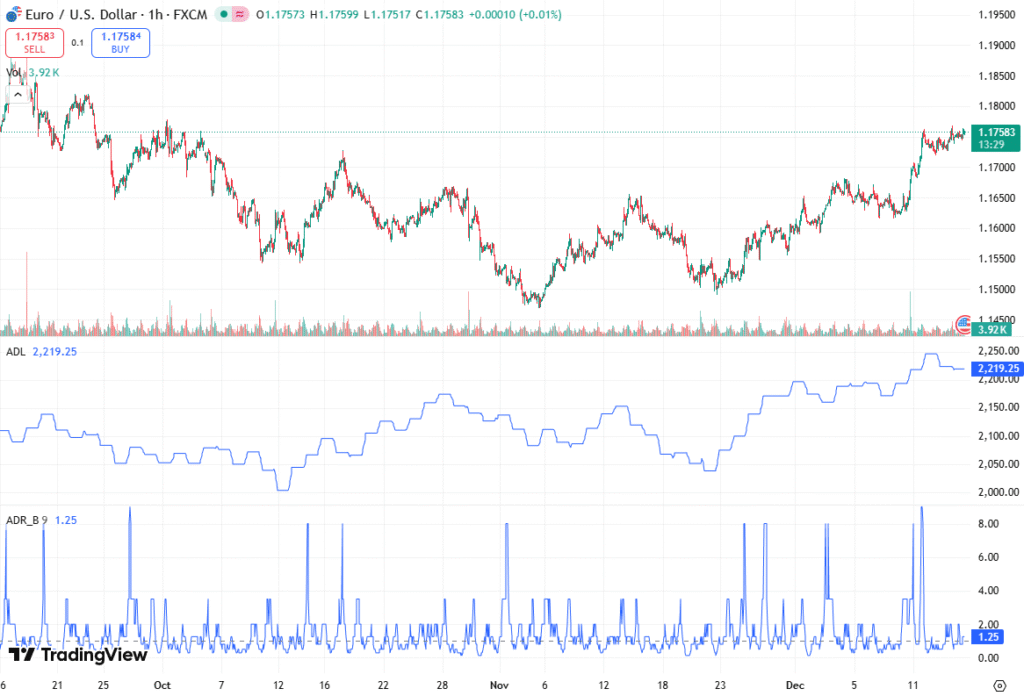

The EUR/USD currency pair is trading cautiously near recent highs as market participants await critical US employment data. After an extended bullish run, the pair is showing early signs of momentum fatigue, with both fundamental developments and technical indicators suggesting a potential pause or corrective phase. The brokers at Orbisolyx provide a comprehensive breakdown of this topic in this article.

At the time of writing, EUR/USD is hovering around 1.1755, slightly below the two-and-a-half-month high of 1.1765, reflecting a market that is increasingly data-dependent and risk-aware.

EUR/USD Price Action: Steady but Hesitant

Preliminary December Purchasing Managers’ Index (PMI) data from the Eurozone painted a mixed-to-negative economic picture, undermining confidence in the region’s short-term growth outlook. The Services PMI fell sharply to 52.6, down from 53.6 in November and well below expectations of 53.9, signaling a loss of momentum in the services sector, while the Manufacturing PMI slipped deeper into contraction territory at 49.2, down from 49.6 and contrary to expectations of stabilization.

At the country level, Germany’s Manufacturing PMI dropped to 47.7, reinforcing concerns over persistent industrial weakness, while its Services PMI eased to 52.6, confirming a broader slowdown. In France, the Services PMI declined to 50.2, nearing stagnation, although the Manufacturing PMI surprised to the upside, rising to 50.6 from 47.8, signaling a return to expansion.

US Dollar Remains Depressed Ahead of NFP

The US Dollar (USD) continues to trade on the defensive, as investors maintain expectations of further Federal Reserve rate cuts in the coming months. This has helped keep the Euro supported near cycle highs, despite weaker regional data.

Recent US data has done little to reverse bearish USD sentiment. The New York Empire State Manufacturing Index plunged to -3.9 in December, missing expectations of 10.6 and collapsing from 18.7 in November, signaling a sharp deterioration in regional manufacturing activity.

Key US Data in Focus: Employment and Retail Sales

Market attention is now firmly focused on a busy US macroeconomic calendar, led by the release of Nonfarm Payrolls (NFP) data for October and November. November NFP is expected to show a 50K increase in payrolls, while the unemployment rate is forecast to remain steady at 4.4%. October payroll figures will also be released, although jobless rate data will be absent due to missing information during the government shutdown.

