The GBP/USD exchange rate has shown a strong rebound in recent sessions, fueled by mixed employment data from the UK and the US. The pair surged to 1.3460, marking its highest level since October 17, and significantly higher than last month’s low of 1.3000. Tarillium experts deliver a detailed and insightful analysis of the subject in their latest piece.

Market participants are now closely monitoring the upcoming UK Consumer Price Index (CPI) release, which could influence Sterling’s momentum and guide the Bank of England’s monetary policy decisions.

US and UK Unemployment Rates Rise

The GBP/USD pair experienced upward pressure following the publication of the latest jobs reports from both sides of the Atlantic. In the UK, the Office of National Statistics (ONS) reported that the unemployment rate increased to 5.1% in October, up from 5.0% in September, reaching its highest level in years. The report highlighted a net loss of 16,000 jobs in October, following 22,000 job losses in September.

Average earnings growth also softened, with average earnings over the three months to October declining to 4.6%. These figures point to slower wage growth, potentially reducing consumer spending power and influencing the trajectory of UK inflation.

On the US side, the Bureau of Labor Statistics (BLS) reported a mixed jobs picture. October saw a decline of 105,000 jobs, largely due to a drop in government employment, while November saw 64,000 new jobs created.

The unemployment rate in the US rose to 4.6%, indicating a softening labor market. These developments contributed to Sterling’s rebound, as investors adjusted currency positions amid signs of moderating global growth pressures.

Sterling Reacts to Inflation Expectations

Market attention has now shifted to the upcoming UK CPI report, expected during the morning session. Economists forecast that the headline CPI will ease slightly from 3.6% in October to 3.5%, suggesting a gradual deceleration in inflation.

This comes at a critical moment as the Bank of England (BoE) prepares to deliver its final interest rate decision of the year. Analysts widely expect the BoE to implement a 0.25% rate cut, despite inflation remaining above the 2% target. Traders anticipate that this move could support GBP gains, especially if the CPI confirms a downward trend in price pressures.

The GBP/USD pair also benefited from falling crude oil prices, which have historically influenced inflation expectations. Brent crude declined to $58 per barrel, while West Texas Intermediate (WTI) fell to $55, easing concerns over energy-driven inflation in both the UK and the US. Lower oil prices generally boost the Sterling by reducing import cost pressures and enhancing real consumer purchasing power.

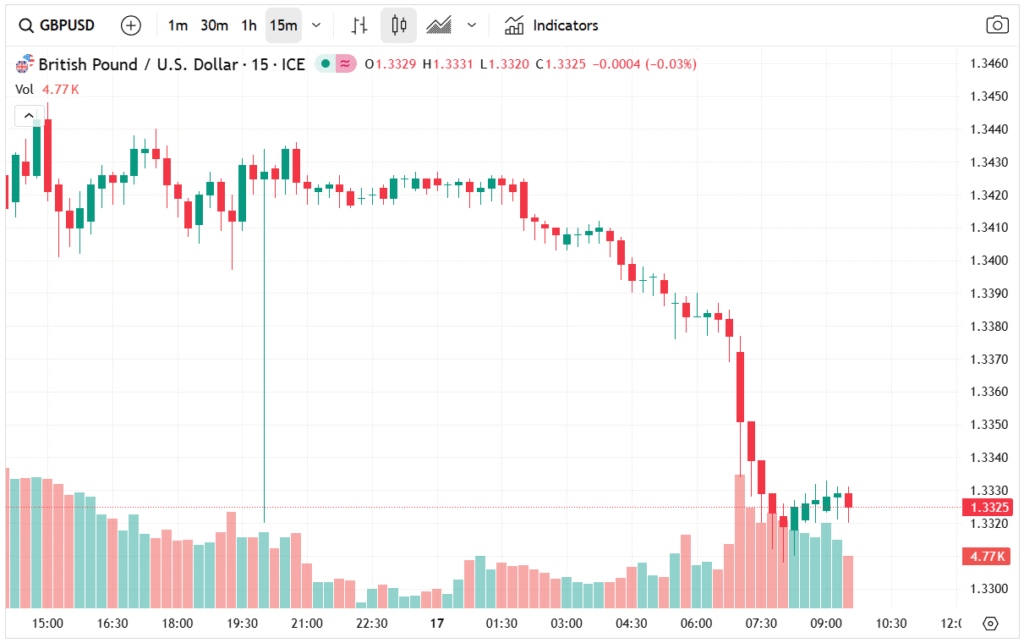

GBP/USD Technical Analysis

From a technical perspective, GBP/USD has shown a strong bullish rebound over the past few days. The pair moved above its 50-day and 100-day Exponential Moving Averages (EMA), indicating a potential trend reversal. The 50-day EMA is currently on the verge of crossing above the 100-day EMA, which could provide a powerful bullish signal for traders targeting short- and medium-term gains.

The Average Directional Index (ADX) has risen to 27, signaling that the current trend is strengthening. Meanwhile, the Relative Strength Index (RSI) is approaching the overbought territory, suggesting that upward momentum remains robust but may soon face a temporary pullback.

Key technical levels to watch include the resistance at 1.3550, which, if broken, could open the door to further upside. Conversely, a decline below support at 1.3315, aligned with the 100-day EMA, would invalidate the bullish scenario, potentially triggering short-term corrective moves.

Market Implications and Outlook

The recent movements in GBP/USD reflect a complex interplay of economic data, central bank expectations, and market sentiment. The combination of higher unemployment rates in both the UK and the US, along with softening earnings, points to slower economic momentum, yet Sterling continues to benefit from the relative resilience of the UK economy against a backdrop of global uncertainties.

The upcoming UK CPI release will be pivotal for traders. A softer-than-expected CPI print could reinforce expectations of a Bank of England rate cut, likely sustaining GBP/USD gains. On the other hand, a surprise uptick in inflation might temper Sterling strength, creating a potential short-term reversal.

Additionally, the decline in oil prices has added to the bullish outlook, as lower energy costs can ease consumer price pressures, further supporting Sterling.

Conclusion

The GBP/USD pair has gained momentum, driven by mixed employment data, falling oil prices, and anticipation of the UK CPI release. Technical indicators, including EMA crossovers, a rising ADX, and RSI levels, suggest that Sterling bulls remain in control, with resistance at 1.3550 as the next key target.