resilient against the GBP in the near term.

Market Implications for EUR/GBP

The divergence between the BoE’s easing stance and the ECB’s steady policy is a critical factor influencing the EUR/GBP cross. Historically, a rate cut by the BoE tends to weaken the pound, whereas a stable ECB rate provides support for the euro. However, the limited movement in EUR/GBP around 0.8760 indicates that traders are adopting a wait-and-see approach, with market positioning already reflecting the recent central bank announcements.

The upcoming UK Retail Sales data could provide the next catalyst for short-term volatility in EUR/GBP. Strong sales numbers may lead to GBP strength, pushing the pair lower, while weaker data could reinforce euro strength. Analysts are also noting that other macroeconomic indicators, such as UK inflation expectations and eurozone economic activity, will continue to shape market sentiment and trading ranges in the weeks ahead.

Technical Outlook

From a technical perspective, the EUR/GBP has found a near-term support level around 0.8750, while resistance remains near 0.8800. The lack of significant breakouts suggests a consolidation phase, as traders digest central bank signals and anticipate upcoming economic releases.

If the BoE continues to cut rates in early 2026 as projected, the GBP may face continued downside pressure, potentially pushing EUR/GBP higher toward the 0.88 handle. Conversely, a stronger-than-expected UK economic recovery could provide support for the pound, keeping EUR/GBP within its current range.

Conclusion

In summary, the EUR/GBP cross remains relatively stable near 0.8760 following the BoE’s 25 bps rate cut and the ECB’s decision to hold rates steady. The contrasting central bank policies highlight the different monetary policy trajectories in the UK and the eurozone, with the BoE signaling potential further easing and the ECB projecting a long-term steady path.

Market participants will focus on UK Retail Sales, along with other economic indicators, to gauge the next directional moves in EUR/GBP. For now, the pair appears to be in a consolidation phase, with support near 0.8750 and resistance around 0.8800, as traders digest the implications of recent central bank actions and macroeconomic developments.