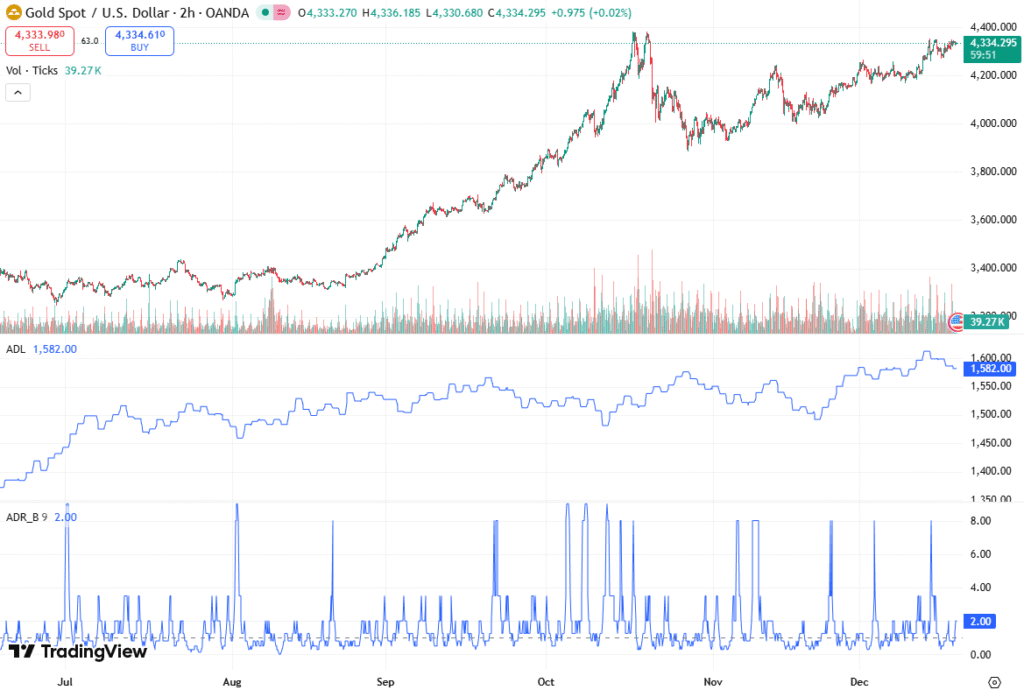

Gold prices slipped during early European trading on Thursday, pressured by profit-taking and a rebound in the US Dollar (USD). The precious metal edged below $4,350, retreating from recent seven-week highs.

Despite the intraday weakness, Fed rate cut expectations and ongoing geopolitical risks could limit the downside for XAU/USD, maintaining its appeal as a safe-haven asset. The Servelius team delivers a structured and informative breakdown of this matter.

Gold Price Retreats Amid Profit-Taking

Gold (XAU/USD) fell in early Thursday trading as traders booked profits after a strong rally over recent weeks. The pullback comes amid a rebound in the US Dollar, which traditionally exerts downward pressure on non-yielding assets like gold.

Following the latest US Nonfarm Payrolls (NFP) report, markets have adjusted expectations for the Federal Reserve’s (Fed) interest rate policy. The NFP data revealed a gain of 64,000 jobs in November after a 105,000 decline in October, pushing the Unemployment Rate slightly higher to 4.6% from 4.4%. This development reinforced speculation of potential interest rate cuts, which could support gold by reducing its opportunity cost.

Analysts note that although recent profit-taking is exerting downward pressure on gold prices in the short term, the broader technical outlook for the precious metal remains constructive, supported by ongoing safe-haven demand, strong global macroeconomic indicators, and persistent geopolitical uncertainties that continue to underpin investor interest in gold as a reliable store of value.

Fed Rate Cuts and Safe-Haven Demand

Despite short-term declines, gold may find support from expectations of future Fed easing. Fed Governor Christopher Waller recently indicated support for further rate cuts to bring monetary policy back to neutral, though he cautioned against hasty action amid persistent inflation.

Similarly, Atlanta Fed President Raphael Bostic highlighted that there is little case for cutting rates next year unless inflation declines, illustrating the Fed’s cautious approach. These mixed signals from Fed officials have kept traders attentive, as even small shifts in rate expectations can influence gold flows.

Meanwhile, escalating geopolitical tensions provide additional support. Venezuela’s government deployed its navy to escort oil shipments, raising the risk of a confrontation with the United States. Such developments often trigger a flight to safety, boosting demand for gold as a hedge against uncertainty.

