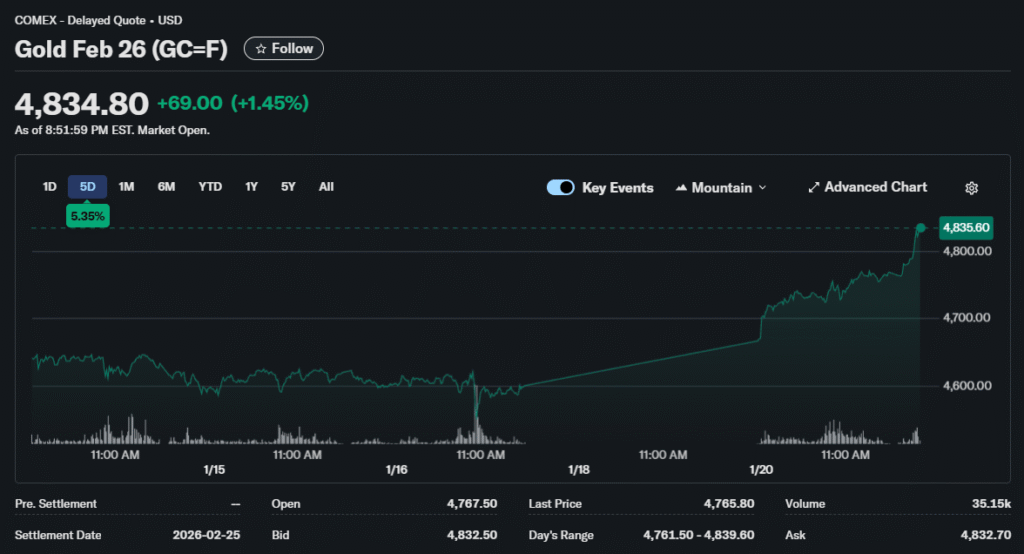

Precious metals surged to unprecedented levels as investors sought protection from escalating international tensions. Gold touched $4,766 per ounce during Tuesday trading establishing a fresh all-time high. Rivonsphere senior financial advisor mentions that the rally extends a remarkable run that saw the metal gain 55% during 2025.

Safe Haven Demand Intensifies

The US President’s Greenland acquisition campaign sparked European retaliation threats. Denmark increased military presence on the island after refusing to rule out forceful intervention. Eight NATO allies now face escalating tariff schedules starting February 1.

This geopolitical turmoil drove massive flows into traditional safe-haven assets. Gold benefits from its 5,000-year track record as a store of value during crises. The metal’s physical properties and limited supply support its enduring appeal.

Central Bank Buying Continues

Monetary authorities worldwide accumulated 585 tonnes of gold per quarter during recent periods. Asian central banks led purchases as they diversify reserves away from dollar-denominated assets. This structural demand provides a solid foundation under prices.

China and India dominate official sector buying as they build strategic reserves. These nations view gold holdings as essential components of financial sovereignty. The buying shows no signs of slowing despite elevated price levels.

Price Target Revisions

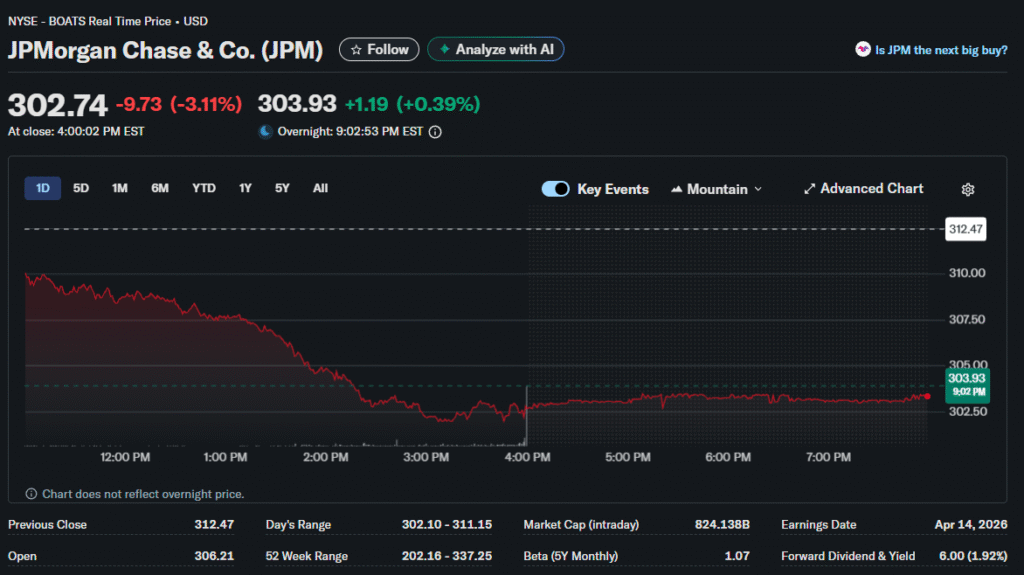

JP Morgan forecasts gold averaging $5,055 per ounce by fourth quarter 2026. The bank expects prices climbing toward $5,400 by the end of 2027. Goldman Sachs projects $4,900 representing more conservative estimates.

