Precious metals experienced their worst selloff in decades as speculative positions unwound violently. Gold plunged nearly 10% on Friday in its biggest single-day decline since the financial crisis. Auralyex senior financial analyst examines how silver crashed 28% in its worst day since March 1980.

Gold futures had touched record levels near $5,600 per ounce on Thursday. By Monday, the metal fell as low as $4,423 before recovering modestly. Silver peaked above $121 per ounce before tumbling to $71 at the lows.

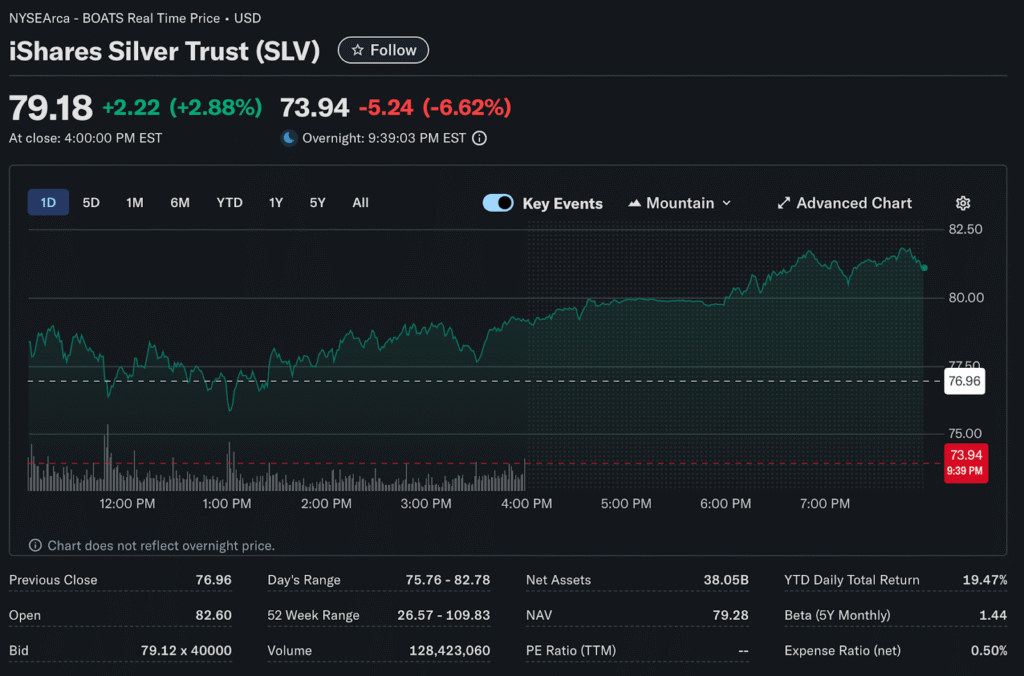

The violent reversal knocked approximately $3.4 trillion off the value of all above-ground gold. Trading volume in precious metals ETFs reached historic levels. The iShares Silver Trust saw more than $40 billion in trading volume on Friday alone.

Fed Chair Nomination Triggers Selloff

The US President nominated Kevin Warsh as the next Federal Reserve chair last Thursday. This announcement sparked reassessment of Fed independence and monetary policy direction. Markets interpreted the nomination as potentially hawkish for precious metals.

Optimism around U.S. interest rate cuts collided with sudden policy uncertainty. The Dollar Index fell to four-year lows before rebounding sharply. A stronger dollar makes gold less attractive for foreign buyers holding other currencies.

José Torres from Interactive Brokers explained the Buy America trade returned with force. The independence bid that drove metals to record heights unraveled quickly. Investors rushed to lock in profits after extraordinary gains.

Chinese Speculation Amplified Price Swings

For weeks, traders spent nights glued to screens as Chinese speculators drove prices higher. Hot money from China pushed gold, copper, and tin beyond fundamental valuations. The wave of speculation created conditions for violent reversal.

Prices for everything seemed to break free from supply and demand gravity. Silver traded above $40 per ounce only briefly in history before 2025. On Friday, the metal plunged by more than $40 in less than twenty hours.

The Shanghai Gold Exchange saw prices fall 12.9% on Monday to the lowest since January 9. This created a discount of nearly $12 per ounce to London prices. The reversed premium indicated weaker demand as import incentives evaporated.

Exchange Margins Raised to Curb Volatility

The CME Group increased margin requirements following the steep selloff. Margins on COMEX gold futures rose to 8% from 6% effective after Monday’s close. Those on COMEX 5,000 ounce silver futures lifted to 15% from 11%.

