Investing in exchange-traded funds (ETFs) is one of the easiest and most efficient ways to build long-term wealth with minimal effort. As we approach 2026, it’s the perfect time to evaluate your portfolio and consider adding some Vanguard ETFs. Whether you seek stability or higher growth potential, there’s an ETF to match every investor’s strategy.

Financial analysts from Arbitics identify three Vanguard ETFs that may be relevant for investors evaluating long-term, diversified investment options. These ETFs offer diversification, allowing you to grow your wealth steadily, regardless of market conditions. For those looking for steady, reliable growth, the Vanguard S&P 500 ETF is ideal.

If higher returns are your goal, the Vanguard Growth ETF offers a focus on growth stocks. For those willing to take on more risk, the Vanguard Information Technology ETF provides targeted exposure to the high-growth tech sector. Each option aligns with different investment objectives and risk tolerances.

1. Vanguard S&P 500 ETF (VOO): A Reliable Foundation

If you’re new to investing or seeking a steady, long-term investment, the Vanguard S&P 500 ETF (VOO) is an excellent choice. This fund tracks the S&P 500 Index, which includes 500 of the largest and most successful U.S. companies, many of which have long histories of leadership in their respective industries.

One of the key advantages of VOO is its diversification across multiple sectors like technology, healthcare, and finance, helping reduce volatility and protect your investment from sector-specific downturns. Additionally, large-cap stocks tend to be more resilient during market dips, providing stability.

While it may not deliver the high returns of more specialized funds, VOO has historically offered strong long-term returns, making it a safe and reliable option for those seeking consistent, steady growth. It’s an ideal choice for investors looking to build a balanced, low-risk portfolio for the future.

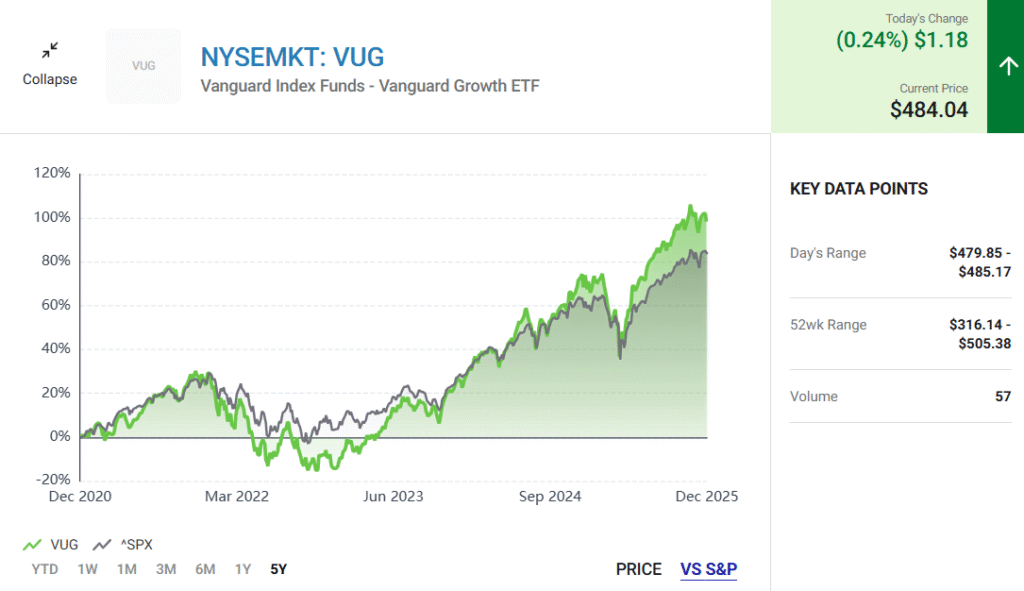

2. Vanguard Growth ETF (VUG): A Path to Faster Gains

While the S&P 500 ETF offers reliable, steady growth, it generally tracks the overall market performance, meaning it’s unlikely to outperform the market itself. For investors seeking above-average returns, the Vanguard Growth ETF (VUG) may be a better option. This fund focuses on large-cap growth stocks with high growth potential.