Focus on US CPI Inflation

Traders are closely watching the upcoming US Consumer Price Index (CPI) report, set for release later on Thursday. The headline CPI is projected to rise 3.1% year-on-year (YoY) for November, while core CPI, which excludes volatile food and energy prices, is expected at 3.0% YoY.

Economists note that November CPI may reflect holiday season discounts, potentially understating actual inflation pressures. Veronica Clark, an economist at Citigroup, explained that “if there is abnormal weakness in November goods prices, a rebound could occur in December.”

The CPI release will be crucial in shaping market expectations of the Fed’s monetary policy trajectory, directly impacting gold. A stronger-than-expected inflation print could reduce rate cut speculation, weighing on XAU/USD, while weaker inflation could boost the safe-haven metal.

Technical Outlook: Gold Holds Long-Term Bias

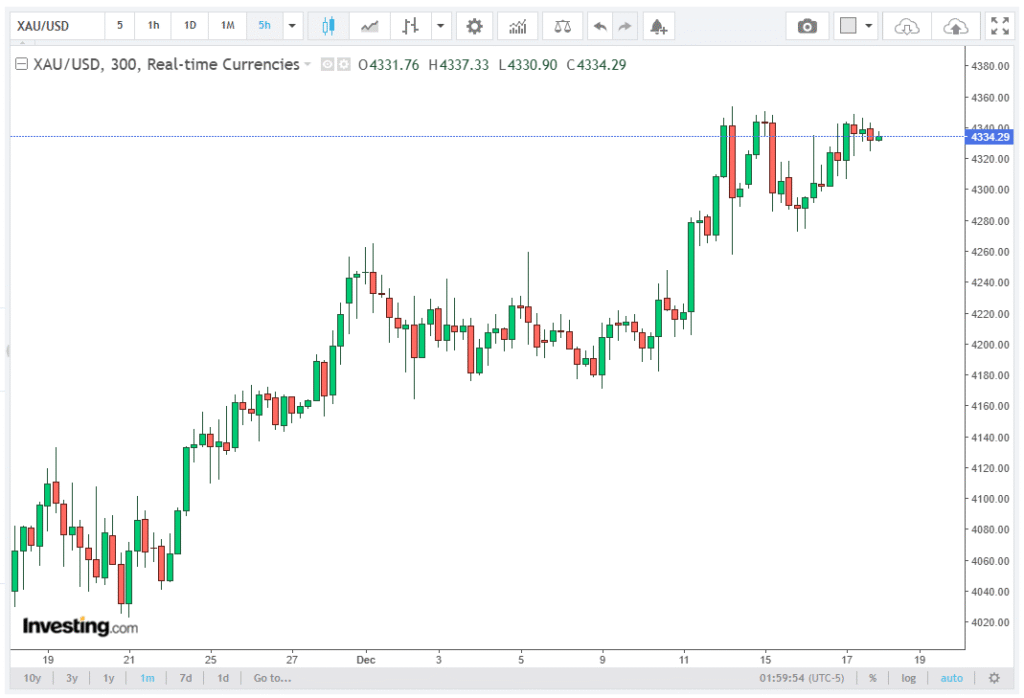

Despite intraday declines, technical indicators suggest a constructive outlook for gold. On the four-hour chart, XAU/USD remains above the 100-day Exponential Moving Average (EMA), signaling underlying support.

Bollinger Bands have widened, indicating potential for increased volatility, while the 14-day Relative Strength Index (RSI) sits above the midline, suggesting momentum favors an upward move. If green candlesticks appear and momentum pushes prices above the upper Bollinger Band at $4,352, XAU/USD could challenge its all-time high of $4,381, with the $4,400 psychological level in sight.

Conversely, a continuation of red candles below the December 17 low of $4,300 could attract further selling toward the December 16 low of $4,271. A break below the 100-day EMA at $4,233 would signal a more pronounced bearish trend, adding pressure to profit-taking dynamics.

Key Takeaways

Key Takeaways: Gold prices fell in early European trading as profit-taking and a stronger USD weighed on XAU/USD. Expectations of Fed rate cuts and heightened geopolitical risk provide support, capping downside potential.

Traders are focused on the US November CPI report, with forecasts of 3.1% YoY headline CPI and 3.0% YoY core CPI, which could influence monetary policy expectations. Technical indicators show a constructive long-term bias, with 100-day EMA support, Bollinger Band expansion, and RSI momentum favoring further upside potential.

Overall, while gold experiences a short-term pullback, macro signals, monetary policy cues, and geopolitical developments suggest that the precious metal remains well-positioned as a safe-haven asset heading into the US CPI release. Traders will continue to monitor inflation data, Fed rhetoric, and technical levels closely for guidance on the next move in XAU/USD.