Higher margins force speculators to post more collateral for positions. This reduces leverage and discourages excessive speculation. Exchanges implemented similar measures during previous volatility spikes.

Analysts Debate Near-Term Direction

Christopher Forbes from CMC Markets called the retreat a classic correction. He argued this represents an air pocket after an extraordinary run rather than a breakdown. Profit taking, firmer dollar, and geopolitical headlines knocked the froth off crowded trade.

In the near term, gold prices will remain elevated but volatile. Markets await further clarity on Warsh’s policy direction and Fed independence. Higher interest rates raise the opportunity cost of holding non-interest-paying metals.

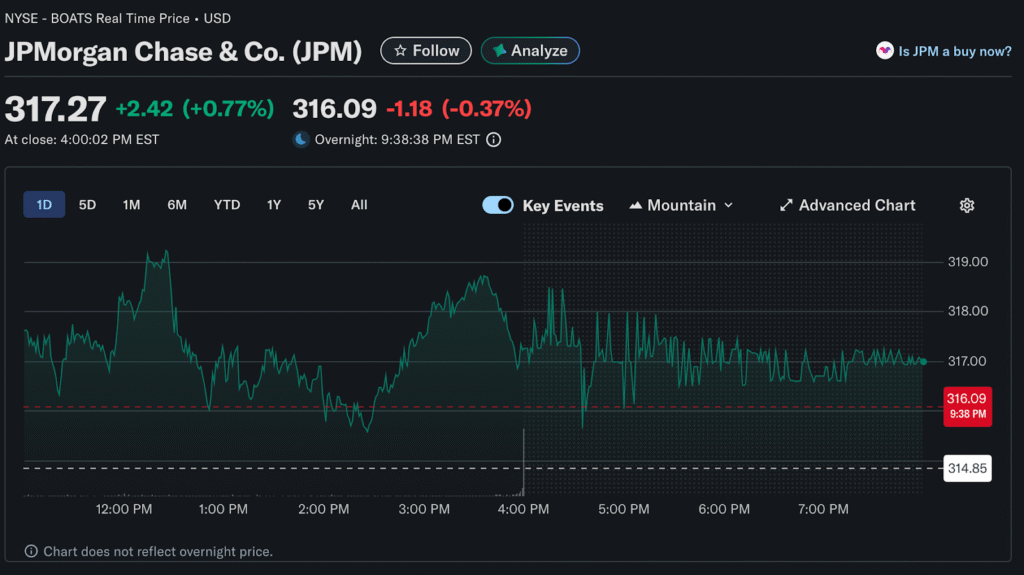

JPMorgan analysts maintained a bullish long-term outlook despite short-term volatility. They forecast gold reaching $6,300 per ounce by the end of 2026. This represents 30% gain from current price levels.

Fundamental Drivers Remain Intact

The investment bank argued gold’s thematic drivers remain positive. Investor rationale for precious allocations has not changed fundamentally. Conditions do not appear primed for sustained reversal in gold prices.

JPMorgan drew contrasts between today’s circumstances and gold weakness in the 1980s and 2013. Current fiscal policies, geopolitical tensions, and central bank buying support higher prices. The debasement trade thesis remains valid despite short term selloff.

Deutsche Bank reiterated its $6,000 per ounce target for gold. Analysts stated conditions supporting gold remain favorable despite the correction. Central banks continue buying at a record clip while moving away from Treasuries.

Silver Shows Industrial Demand Strength

Silver maintained a historic premium over London quotes on the Shanghai Exchange. The premium worth equivalent of $15 per ounce reflects industrial demand. Green energy technology and AI computing require increasing amounts of silver.

Despite the 40% plunge from recent highs, silver prices remain up around 16% year to date. Gold prices are also about 8% higher since the start of 2026. Both metals saw record rallies in 2025, surging 65% and 145% respectively.

Bank Julius Baer analysts expect investors to resume purchases once markets stabilize. Two fundamental drivers remain unchanged for precious metals. The dollar should continue depreciating, and central banks should increase gold holdings.

Long-Term Bullish Case Persists

Analysts view recent volatility as a typical boom-bust cycle for precious metals. Sharp corrections happen after parabolic rallies driven by speculation. Underlying fundamentals supporting higher prices remain in place.

Diego Franzin from Plenisfer Investments highlighted gold’s unique properties. In a world where almost every financial activity incorporates credit risk, gold remains counterparty-free. It makes no promises, pays no interest, and depends on no political decisions.

The 10% plunge in gold knocked off what many called a crowded trade. Market positioning became one-sided before the correction began. Healthy consolidation allows new buyers to enter at better levels for longer-term appreciation.