The cryptocurrency market opened the week under pressure as Bitcoin slid below $85,000 on Monday, extending its four-day decline. This drop has impacted not only Bitcoin but also other major coins such as Ethereum (ETH), XRP, and Solana (SOL), highlighting a broad-based pullback driven by changing institutional sentiment and market dynamics.

This article by Orbisolyx delivers expert insight and a comprehensive explanation of the subject.

Bitcoin Slides Below $85K as Four-Day Decline Extends

Bitcoin’s fall below $85K marks a continuation of its four-day losing streak, signaling a growing period of market weakness. The slide began in earnest during the American trading session, likely influenced by portfolio rebalancing as institutional investors and corporations prepare for year-end adjustments.

The cryptocurrency market capitalisation fell by 2.7%, bringing the total market value to $2.94 trillion. Buyers failed to maintain the market above the $3 trillion threshold, although key coins managed to hold above last month’s lows, showing some resilience despite the ongoing downturn.

Major Coins Bear the Brunt

Among the leading cryptocurrencies, Bitcoin lost 4%, while Ethereum and XRP fell about 6%, and Solana dropped 5%. These ETF-backed major coins appear to be particularly affected by shifts in institutional sentiment, which had previously driven strong inflows from April through August.

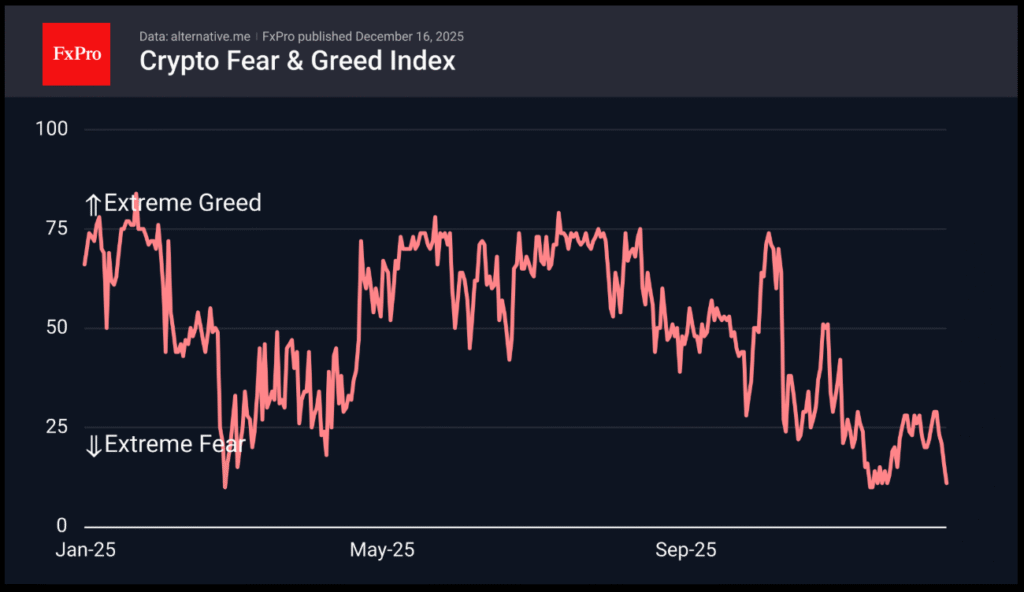

The sentiment index also registered a notable decline, dropping to 11, its lowest level in a month. This suggests that the current downturn is more than a temporary correction, contrasting with the milder dips experienced in February and April. The fall into the fear zone confirms broader market caution and a reduction in risk appetite.

