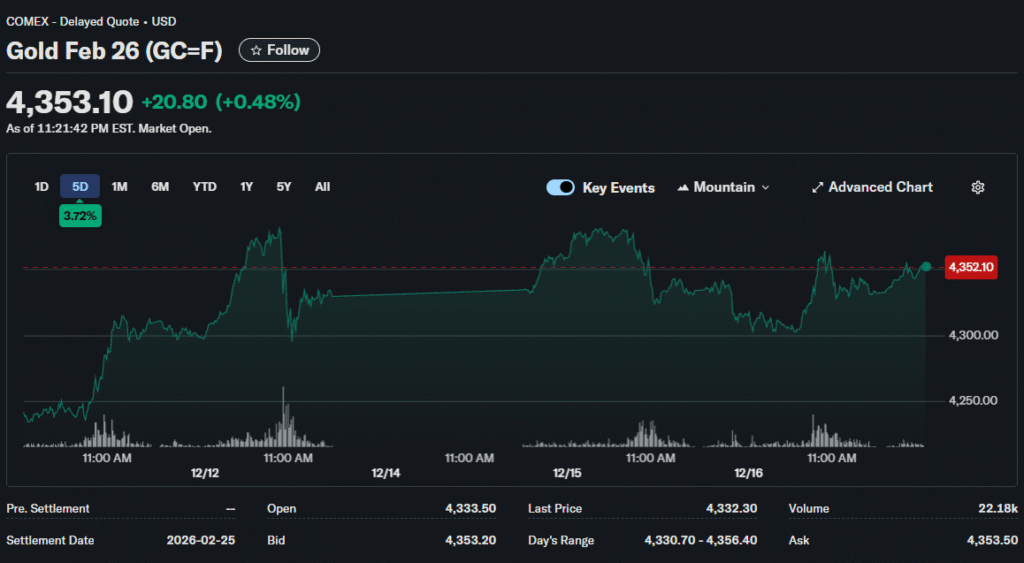

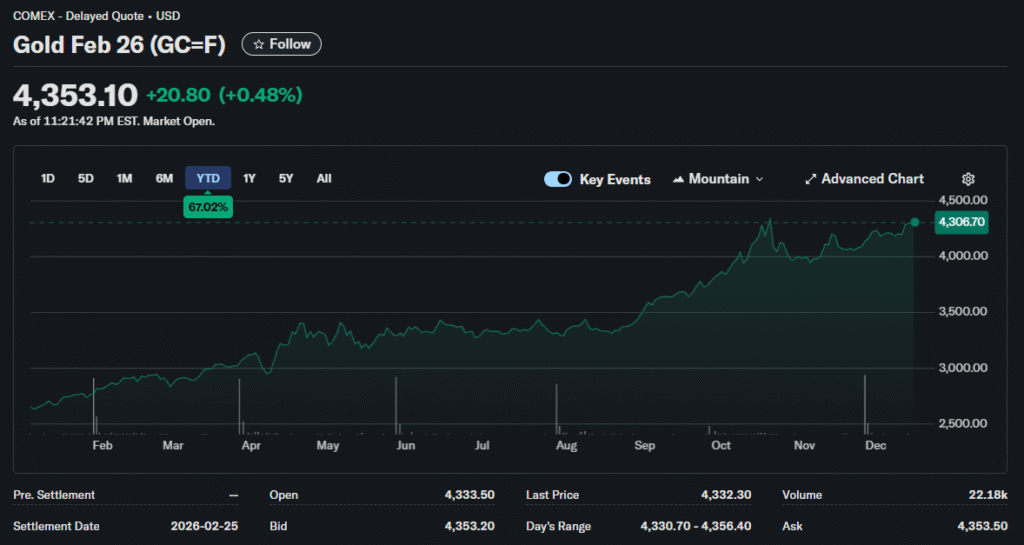

A lead financial analyst at Rineplex explores how gold climbed past $4,000 per ounce earlier in 2025, delivering 60% gains that solidly beat Bitcoin’s volatile performance. The precious metal demonstrated why generations of investors trusted it during turbulent times.

Central Bank Accumulation

Global central banks purchased gold at unprecedented rates throughout 2025. Emerging market monetary authorities diversified away from dollar-denominated reserves. Geopolitical tensions accelerated de-dollarization strategies among developing nations.

China’s People’s Bank added to holdings consistently despite elevated prices. India’s Reserve Bank similarly accumulated tonnage. These official sector purchases provided a steady bid supporting the market.

Western central banks halted decades-long sales programs. The shift from net sellers to neutral observers removed supply overhang. This behavioral change reflected shifting views on gold’s monetary role.

