Medline shares surged 41% in their Wednesday market debut, closing at $41 after pricing at $29 per share. The medical supplies distributor’s performance in 2025 was the strongest year for initial public offerings since 2021. The company now commands a market capitalization exceeding $54 billion.

Logirium‘s junior broker analyzes the blockbuster first-day performance of Medline’s $6.26 billion initial public offering and what it signals for the IPO market heading into 2026. The Illinois-based manufacturer and distributor raised $6.26 billion through an upsized offering, representing the largest global IPO of 2025.

Private Equity Exit Strategy

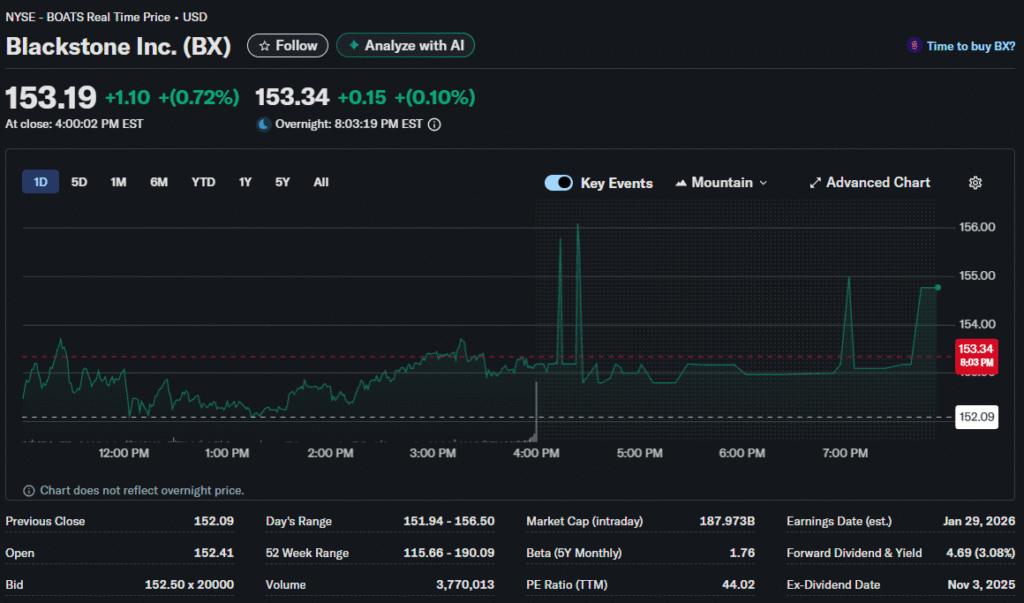

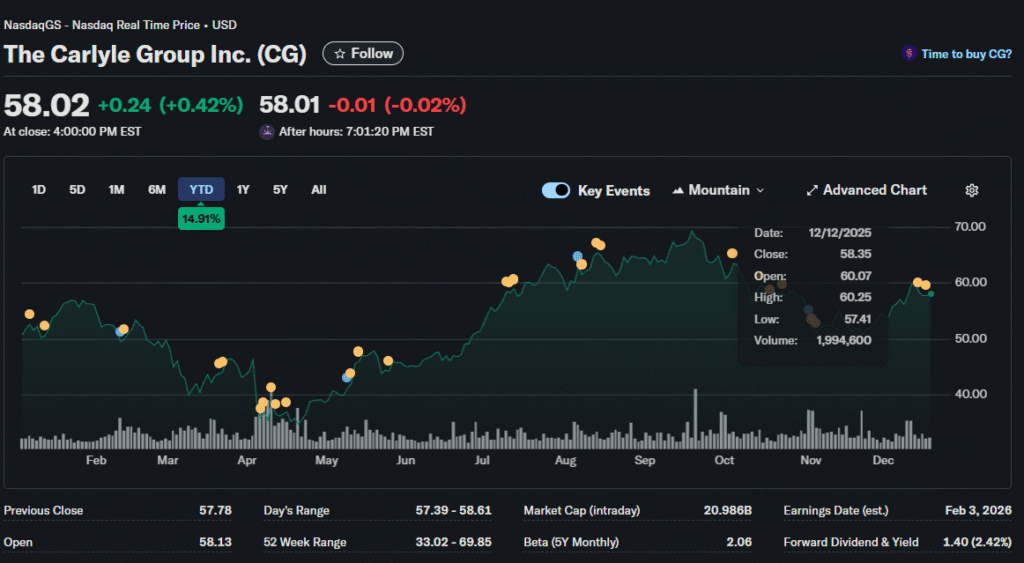

Three private equity giants orchestrated Wednesday’s listing. Blackstone, Carlyle, and Hellman & Friedman acquired majority stakes in 2021 for approximately $30 billion. That transaction ranked among the largest leveraged buyouts since the 2008 financial crisis.

