The EUR/USD currency pair is currently hovering near key resistance levels as traders and investors brace for significant macro-economic events this week. As of the latest data, the pair is trading at 1.1737, just below the weekly high of 1.1800, reflecting a cautious market sentiment ahead of the European Central Bank (ECB) interest rate decision and the upcoming US inflation data.

Market participants are closely watching these events, as they are likely to provide direction for the forex market and influence EUR/USD volatility. This article from Aurudium offers readers a clear and thorough explanation of the subject.

ECB Interest Rate Decision in Focus

The primary focus for traders is the ECB monetary policy decision. Economists polled by Reuters largely expect the ECB to keep interest rates unchanged at 2%, citing the resilient performance of the Eurozone economy. Recent economic indicators suggest that growth is proceeding faster than expected, driven by exporter performance, especially those navigating US tariffs more efficiently than anticipated.

A key contributor to this resilience is Germany, the largest economy in the Eurozone, where strong consumer spending is supporting overall growth. Meanwhile, the French economy continues to demonstrate robustness, even amid budgetary challenges, reinforcing confidence that the Eurozone recovery remains on track.

Importantly, Eurozone inflation is nearing the ECB’s 2% target, suggesting that price stability is being maintained. Analysts predict that inflation will remain steady in the coming months. This scenario supports the likelihood that the ECB will maintain current monetary policy settings, while potentially raising economic growth forecasts.

Some market strategists suggest that the ECB may even signal a modest interest rate hike in late 2026, which could create a divergence with the Federal Reserve (Fed). While the ECB is showing signs of potential tightening, the Fed is widely expected to continue cutting rates, reflecting differing economic conditions across regions.

US Inflation Data: Another Key Catalyst

In addition to the ECB decision, the EUR/USD pair is also sensitive to upcoming US inflation reports. These data will be released shortly after the Bureau of Labor Statistics’ latest employment figures, providing a comprehensive view of US economic momentum.

Analysts expect inflationary pressures in the US to moderate, supported by recent declines in crude oil prices and easing commodity costs. A slowdown in US inflation could influence the Federal Reserve’s policy outlook, potentially lowering the probability of further rate hikes in the near term.

Traders anticipate that the intersection of US inflation trends and ECB guidance will provide the next directional cue for EUR/USD, highlighting the importance of fundamental analysis in currency trading.

