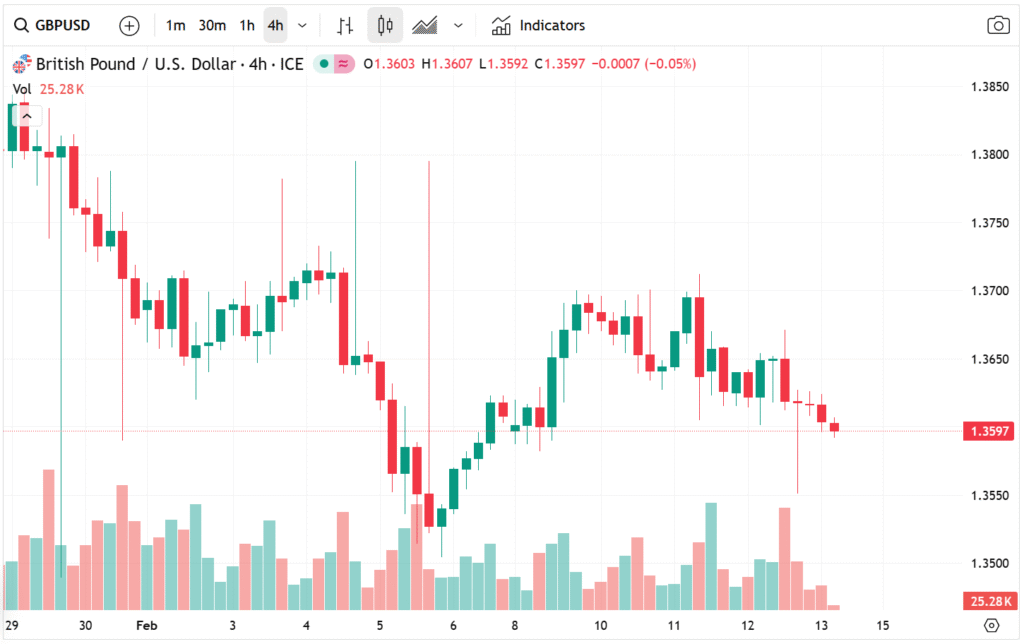

The GBP/USD pair edged lower following the release of a stronger-than-anticipated US Non-Farm Payrolls (NFP) report, which boosted demand for the US Dollar and prompted a mild retracement in the exchange rate. The pair declined to a low of 1.3627, down from this week’s high of 1.3720, as traders shifted their focus toward the upcoming US inflation report and the latest UK GDP data.

Despite the recent retracement, the broader technical structure suggests that the pair remains constructive, particularly if it breaks decisively above the critical 1.3730 resistance level. The brokers at Rivonsphere provide a comprehensive breakdown of this topic in this article.

Strong US Jobs Data Supports the Dollar

The recent pullback in GBP/USD followed the release of robust employment figures from the Bureau of Labor Statistics. The data showed that the US economy created 130,000 jobs, significantly outperforming the consensus forecast of 70,000. This upside surprise reinforced confidence in the resilience of the US labor market despite tighter monetary conditions.

The report also revealed that the unemployment rate declined to 4.3% from 4.4%, while wage growth remained firm in recent months. Continued earnings expansion highlights underlying economic strength, even as major corporations such as Amazon and Target announced substantial layoffs.

These developments complicate the outlook for the Federal Reserve. A strong labor market reduces the urgency for aggressive interest rate cuts, especially if inflation remains above target. However, investors remain cautious given the possibility of future downward revisions to the employment data, a pattern observed in previous releases.

Inflation Data: The Next Major Catalyst

Attention now turns to the highly anticipated Consumer Price Index (CPI) report. Economists surveyed by Reuters expect the headline CPI to ease from 2.7% in December to 2.6% in January, while core inflation, which excludes volatile food and energy prices, is projected to decline from 2.6% to 2.5%.

If inflation continues to moderate, pressure could build on the Federal Reserve to begin implementing monetary easing. Lower interest rate expectations would likely push down US Treasury yields, weakening the dollar and providing support for GBP/USD.

