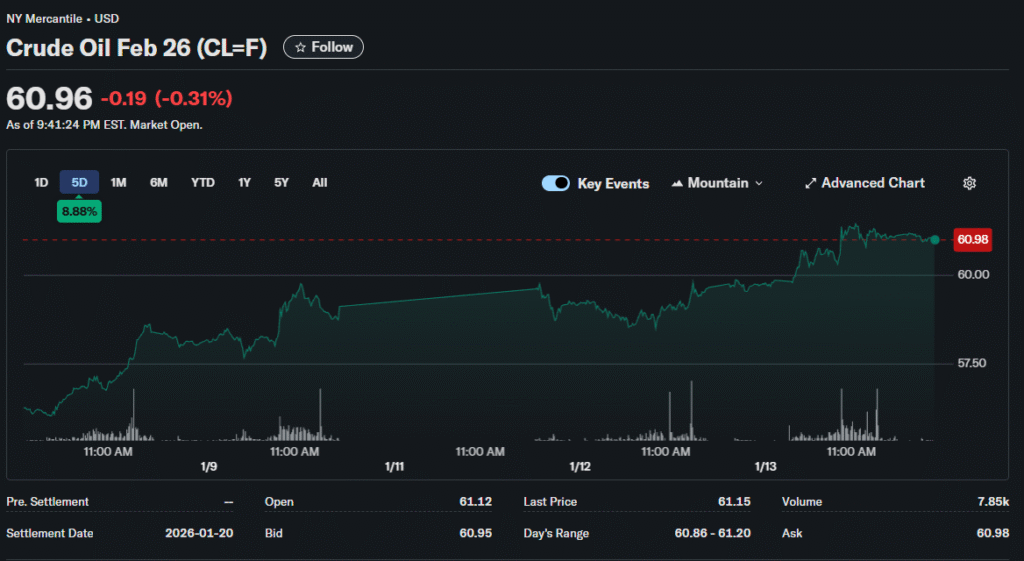

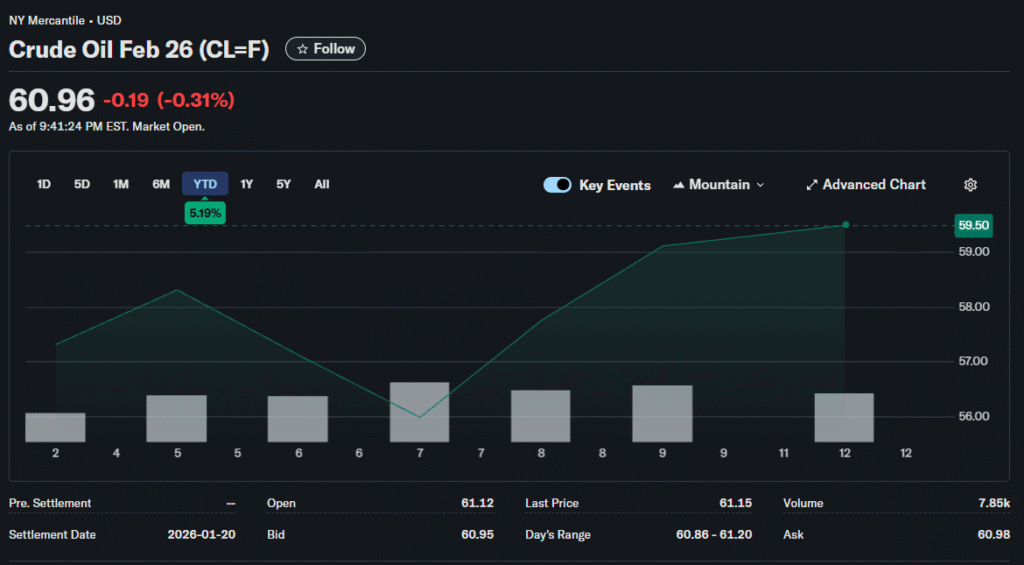

WTI crude touched $59.50 per barrel on Monday while Brent hovered near $63. These levels represent steep declines from mid-2025 peaks, which were above $80. Finance expert at Rivonsphere explores the supply glut reshaping energy markets.

Supply Side Pressures

U.S. output remains near record levels at 13.83 million barrels daily. This production approaches the all-time high of 13.86 million set in early November. Meanwhile, OPEC increased supplies under political pressure to boost global output.

Canadian and Guyanese production adds further volume to saturated markets. OPEC’s traditional role as swing producer erodes as non-member production surges. The cartel faces difficult choices between market share and price support.