EUR/USD Technical Analysis

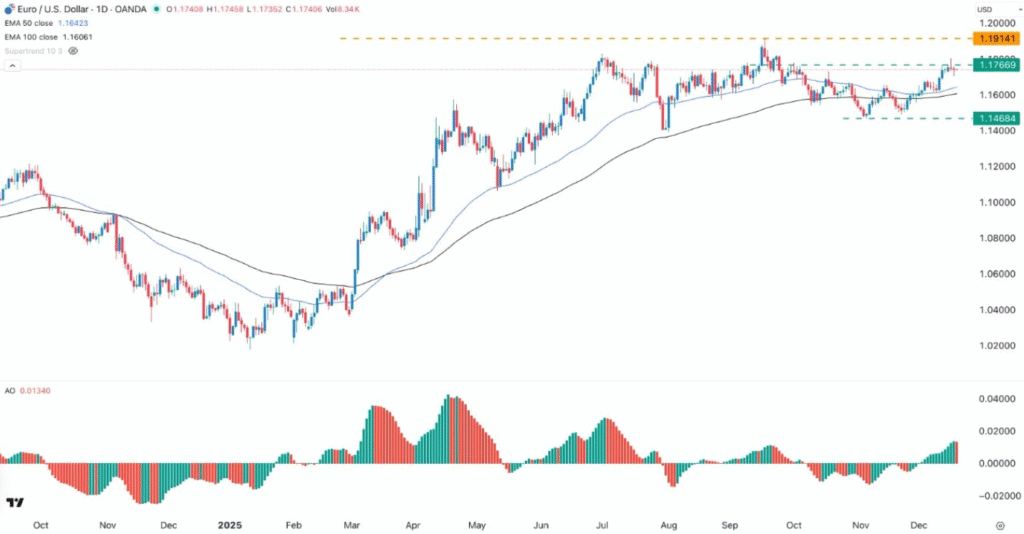

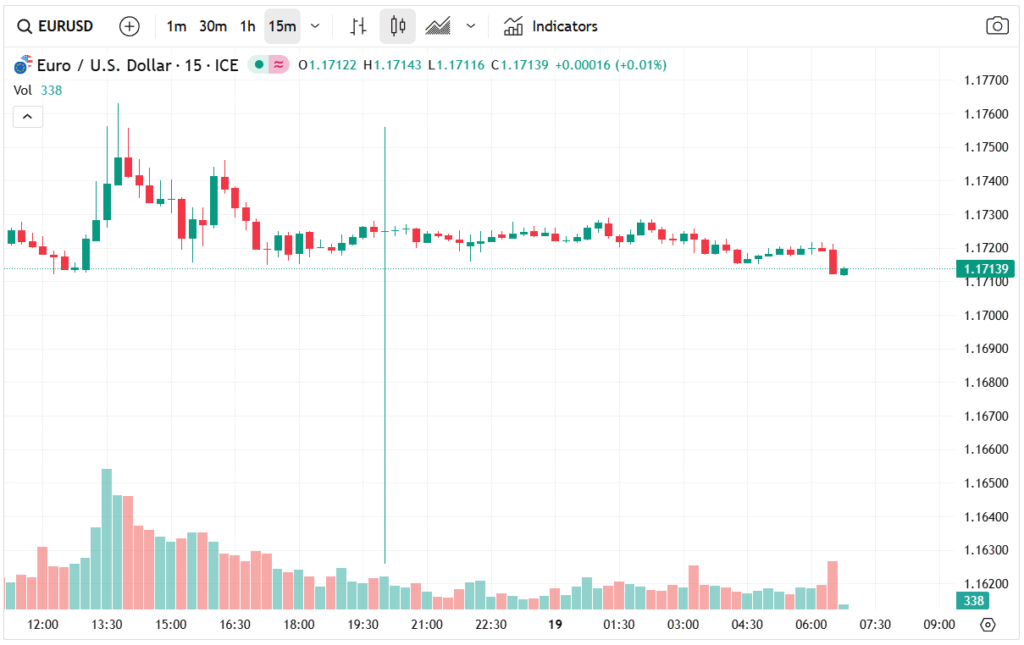

From a technical perspective, the EUR/USD daily chart shows that the pair pulled back to 1.1735, slightly below this week’s high of 1.1797. The minor retracement is largely attributed to the market’s wait-and-see approach ahead of the ECB announcement.

Despite the pullback, the pair remains above the 50-day moving average (MA50), signaling that the short-term trend continues to be bullish. Additionally, the Awesome Oscillator has moved above the zero line, reinforcing the upward momentum. These technical indicators suggest that EUR/USD bulls remain in control, with the next key psychological resistance level at 1.1800.

A decisive break above 1.1800 would strengthen bullish sentiment, potentially targeting the year-to-date high of 1.1915. Traders are also monitoring intraday support levels, which are currently near 1.1720–1.1730, for indications of pullback limits and potential entry points for long positions.

Market Sentiment and Trading Strategy

Investor sentiment in the EUR/USD market is currently characterized by caution and anticipation. The convergence of ECB policy signals and US inflation data makes this a high-impact week for forex traders. Market participants are likely to adopt strategic positioning, balancing risk management with profit opportunities.

For short-term traders, monitoring price action around 1.1735–1.1800 is critical. A break above resistance could lead to a rapid bullish move, while a failure to sustain above this level may result in a temporary pullback. Similarly, long-term investors are likely to focus on fundamental drivers, including Eurozone growth and inflation trends, alongside Fed-ECB policy divergence, to guide positioning decisions.

Conclusion

The EUR/USD pair remains stuck at a key price as traders await critical macro-economic updates. The upcoming ECB interest rate decision and US inflation report are set to be the primary catalysts for volatility. From a technical standpoint, the pair shows bullish momentum, supported by the 50-day moving average and Awesome Oscillator readings, with resistance at 1.1800 and a potential target at 1.1915.

Traders should maintain a watchful eye on both fundamental and technical indicators, as this week’s events could define short-term direction for the EUR/USD forex market, providing opportunities for strategic trades and risk-adjusted exposure in a key major currency pair.