One of the key advantages of VUG is its ability to target high-growth companies, offering better returns than the more diversified S&P 500 ETF. Over the past decade, VUG has averaged an annual return of 17.22%, significantly outperforming the 14.58% return of the S&P 500 ETF.

While the Vanguard Growth ETF carries higher risk due to its more focused strategy, it strikes a good balance for those seeking higher growth potential while maintaining the stability of large-cap stocks. This makes it an appealing choice for long-term investors who are looking for growth but still value some level of stability.

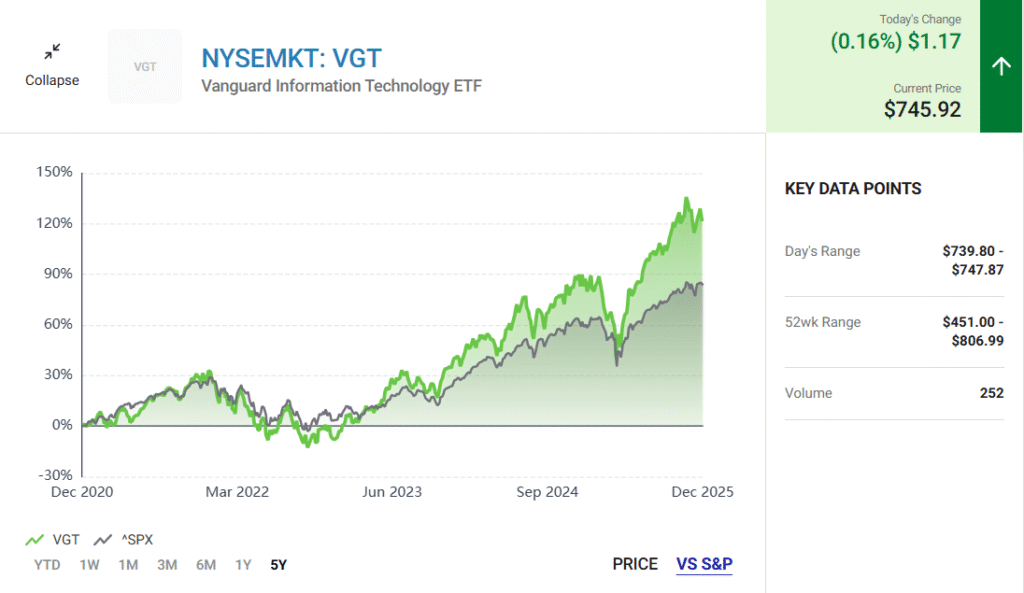

3. Vanguard Information Technology ETF (VGT): For High-Risk, High-Reward Investors

For investors looking to maximize their returns, focusing on a specific sector can be highly rewarding. The Vanguard Information Technology ETF (VGT) targets the technology sector, one of the most volatile yet high-growth sectors in the market.

The key advantage of VGT is that it provides targeted exposure to tech, a sector that has demonstrated remarkable growth in recent years. Over the past decade, VGT has delivered an average annual return of 22.18%, surpassing both the Vanguard Growth ETF and the S&P 500 ETF.

While the VGT ETF carries more volatility due to its narrow sector focus, its potential for higher returns is significant. The technology sector continues to be a major growth driver, and this fund offers investors the opportunity to capitalize on the strong momentum in tech.

Conclusion: Three ETFs for Long-Term Wealth

For long-term investors, these three Vanguard ETFs provide distinct benefits depending on your investment goals and risk tolerance. The Vanguard S&P 500 ETF offers diversification and stability, making it a solid choice for those seeking steady, reliable growth over time.

If you’re aiming for higher returns, the Vanguard Growth ETF focuses on growth stocks, providing a balance between risk and reward. Meanwhile, the Vanguard Information Technology ETF offers the potential for high returns but comes with higher volatility due to its concentrated focus on the tech sector, making it ideal for investors willing to take on more risk for potentially greater gains.

Many brokers have noted that adding these ETFs to your portfolio might help you achieve your financial goals over the next decade. Whether you’re seeking stability, above-average returns, or sector-specific growth, these ETFs are poised to help you build substantial wealth over time. Incorporating these ETFs into your strategy can provide consistent growth and diversification, making them great picks for 2026 and beyond.