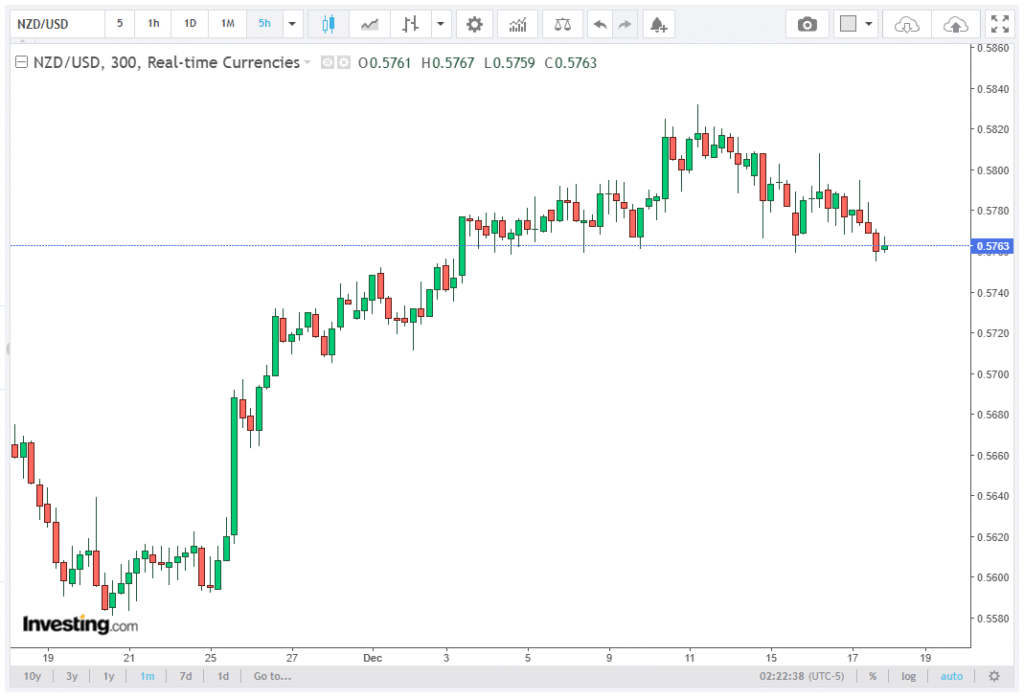

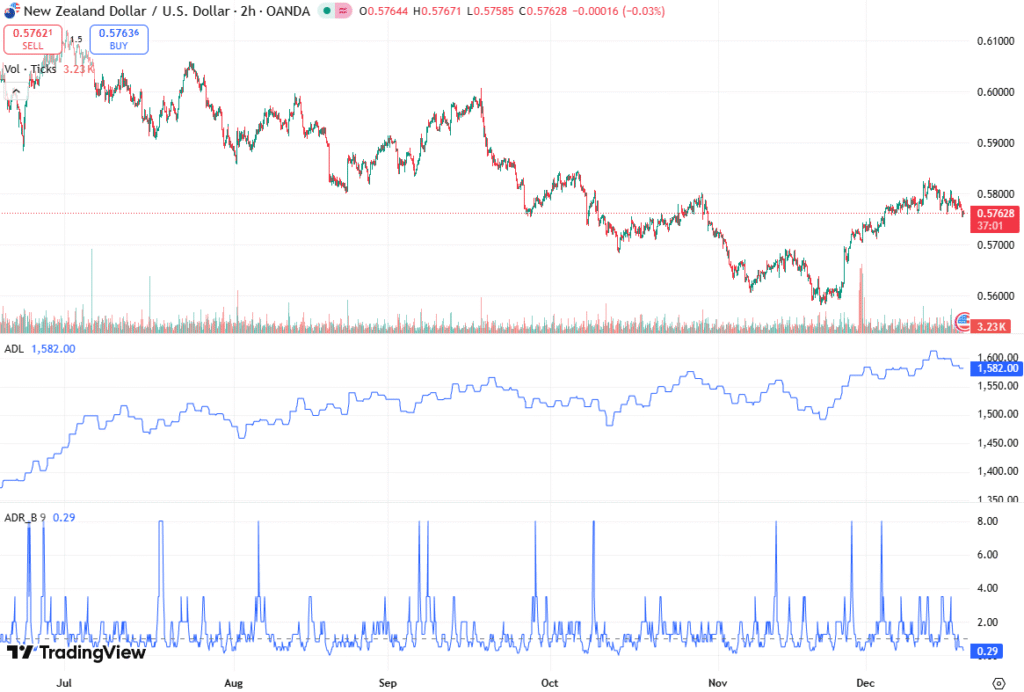

The NZD/USD currency pair has weakened, falling to around 0.5760 during early European trading hours on Thursday, extending its losses for the second consecutive session. The decline comes despite stronger-than-expected economic growth in New Zealand, highlighting market skepticism about near-term inflation pressures and the trajectory of monetary policy.

