The Bank of Japan’s imminent policy shift threatens to unwind carry trades that supported risk assets for years. Market watchers brace for volatility as the world’s third-largest economy exits ultra-loose monetary policy.

Fimatron‘s junior broker highlights why all 50 economists surveyed expect the BOJ to raise rates to 0.75% this Friday. This marks the first increase since January and represents the highest policy rate in approximately 30 years.

The Unanimous Verdict

Bloomberg’s survey showed 100% consensus that the Bank of Japan will hike at its December 18-19 meeting. This unprecedented unanimity reflects Governor Kazuo Ueda’s clear signaling that conditions for tightening are met.

The 25 basis point increase from 0.5% brings rates to levels not seen since 1995. For a country that spent decades fighting deflation through unconventional easing, this represents a historic reversal.

Stubborn food costs kept inflation above the 2% target for nearly four years. Unlike Western economies where energy drove price pressures, Japan faces persistent increases in everyday goods that strain household budgets.

Labor Market Tightness

An ad hoc BOJ survey showed branch offices expect companies to continue bumper wage hikes in 2026. Intensifying labor shortages force employers to compete aggressively for workers in an aging society with declining workforce participation.

Wage growth creates a self-reinforcing cycle. Higher pay supports consumer spending that allows companies to raise prices without losing customers. Those price increases justify further wage demands, embedding inflation expectations.

The central bank estimates the neutral rate falls between 1% and 2.5%. Current policy at 0.75% remains accommodative, suggesting room for additional hikes before reaching truly restrictive levels.

Yen Carry Trade Unwinds

For years, global investors borrowed Japanese yen at near-zero interest rates to fund purchases of higher-yielding assets. This “carry trade” worked brilliantly when the BOJ maintained ultra-loose policy while other central banks raised rates.

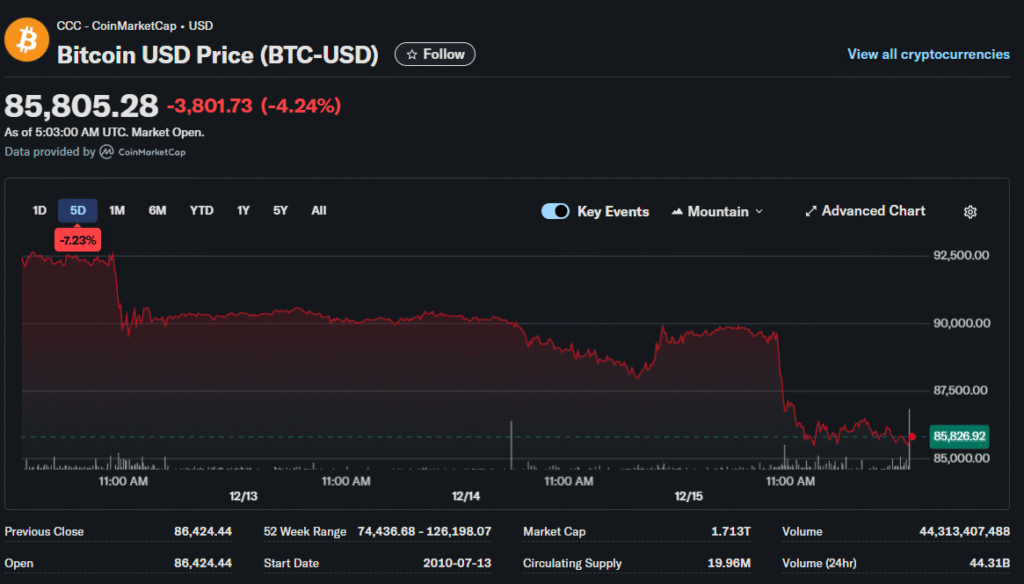

Now that trade reverses painfully. Rising Japanese rates reduce profit margins on carry positions. Traders must sell foreign assets and buy yen to repay loans, creating selling pressure across stocks, bonds, and cryptocurrencies.