UK GDP in Focus

On the UK side, traders are awaiting growth data from the Office for National Statistics. Analysts expect the economy to have expanded by 1.2% in the fourth quarter, slightly down from 1.3% previously.

A slowdown in economic growth could weigh on the British Pound, particularly if accompanied by weaker business investment or consumer spending. However, an upside surprise in GDP would strengthen the argument that the UK economy is stabilizing, potentially supporting sterling and reinforcing expectations that the Bank of England may proceed cautiously with rate cuts.

GBP/USD Technical Analysis

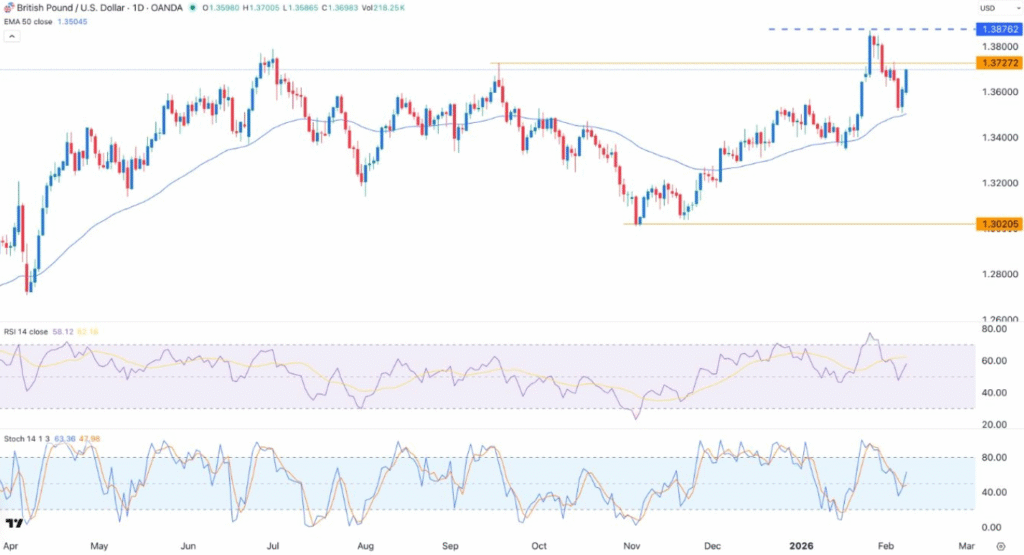

From a technical perspective, the recent decline appears to be a corrective pullback within a broader bullish trend, rather than the start of a sustained reversal. The pair has retreated from 1.3730 to around 1.3630, coinciding with a rebound in the US Dollar Index (DXY) following the strong employment report.

On the daily chart, GBP/USD remains above the 50-day Exponential Moving Average (EMA), a key indicator of medium-term trend direction. Holding above this moving average suggests that buyers still maintain structural control.

However, momentum indicators show emerging caution. The Percentage Price Oscillator (PPO) has formed a bearish crossover, signaling short-term downside pressure. While this does not invalidate the broader uptrend, it increases the likelihood of near-term consolidation.

The critical technical barrier remains the 1.3730 resistance zone, which aligns with a significant historical high from September last year. A decisive daily close above 1.3730 would confirm a breakout and likely trigger renewed bullish momentum.

In that scenario, the next upside target lies near the year-to-date high of 1.3865. A sustained move toward this level would reinforce the prevailing uptrend and potentially open the door for further gains.

On the downside, failure to break above resistance combined with a move below the 50-day EMA could expose the pair to a deeper retracement toward the 1.3500 psychological support level.

Trading Outlook

The near-term outlook for GBP/USD hinges on upcoming macroeconomic releases. Strong US labor data supports the dollar, but moderating inflation could quickly shift expectations back toward rate cuts. Meanwhile, UK GDP figures will shape sentiment toward sterling.

Technically, the pair maintains a bullish bias above 1.3730. A confirmed breakout above this key resistance would likely accelerate gains toward 1.3865, while continued rejection could result in range-bound trading ahead of major economic catalysts.

In conclusion, although short-term volatility is expected around the inflation and GDP announcements, the broader outlook remains constructive. A sustained move above 1.3730 would validate the bullish scenario and strengthen the case for further upside in GBP/USD.