Voluntary cuts become increasingly challenging to maintain when others increase their output. The coordination breakdown threatens OPEC’s ability to influence global prices. Members question whether sacrificing revenue makes sense when competitors gain market share.

Demand Growth Concerns

Global consumption increases fail to keep pace with supply expansion rates. China’s economic slowdown has reduced the demand for petroleum products. European demand remains tepid amid persistent manufacturing weakness.

U.S. gasoline consumption remains steady, offering little growth momentum. Electric vehicle adoption accelerates in the primary market, reducing long-term petroleum needs. Efficiency improvements in transportation decrease fuel consumption per mile traveled.

Storage Capacity Challenges

Global inventories continue increasing as production outpaces consumption across major markets. Floating storage vessels fill with unsold crude as traders hope for price recovery. This inventory buildup signals that market participants expect oversupply conditions to persist.

Venezuela’s state oil company, PDVSA, shuts down wells producing extra-heavy crude as storage reaches capacity. The Orinoco Belt facilities lack space to accommodate continued production. Sanctions forcing vessel closures at Venezuelan ports exacerbate storage constraints.

Commercial storage costs rise as available capacity diminishes in key trading hubs. Tank farms in Cushing, Oklahoma, approach maximum levels, limiting further inventory growth. This creates downward pressure on spot prices relative to future delivery contracts.

Price Forecast Spectrum

The Energy Information Administration expects Brent to average $56 per barrel in the first quarter 2026. The forecast anticipates sustained pressure throughout the year as oversupply persists. Some analysts predict WTI could briefly crash below $50 before stabilizing.

OPEC production cuts would likely follow such price declines. Many U.S. shale operators require prices above $50 to justify continued drilling. Capital discipline improved after previous downturns but breakeven levels vary widely.

Lower crude prices benefit consumers through cheaper gasoline at the pump. National average gas prices fell to $2.81 per gallon according to AAA data. This represents the lowest level since March 2021 providing relief for household budgets.

Major Oil Company Response

Exxon and Chevron peg their global breakeven targets around $30 per barrel for 2030. Current prices provide comfortable margins but the gap narrows uncomfortably. Fourth quarter results already show $800 million to $1.2 billion hits from price weakness.

Sustained low prices threaten dividend sustainability and growth plans. Oil majors increasingly pivot toward natural gas and power generation projects. Gas-fired plants serving AI data centers offer steadier returns than volatile crude markets.

Consolidation Wave Potential

Historical patterns show merger activity accelerates during price downturns. The 2020-2021 wave followed pandemic-driven price collapse. Another consolidation phase emerged after 2022 highs reversed in 2023.

Current weakness could trigger similar combination activity. Dozens of publicly traded independent producers lack scale to weather extended low prices. Mergers deliver cost synergies and operational efficiencies that improve margins.

Exxon acquired Denbury Resources for nearly $5 billion in late 2023. The company finalized its $60 billion megadeal with Pioneer Natural Resources in May 2024. Chevron bought PDC Energy for over $6 billion while closing its $55 billion Hess acquisition.

Geopolitical Wild Cards

Iranian protests and Venezuelan instability inject uncertainty into supply forecasts. Iran exports nearly 2 million barrels daily as OPEC’s fourth largest producer. Any disruption carries material consequences for global balances.

Yet markets largely discount these tail risks given overall abundance. Geopolitical tensions historically supported oil prices through fear premiums. Current market structure suggests oversupply overwhelms these traditional factors.

Natural Gas Divergence

While crude struggles, natural gas prices held firm above $4.25 per MMBtu for Henry Hub. LNG Canada reached 71% utilization, supporting robust export demand. Total gas exports, including Mexican pipeline deliveries, reached 24 Bcf per day.

This strength contrasts sharply with the weakness of crude oil. Gas benefits from LNG export growth and power generation demand. AI data centers drive electricity consumption, requiring gas-fired generation capacity.

Investment Strategy Implications

Energy stocks are facing headwinds from depressed commodity prices, despite solid operational performance. Lower crude prices compress margins and cash flows, reducing shareholder distributions. Patient investors may find value if consolidation leads to stronger entities.

Near-term returns likely remain challenged. The sector requires new catalysts to regain investor favor. Stronger balance sheets allow major companies to pursue opportunistic deals during periods of market stress.

Producer Economics Shift

Lower prices could trigger production cuts that eventually rebalance markets. This diversification provides revenue stability amid uncertainties related to the energy transition. Only actual supply disruptions would meaningfully tighten balances given current oversupply conditions.

The US President’s push for lower oil prices creates tension with domestic energy industry interests. Gasoline prices dropped, providing political benefits, but producers face margin compression. Industry respondents in Dallas Fed surveys express frustration over political pressure.