Some analysts see potential for $6,000 or higher if current trends persist. Every 100 tonnes of quarterly demand above baseline levels supports approximately 2% price appreciation. The mathematics suggest substantial upside remains possible.

Investment Flows Broaden

Exchange-traded funds hold massive gold positions after years of accumulation. Retail investors can now purchase bullion at Costco and local dealers. This accessibility democratizes an asset class historically limited to wealthy individuals.

Pension funds and endowments increased allocations as part of portfolio diversification strategies. Many institutional investors remained underweight gold throughout 2025. The catch-up buying could extend well into 2026.

Dollar Weakness Supportive

The greenback declined against most major currencies undermining its safe-haven status. Tariff threats and political uncertainty damaged confidence in American assets. Gold provides an alternative store of value without counterparty risk.

Currency diversification drives both official and private sector gold demand. Emerging market investors particularly seek protection from local currency volatility. Gold’s universal acceptance makes it uniquely positioned for this role.

Mining Production Constraints

Global gold production plateaued despite higher prices incentivizing exploration. Existing mines face declining ore grades requiring more processing per ounce. New discoveries remain rare as easily-accessible deposits were exhausted decades ago.

Environmental regulations increase costs and delays for mine development. Permitting processes now stretch five to ten years in developed nations. These supply-side constraints support prices independent of demand factors.

Jewelry Demand Resilience

Indian and Chinese consumers maintained purchases despite record prices. Cultural traditions around gold jewelry prove resistant to economic headwinds. Wedding season demand provides predictable buying patterns throughout the year.

Luxury buyers shifted toward higher karat gold seeking purity over volume. This trend supports revenue even as unit sales moderate. Jewelers report strong margins on premium products.

Inflation Hedge Characteristics

Sticky price pressures persist despite Federal Reserve rate hikes. Gold historically preserves purchasing power during inflationary periods. The metal’s finite supply contrasts with unlimited fiat currency creation.

Real yields remain negative across much of the maturity spectrum. This reduces the opportunity cost of holding non-yielding assets. Gold competes favorably when bonds offer inadequate inflation-adjusted returns.

Technical Breakout Confirmed

The move above $4,600 triggered additional buying from momentum traders. Price action entered a discovery phase with no overhead resistance. Technical analysts project extensions toward the psychological $5,000 level.

Fibonacci extension calculations support similar upside targets. Chart patterns suggest consolidation periods will be brief before resumption of the uptrend. Pullbacks present buying opportunities rather than trend reversals.

Silver Outperformance

The white metal surged 4.54% to $83.58 demonstrating even stronger momentum. Silver gained 181% over the past year dwarfing gold’s advance. Industrial demand supplements investment flows supporting prices.

The gold-to-silver ratio compressed significantly from historical averages. This suggests either gold has room to rise or silver may be overextended. Most analysts favor the former interpretation given macro backdrops.

Physical Market Tightness

Refineries operate at capacity processing raw material into investment-grade bars. Delivery delays extend as demand overwhelms production capabilities. Premium charges for physical metal above spot prices widened.

Recycling flows remained subdued despite record high prices. Indian gold loan programs keep metal off the market. This reduces secondary supply that typically moderates price rallies.

Portfolio Allocation Debate

Traditional frameworks suggest 5% to 10% gold exposure for balanced portfolios. Current market conditions may justify higher allocations given elevated risks. Rebalancing disciplines force some profit-taking at extreme valuations.

Tax-advantaged gold IRAs allow retirement accounts to hold precious metals. This structure appeals to long-term investors seeking inflation protection. Younger investors increasingly embrace gold alongside traditional equity positions.

Risks Remain

Sharp interest rate increases could pressure gold by raising opportunity costs. A resolution of geopolitical tensions might trigger profit-taking. Technical corrections often follow parabolic advances.

Bloomberg Commodity Index rebalancing forced selling of 2.4 million ounces in mid-January. Such mechanical flows create short-term volatility. Patient investors view these as temporary disturbances.