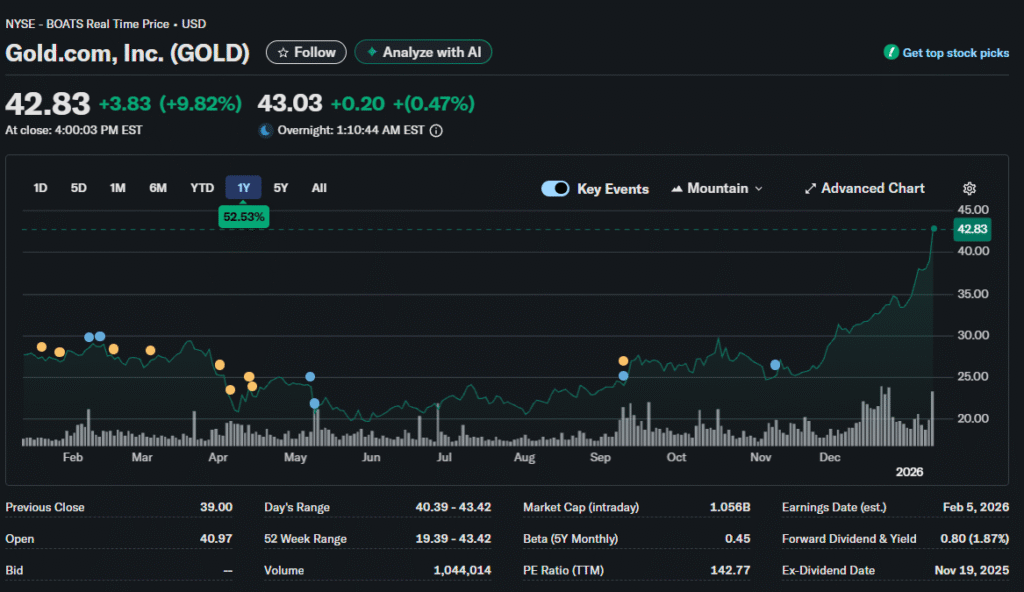

The precious metal climbed 2% on January 12, crossing the $4,600 per ounce threshold for the first time. This milestone extends a remarkable run that saw prices jump 6% in just the first twelve days of 2026. Nexymus senior financial analyst examines how converging crises pushed investors toward traditional safe havens.

Last year’s performance already stood out with 64% gains. That marked the most substantial yearly advance since 1975, when economic chaos similarly drove refugee seeking. The pattern repeats as uncertainty about policy direction and international tensions mount simultaneously.

Powell Investigation Sparks Rate Cut Speculation

Federal prosecutors launched a criminal probe targeting Fed Chair Jerome Powell over building renovation testimony. The $2.5 billion headquarters project became the focal point for broader questions. Markets now price in the possibility that Powell will exit before his term concludes in May.

A finance expert examines the implications of leadership turnover for monetary policy expectations. Someone favoring aggressive rate reductions could take the chair. This would reduce the cost of owning assets that generate no income, such as physical metals.

Data showing softer labor conditions reinforced bets on dovish policy shifts ahead. Traders built positions reflecting these assumptions without waiting for official confirmation. The buying accelerated as weekend news broke about the Justice Department’s actions.

Rate Environment Supports Valuations

Three-quarter-point cuts were already implemented in late 2025 by the central bank. Forecasts indicate that at least one more reduction is expected to arrive sometime in 2026. Each decrease makes bonds less attractive relative to gold holdings.

One financial expert breaks down why falling rates traditionally boost precious metal appeal. Treasury securities paying smaller coupons lose competitiveness against hard assets. Investors adjust their allocations when this relationship reaches specific thresholds.

Monday’s surge occurred despite Treasury yields remaining relatively steady throughout the session. This indicates fear-based buying overwhelmed typical interest rate mechanics. Preserving capital took priority over generating returns in portfolios.

Global Tensions Compound Anxiety

Washington’s military action in Venezuela captured that nation’s president over the weekend. Separately, renewed friction with Iran emerged as officials weighed response options. Each flashpoint individually might trigger modest defensive positioning.

Many brokers note how simultaneous crises multiply their psychological impact on markets. Combined pressures create sustained flows into safety rather than brief spikes. Standard Chartered has already named gold among its top conviction plays for the year.

The metal benefits when stocks linked to international commerce face uncertainty. Currencies of affected nations tend to weaken against tangible assets, such as gold. Gold transcends borders in ways that financial assets cannot during periods of geopolitical stress.