The firms are executing a partial exit while maintaining substantial positions. Proceeds from the offering will help Medline reduce its $16.8 billion debt load by approximately $4 billion. Credit rating agencies have placed the company on review for potential upgrades following this deleveraging.

Fitch Ratings expects a multi-notch upgrade to Medline’s credit profile. The agency cited enhanced financial flexibility and reduced interest expense. Lower debt service costs should improve free cash flow generation considerably. This matters for both equity valuations and the company’s competitive positioning.

Business Profile Stands Out

Medline operates differently from typical IPO candidates. The company isn’t pitching future profitability or disruptive technology. It offers a track record spanning nearly 60 years of consecutive revenue growth.

Nine-month 2025 results showed $20.6 billion in net sales, up from $18.7 billion year-over-year. Net income reached $1.02 billion compared to $977 million in the prior period. These numbers demonstrate organic growth capability rather than acquisition-driven expansion.

The company manufactures and distributes roughly 335,000 different medical-surgical products. Product categories range from surgical gloves and masks to wheelchairs and hospital beds. Medline serves customers in over 100 countries through 22 manufacturing facilities and 69 distribution centers.

Supply Chain Integration

Medline positions itself as more than a product supplier. The company provides comprehensive supply chain solutions to healthcare facilities. These services include procurement management, logistics optimization, and inventory control systems.

This integrated approach creates switching costs for hospital customers. Once embedded in a facility’s operations, Medline becomes difficult to replace. The business model generates recurring revenue streams with relatively predictable demand patterns.

Healthcare spending generally proves resistant to economic cycles. Hospitals require medical supplies regardless of GDP growth rates. This defensive characteristic attracted investors seeking stability amid market volatility elsewhere.

Tariff Headwinds Acknowledged

Management disclosed expectations for $150-200 million in tariff-related costs during fiscal 2026. The majority of Medline’s products are sourced or manufactured in Asian nations, particularly China. Trade policy uncertainty had delayed the company’s original IPO timeline earlier in 2025.

The tariff impact matters because Medline’s value proposition centers on reliability and cost-effectiveness. Rising input costs pressure margins unless passed through to customers. Healthcare providers face their own budget constraints that limit pricing flexibility.

The company initially planned to list earlier in 2025 but postponed due to tariff uncertainty. Wednesday’s successful debut suggests investors view the headwinds as manageable rather than existential threats to the business model.

Institutional Demand Signals

The upsized offering and premium pricing indicate robust institutional appetite. Medline initially planned to sell 179 million shares at $26-30 each. Strong cornerstone investor interest allowed the company to increase both size and price.

Major asset managers indicated interest in significant allocations. Members of the founding Mills family also purchased shares in the offering. These indications of support from sophisticated investors bolstered confidence heading into the debut.

The stock opened at $35, representing a 21% first-day pop. Trading volume remained heavy throughout the session. Nearly 100 million shares changed hands, providing liquidity for both institutional and retail participants.

Market Timing Considerations

The listing comes during a volatile period for equity markets. Technology stocks have sold off sharply in recent weeks. The government shutdown disrupted economic data collection. Yet Medline succeeded despite these challenging conditions.

This performance suggests investors differentiate between speculative growth stories and profitable businesses with established operations. The disconnect between Medline’s strength and tech weakness highlights ongoing sector rotation dynamics.

Just over 200 IPOs were priced in 2025, including Medline. This represents the strongest activity since 2021. However, the total remains well below pre-pandemic norms when 300-400 deals annually were typical.

Longer-Term Considerations

The first-day pop creates pressure on Medline’s management to justify the elevated valuation. Quarterly earnings reports will face intense scrutiny. Any margin compression or revenue growth deceleration could trigger profit-taking.

The company must navigate ongoing tariff uncertainty while maintaining cost competitiveness. Healthcare providers increasingly consolidate purchasing power through group buying organizations. This dynamic could pressure Medline’s pricing over time.

Employee count of 43,000 workers worldwide suggests meaningful labor cost exposure. Wage inflation in healthcare-adjacent industries has run above general inflation rates. Managing these expenses while growing profitably will test operational efficiency.