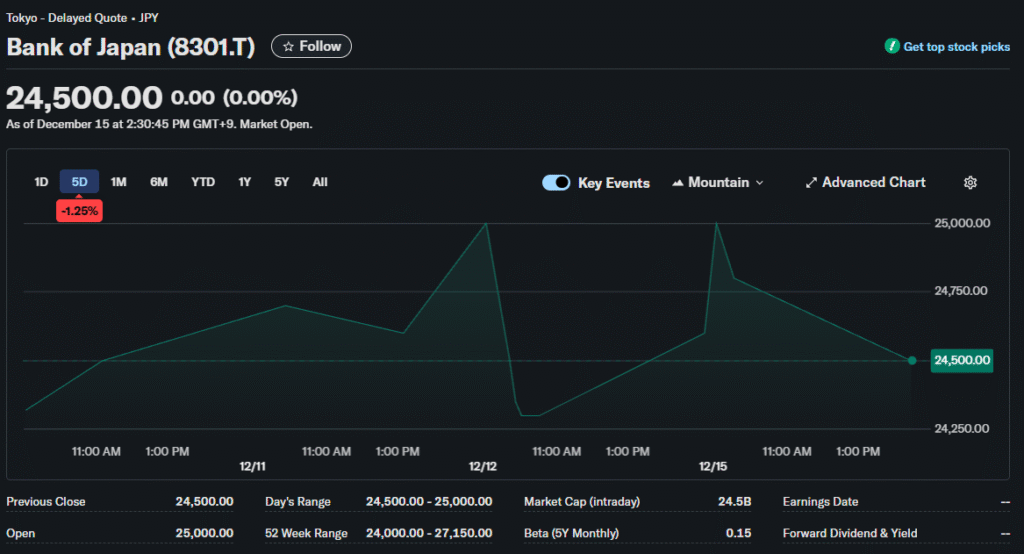

The previous hike to 0.5% in July triggered market chaos. Bitcoin crashed from $65,000 to $50,000 within days. Equity volatility spiked globally as leveraged positions liquidated rapidly.

Speculative Positioning Differs

This time, speculators already hold net long yen exposure according to CFTC data. This contrasts with mid-2024 when shorts dominated positioning. The shift suggests market participants anticipated the hike and adjusted proactively.

Japanese bond yields climbed throughout 2025, hitting multi-decade highs across maturities. The upcoming rate increase essentially catches official policy up with where markets already trade rather than shocking expectations.

These factors might limit the immediate market reaction compared to previous moves. However, the broader trend of rising Japanese rates creates ongoing pressure for carry trade reduction.

Currency Market Impact

The yen strengthened in anticipation of the hike but faces uncertain direction afterward. Finance Minister Satsuki Katayama signaled acceptance of the move, reducing political pressure on the BOJ.

Authorities stand ready to intervene, preventing “abrupt, sharp yen falls” disconnected from fundamentals. Government officials share the central bank’s aversion to excessive currency weakness that imports inflation.

A stronger yen helps contain price pressures by reducing import costs. However, it hurts exporters whose products become less competitive in foreign markets. This trade-off complicates policymaking in an export-dependent economy.

Inflation Outlook

The BOJ must assess whether corporate behavior around wages will persist. Short-term price increases mean nothing if companies revert to old patterns of suppressing compensation growth.

Prime Minister Sanae Takaichi previously opposed aggressive tightening but moderated her rhetoric after taking office in October. This political shift gave the central bank room to act without facing intense criticism.

Some analysts worry that both weak yen and higher rates push up consumer prices and production costs simultaneously. This squeeze could weigh on business sentiment even as the BOJ tries to normalize policy.

Global Spillover Effects

The Federal Reserve cut rates by 25 basis points to a three-year low while the BOJ tightens. This policy divergence pressures the dollar-yen exchange rate and affects capital flows between the world’s largest economies.

The European Central Bank also cut recently amid weakening growth. Japan stands virtually alone among major central banks in hiking. This divergence creates opportunities for currency traders but risks destabilizing cross-border investment flows.

Central banks in Asia watch nervously as Japanese rate increases affect regional currencies. Countries that borrowed in yen benefit from appreciation, while export competitors face tougher price competition.

Long-Term Implications

Japan’s shift from deflation to sustained inflation represents a generational change. Younger workers never experienced price pressures, while retirees remember the pain of 1970s oil shocks.

If inflation expectations embed permanently, the BOJ may need rates higher than current forecasts suggest. This would represent a complete reversal from the Bank’s struggle to escape deflationary mindset.

The global implications extend beyond immediate market moves. Japan’s economic transformation affects trade patterns, capital flows, and regional power dynamics as the country adapts to new realities.