In addition, the US Commerce Department will publish October Retail Sales, with headline retail sales expected to rise 0.2%, matching September’s pace, and retail sales excluding autos forecast at 0.2%, slightly below September’s 0.3% increase. Together, these releases will shape expectations around US economic resilience, consumer demand, and future Fed policy decisions.

Monetary Policy Outlook: ECB vs Fed

The European Central Bank (ECB) is widely expected to keep interest rates unchanged at its upcoming meeting. However, speculation is growing that policymakers may signal a potential rate hike in the second half of 2026, lending medium-term support to the Euro.

In contrast, the Federal Reserve remains under pressure to ease policy further, reinforcing the policy divergence narrative that has underpinned the EUR/USD rally in recent weeks.

Adding to Euro support, geopolitical developments have improved sentiment. Reports of progress toward a Ukraine peace framework, including NATO-style security guarantees discussed between the US and the Ukrainian presidents, have modestly boosted European risk assets.

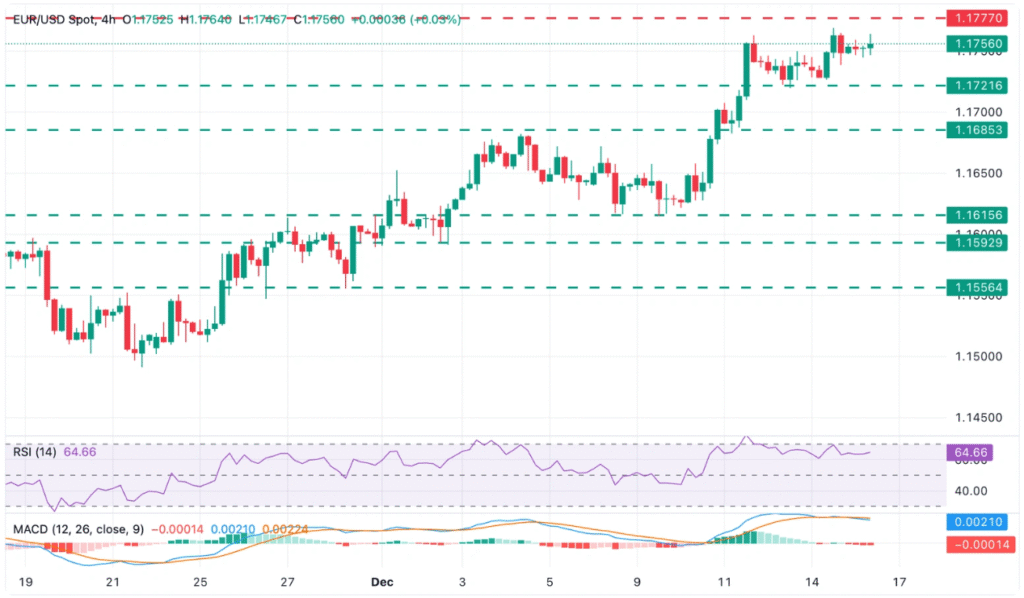

Technical Analysis: Rally Shows Signs of Exhaustion

From a technical perspective, the EUR/USD bullish trend remains intact, though signs of short-term exhaustion are becoming increasingly evident. The 4-hour Relative Strength Index (RSI) is showing a bearish divergence, pointing to waning upside momentum despite elevated price levels, while the MACD has crossed below its signal line, a classic early warning of a potential corrective move.

Key support levels are located at 1.1720 (December 12 low and immediate support), 1.1685 (December 11 low), and 1.1615 (December 9 low and a deeper correction target). On the upside, key resistance levels are seen at 1.1760–1.1770, a repeatedly rejected resistance zone, followed by 1.1780 (October 1 peak) and 1.1820 (September 23–24 highs and a major bullish objective).

A clear break above 1.1770–1.1780 would be needed to reignite bullish momentum, while failure to do so increases the risk of a near-term pullback.

Conclusion: Cautious Optimism with Rising Data Sensitivity

The EUR/USD pair remains supported near recent highs, but soft Eurozone data, fading technical momentum, and imminent US employment releases are encouraging a more cautious market stance. While the broader trend still favors the Euro, the rally appears increasingly vulnerable to disappointment, making upcoming data pivotal for determining the pair’s next directional move.