Servelius professionals unpack the topic’s complexities in a detailed and accessible way.

New Zealand GDP Surprises on the Upside

New Zealand’s Gross Domestic Product (GDP) rose 1.1% quarter-over-quarter (QoQ) in Q3, exceeding market expectations of 0.9%. This growth rebound follows a revised Q2 contraction of 1.0% (down from -0.9%), signaling a temporary improvement in domestic economic activity. On an annual basis, the economy expanded 1.3% year-over-year (YoY) in Q3, recovering from a 1.1% decline (revised from -0.6%) in Q2 and aligning with analysts’ forecasts.

Despite these positive figures, substantial spare capacity persists across the New Zealand economy. Economists caution that the recent GDP rebound is unlikely to translate into significant inflationary pressures, limiting the scope for near-term policy tightening by the Reserve Bank of New Zealand (RBNZ).

RBNZ Rate Hike Expectations Ease

Following the GDP release, market expectations for an imminent rate hike have eased. The CME Group’s RBNZ-implied probability tool indicates a roughly 40% chance of a policy rate increase by July next year, down from 50% before the data. This suggests that traders and investors are increasingly factoring in a more cautious monetary policy stance as economic slack continues to moderate inflation prospects.

The weakening of the NZD against the USD reflects these dynamics. Despite solid Q3 GDP growth, the NZD/USD pair struggles to gain traction, indicating that markets are prioritizing inflation outlooks and central bank guidance over short-term growth figures.

US Dollar Holds Firm Ahead of CPI

On the other side of the currency equation, the US Dollar (USD) remains relatively steady, supported by market caution ahead of the release of the delayed US Consumer Price Index (CPI) report later in the day. The CPI data is expected to provide further insight into the trajectory of inflation pressures in the United States, which in turn could influence the Federal Reserve’s monetary policy outlook.

Federal Reserve (Fed) Governor Christopher Waller, a potential candidate for the Fed Chair position, reiterated a dovish stance during a CNBC forum. Waller indicated that with inflation remaining high, there’s no immediate pressure to lower interest rates. The central bank can gradually ease the policy rate, moving it closer to a neutral level at a measured pace.

This commentary underscores the Fed’s gradualist approach to interest rate adjustments, reinforcing the USD’s relative strength in the lead-up to key inflation data releases.

Market Sentiment and Fed Rate Outlook

According to the CME FedWatch Tool, futures tied to Fed funds now indicate a 75.6% chance that the Federal Reserve will keep US interest rates unchanged at its January meeting, up modestly from 74% just a week earlier.

This modest increase reflects market expectations that the Federal Reserve may adopt a wait-and-see approach, taking cues from incoming CPI readings and other economic indicators before making any adjustments to monetary policy.

Consequently, the NZD/USD pair remains under pressure as traders weigh the implications of a steady USD against the backdrop of subdued inflation risks in New Zealand.

Technical Implications for NZD/USD

From a technical perspective, the NZD/USD is now trading near a key support level at 0.5750. A sustained breach below this level could open the door to further downside risk, potentially targeting 0.5700 in the near term.

Resistance levels remain around 0.5800, reflecting the psychological ceiling where short-term traders might look for profit-taking opportunities. However, the lack of inflation-driven bullish catalysts in New Zealand suggests that any upward moves may be limited unless accompanied by stronger domestic price pressures or RBNZ guidance indicating a more hawkish stance.

Looking Ahead: Key Drivers

The immediate market focus will be on the US CPI report, which could significantly influence NZD/USD momentum. A higher-than-expected reading may reinforce USD strength, while a softer print could allow the NZD to stabilize or even rebound.

Meanwhile, ongoing RBNZ commentary and economic releases, including employment data and consumer confidence figures, will continue to shape market expectations for New Zealand interest rates and FX positioning.

Conclusion

Despite Q3 GDP growth surpassing expectations, NZD/USD continues to weaken, hovering near 0.5760. The NZD is pressured by subdued inflation expectations and a softened rate hike outlook from the RBNZ, while the USD remains supported by pre-CPI caution and a dovish Fed stance. Traders should focus on the upcoming US CPI release, as well as ongoing New Zealand economic indicators, to anticipate the next moves in this key currency pair.