Central Banks Continue Accumulating

Reserve managers bought aggressively during Q3 2025, despite prices hitting records at the time. This pattern diverges from historical norms, where official purchases typically slow at peaks. The shift reflects strategic rather than tactical thinking about portfolio construction.

A lead broker at Nexymus examines why nations diversify their reserves away from dollar concentration. Adding gold allocations happens systematically regardless of current valuations. Countries pursuing this path view metals as long-term investments serving their objectives.

Forecasters at JP Morgan anticipate around 250 tonnes flowing into exchange-traded products. Last year saw inflows multiply ninefold as retail access expanded dramatically. Regular investors can now participate through vehicles that didn’t exist previously.

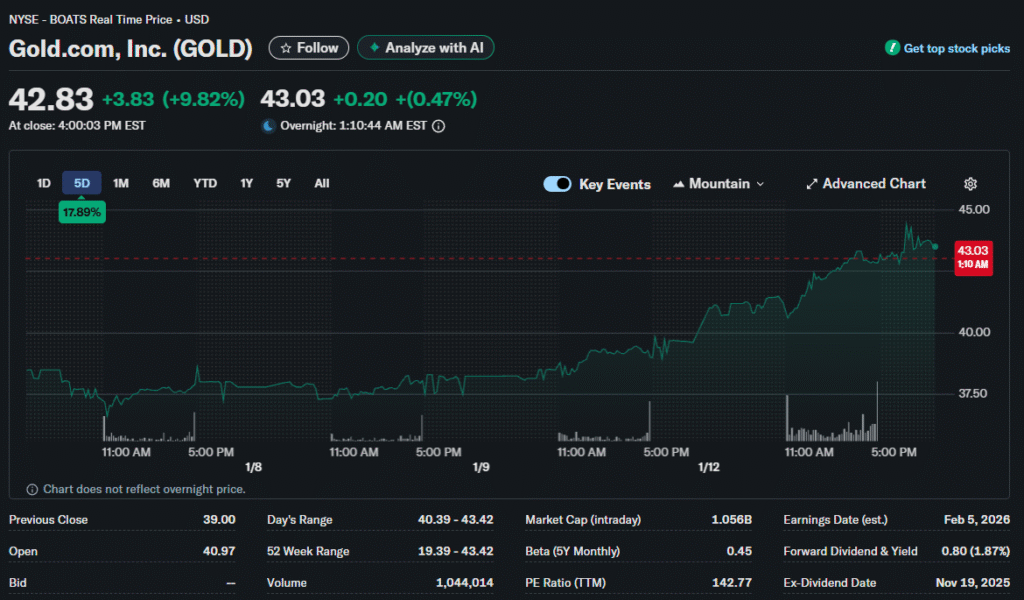

Charts Show Path to $5,000

Breaking through $4,600 removes technical resistance limiting further advances. Fibonacci projection models indicate that $5,000 is the next primary target. No overhead barriers exist until psychological round numbers create temporary pauses.

A financial analyst identifies where support would confirm the bullish structure remains intact. Initial buying interest is expected to emerge around $4,360 if profit-taking occurs. More substantial support is found at $4,255, where previous consolidation has built a base.

Major institutions revised their year-end targets upward, with most settling near $5,000. Goldman Sachs expects $4,900 to be achievable by December. Morgan Stanley forecasts $4,800 under current conditions. Extreme scenarios involving conflict escalation push some estimates toward $6,000.

Silver Rally Outpaces Gold Gains

The white metal jumped 4.54% to reach $83.58 on Monday. The annual performance shows a 181.78% appreciation as industrial uses expanded. Solar manufacturing and electronics fabrication absorbed physical supply alongside investment demand.

One analyst highlights how silver straddles both monetary and industrial categories uniquely. Supply and demand fundamentals differ from those of pure store-of-value metals. When manufacturing and investment sectors buy together, price movements amplify considerably.

Chart analysis targets $88 based on extension calculations. Silver has already matched the gains of the S&P 500 throughout all of 2025. This occurred within two weeks of the 2026 trading period.

Allocation Decisions Intensify

Broker at Nexymus concludes that 73% yearly gains create rebalancing pressures for institutions. Mechanical selling rules require trimming positions that have grown too large. Yet, fresh capital continues to enter as political and geopolitical uncertainties show no signs of resolution. Portfolio managers face choices between chasing established trends or waiting for corrections that may never materialize.