Key Support Levels in Focus

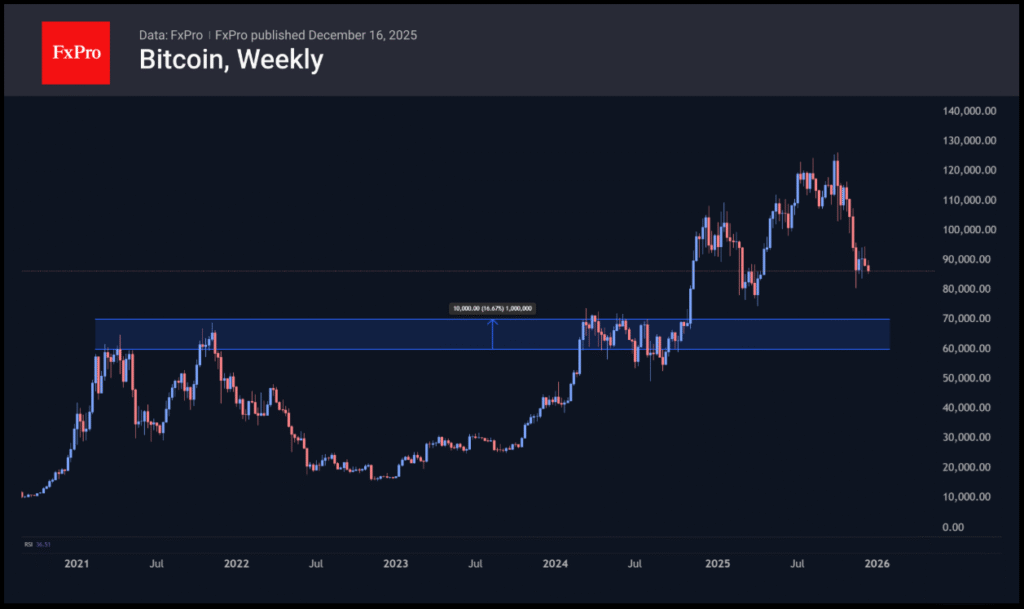

Technical analysts now highlight the next significant support for Bitcoin in the $81K range, anchored by November lows and the March support range from earlier this year. Below that, the golden support is estimated between $60,000 and $70,000, aligned with resistance levels recorded in 2021 and 2024.

While the current Bitcoin rally appears to have paused, analysts warn of a potential deeper correction before the next major upward phase. CryptoQuant suggests a possible drop toward $50,000, indicating that market participants should remain cautious and monitor key support and resistance levels closely.

Market Liquidity and Year-End Dynamics

Market liquidity is declining as the end of the year approaches. According to FlowDesk, participants are closing positions and optimising balances, avoiding aggressive leverage and high-risk bets. This decline is compounded by historically low trading volumes, typical for the holiday period, which can amplify price volatility.

Despite the correction, companies with Bitcoin reserves continue to accumulate selectively but steadily. The buyer base has broadened to include not just miners but also tech giants and financial institutions, reflecting growing corporate adoption of Bitcoin.

One notable player, referred to as Strategy, purchased 10,624 BTC (~$980 million) over the past week, mirroring the previous week’s scale, the highest weekly accumulation since July. Strategy now holds 671,268 BTC with an average purchase price of $74,972, underlining confidence in long-term value despite short-term price dips.

Mining and Hash Rate Concerns

Meanwhile, Bitcoin’s hash rate fell 17.25% over the week, largely due to potential closures of mining farms in Xinjiang, China, according to BlockBeats. This development may be tied to recent government measures following a Reuters article in late November, which suggested that China’s mining sector was experiencing a “quiet revival.”

China’s share of the global hash rate had reportedly increased to 14%, and regulatory pressures could reverse this trend. Reduced hash rate can temporarily impact network security and mining rewards, though the long-term effect may stabilize as miners adapt to changing regulatory landscapes.

Institutional Shifts and ETF Influence

The recent pullback also underscores the growing influence of institutional investors and ETF-linked cryptocurrencies on market dynamics. ETFs tied to Bitcoin, Ethereum, and Solana have increased market exposure to corporate and professional investors, making price movements more sensitive to portfolio adjustments and risk management strategies.

As institutions rebalance holdings ahead of year-end, short-term volatility has intensified, dragging major coins down even as retail investor interest remains steady. This trend highlights how institutional sentiment can now dictate broader market performance more than individual trading activity.

Outlook for the Cryptocurrency Market

The current market correction reflects a combination of technical, institutional, and macroeconomic factors. While major coins are under pressure, selective accumulation by corporate holders and miners suggests that long-term confidence remains intact.

Analysts recommend monitoring key support levels, especially in the $81K range for Bitcoin, and observing how institutional sentiment evolves as the year closes. A deeper correction may provide buying opportunities for long-term investors, but caution remains essential as liquidity remains low and trading volumes taper.

In summary, the major coins dragged the market down, with Bitcoin, Ethereum, XRP, and Solana leading the decline. Shifts in institutional activity, coupled with portfolio rebalancing and regulatory developments, have contributed to this multi-day dip.