Inflation Hedge Performance

Gold fulfilled its traditional inflation protection role effectively. In comparison, Bitcoin evangelists promoted digital scarcity narratives; gold actually delivered during price level increases. The metal preserved purchasing power as fiat currencies weakened.

Real yields on Treasury securities turned positive as inflation moderated, typically a headwind for gold. However, persistent geopolitical uncertainty and currency debasement fears offset this traditional negative correlation.

Financial experts note that gold mining stocks lagged bullion performance significantly. This divergence suggested physical metal demand driven by monetary concerns rather than industrial optimism. ETF flows confirmed that investment rather than industrial consumption dominated.

Dollar Dynamics

Gold’s rally occurred despite dollar strength for much of the year. This atypical pattern highlighted genuine demand rather than currency-driven mechanical moves. Non-dollar buyers faced even higher prices, yet accumulation continued.

Euro weakness and yen volatility drove European and Japanese investors into gold. Local currency gold prices hit record levels in multiple jurisdictions. This global phenomenon transcended single-currency dynamics.

The dollar’s reserve currency status faced long-term structural questions. The BRICS nations’ payment system development is aimed at reducing dollar dependency. Gold is positioned as a neutral alternative acceptable to all parties.

ETF Flow Patterns

Gold-backed ETFs experienced significant inflows after years of redemptions. North American and Asian funds led accumulation. European investors showed more caution, given the stronger euro gold price performance.

Institutional allocations to gold increased from historically low levels. Portfolio managers added tactical positions initially, then migrated toward strategic weightings. Modern portfolio theory’s correlation benefits proved valuable during market stress.

However, retail participation remained subdued relative to cryptocurrency enthusiasm. Younger investors gravitated toward digital assets over traditional precious metals. This generational divide created interesting long-term demand questions.

Mining Industry Struggles

Gold production plateaued despite soaring prices. Major discoveries declined globally over the past decade. Existing deposits faced rising extraction costs and declining ore grades.

Environmental regulations complicated new mine development. Permitting timelines stretched into decades in developed markets. This supply constraint supported a long-term bullish thesis even if prices moderated near term.

All-in sustaining costs for producers exceeded $1,200 per ounce on average. This provided a fundamental floor for prices. However, the lack of margin expansion at current levels disappointed equity investors.

Jewelry Demand Softness

Traditional jewelry consumption, particularly in India and China, disappointed expectations. High prices reduced physical buying from price-sensitive consumers. Wedding season demand moderated as younger generations prioritized experiences over physical goods.

Recycling activity increased as high prices incentivized liquidation. Cash-for-gold operations thrived globally. This secondary supply partially offset mining production shortfalls.

However, the central bank’s buying more than compensated for jewelry weakness. The shift from consumer to official sector demand altered market dynamics fundamentally.

Technical Analysis Points

Gold broke decisively through resistance at $3,000 psychological level. The move higher demonstrated powerful momentum. Fibonacci extensions suggested potential targets approaching $4,500 if the rally continued.

However, relative strength index readings approached overbought territory. Short-term corrections seemed likely even if the longer-term trajectory remained positive. Traders watched $3,800 as a key support level.

Options markets showed heavy call buying at $4,500 and $5,000 strikes. This positioning reflected bullish sentiment extending into 2026. However, putting protection around $3,500 indicated prudent risk management.

Silver’s Shadow

Gold’s quieter performance contrasted sharply with silver’s explosive move. While silver grabbed headlines with 115% gains, gold’s steadier appreciation attracted conservative capital. Risk-adjusted returns favored gold’s stability.

The historical gold-silver ratio collapsed as silver outperformed. The traditional 60-80:1 relationship has been compressed significantly. Mean reversion arguments suggested the ratio would widen again, though timing remained uncertain.

Investors choosing between metals faced tradeoffs. Silver offered greater upside volatility, but gold provided reliable wealth preservation. Portfolio construction strategies are incorporated for diversification benefits.

Traditional 5-10% gold allocation faced reevaluation. Some advisors suggested increasing to 15% given monetary uncertainties, though elevated prices created opportunity cost concerns. The enduring question remained whether $4,000 gold represented a new normal or a bubble peak requiring cautious navigation.

Looking Forward

Gold’s 2025 performance validated its enduring role in portfolio construction. The metal was delivered during maximum uncertainty periods as intended.

Whether prices sustain depended on inflation trajectory, dollar fate, and geopolitical evolution, both technical and fundamental analysts agreed gold retained relevance despite digital asset competition, though debate continued about optimal allocation levels at current valuations.