The consumer technology market is once again refocusing on Apple’s long term product strategy as speculation around a foldable iPhone intensifies. Experts from Trilessyum are examining how a premium foldable device could reshape Apple’s upgrade dynamics, pricing power, and investor sentiment over the next several years.

While foldable smartphones have existed in the Android ecosystem for some time, Apple’s cautious approach has kept it on the sidelines. That patience may now be nearing its end. According to market analysts, Apple is preparing for a controlled but meaningful entry into the foldable segment, positioning the product as a high end addition rather than a mass market replacement.

Measured Rollout With Premium Positioning

Industry forecasts suggest Apple’s foldable iPhone could debut alongside its next generation flagship lineup, potentially as early as late 2026. Pricing expectations remain firmly in the premium category, with estimates clustering near $2,000 per device, placing it well above current Pro Max models.

Market experts note that Apple’s strategy appears focused on margin protection rather than volume leadership. Early shipment estimates point to approximately 8 million units in 2026, representing roughly 3 % of total iPhone shipments, followed by a potential expansion toward 20 million units in 2027 if adoption proves resilient.

This approach reflects Apple’s historical playbook. New form factors are typically introduced at limited scale, refined through multiple cycles, and gradually expanded once manufacturing efficiency and consumer demand align.

Investor Sentiment and Share Performance Context

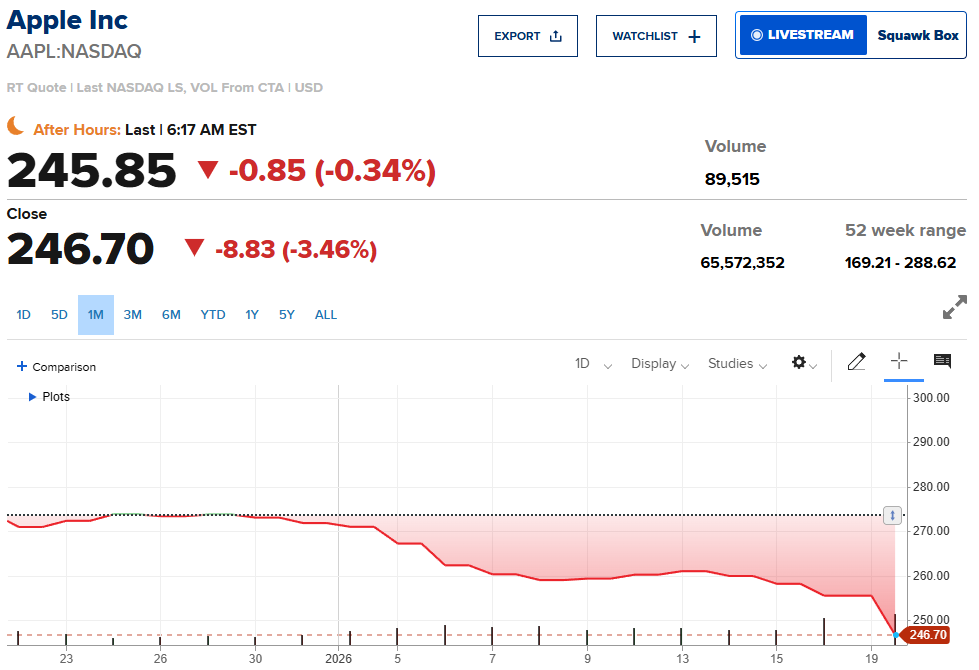

Despite its dominant brand position, Apple’s equity performance has struggled to keep pace with broader market benchmarks over the past year. Shares have gained 11 % over the last twelve months, trailing the 15 % advance of the S&P 500 during the same period. Early 2026 performance has remained pressured, with the stock down approximately 6 % year to date.

Market participants attribute part of this underperformance to investor rotation toward companies more directly associated with artificial intelligence infrastructure and software. Rising component costs, particularly in memory pricing, have also introduced near term margin concerns, leading some analysts to revise price targets lower.

At the time of writing, Apple shares were trading near $245, reflecting ongoing volatility as investors reassess growth catalysts.

AI Integration Alters the Competitive Narrative

Beyond hardware, Apple’s renewed focus on artificial intelligence is becoming an increasingly important variable in the investment case. A recently announced partnership with Google will integrate Gemini AI models and cloud capabilities into future versions of Siri.

The market analysts emphasize that while this move acknowledges Apple’s slower AI development pace relative to some competitors, it simultaneously accelerates its ability to deploy advanced AI features across its installed base. From a strategic perspective, access to mature AI infrastructure could shorten Apple’s innovation cycle and enhance the perceived value of upcoming devices.

This integration may prove particularly relevant when paired with a foldable device launch, allowing Apple to bundle new hardware form factors with materially improved software experiences.

Upgrade Cycles Show Signs of Fatigue

Consumer replacement behavior remains a key factor supporting a foldable iPhone launch. Research shows that more than 70 % of recent US iPhone buyers are using devices at least two years old, up from 66 % the prior year, while over one third have kept their phones for three years or longer.

This lengthening upgrade cycle has pressured unit growth and created demand for a more meaningful hardware shift. A foldable design could provide that reset, encouraging upgrades from users who view recent iterations as incremental.

Technical Perspective on Apple Shares

From a technical perspective, Apple’s share price continues to consolidate below prior highs. Market experts note that stabilization near key support levels suggests investors are awaiting clearer catalysts, such as confirmation of a foldable launch timeline.

Broader Implications for Apple’s Ecosystem

The introduction of a foldable iPhone would represent more than a single product launch. It would signal Apple’s willingness to redefine its hardware roadmap at a time when consumer expectations are evolving and competition is intensifying.

They pointed out that Apple’s strength lies in ecosystem integration. A foldable device designed to work seamlessly with iOS, cloud services, AI powered assistants, and wearable products could reinforce user lock in while attracting high value customers seeking differentiated experiences.

Execution risk remains present. Manufacturing complexity, durability concerns, and pricing sensitivity will all influence adoption rates. However, Apple’s financial resilience provides flexibility to absorb early inefficiencies while refining the product over successive iterations.

Outlook

Looking ahead, the foldable iPhone narrative may help shift Apple’s market perception from incremental evolution to selective innovation. Combined with enhanced AI capabilities and a large base of delayed upgraders, the setup creates optionality rather than certainty.

For investors, the key question is not whether foldable devices will dominate unit volumes, but whether they can meaningfully reaccelerate revenue growth and reinforce Apple’s premium positioning in a slowing smartphone market.