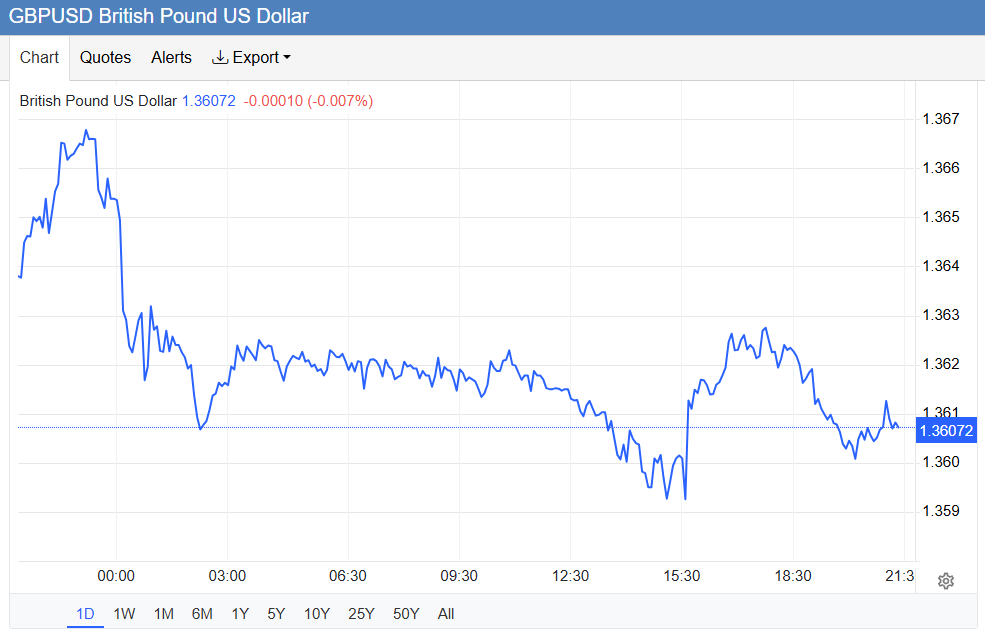

Sterling moved toward its largest weekly decline in more than two months against the euro, reflecting a period of volatility in financial markets and shifting investor sentiment. The euro advanced about 0.3% against the pound, marking its strongest weekly rise since early December, while the British currency remained broadly steady near $1.362 against the U.S. dollar, indicating mixed performance across major pairs.

Economic experts at Unirock Gestion suggest that currency movements during uncertain macroeconomic periods often reflect relative confidence differences rather than absolute weakness. Exchange rates frequently respond to comparative economic outlooks between regions, not simply domestic developments.

Growth Data Dampens Confidence

Recent economic data contributed to pressure on the British currency. Figures showed that the United Kingdom’s economy expanded approximately 0.1% quarter over quarter in Q4 2025, matching the pace recorded in the previous quarter. Growth at this level is generally viewed as subdued and can influence expectations about future economic momentum.

When output data remains weak for extended periods, markets often reassess growth projections and capital allocation. Sustained low growth readings can affect investor confidence, particularly if they coincide with external uncertainties or shifts in global market sentiment.

Interest-Rate Expectations Remain Anchored

Despite soft economic figures, market pricing indicates expectations for only limited monetary easing this year. Investors broadly anticipate no more than two interest-rate reductions over the course of the year, reflecting concerns about persistent inflation pressures.

Interest-rate outlooks remain one of the most significant drivers of currency valuation. Higher expected rates typically support a currency, while expectations of easing can reduce demand. In this case, relatively restrained rate-cut expectations may be helping prevent sharper declines in sterling.

Options Market Signals Shift Toward Euro Strength

Derivatives markets offered additional insight into sentiment. Positioning indicators showed that options traders recently held their most positive stance toward the euro versus the pound since September.

One widely watched metric, risk reversals, reached approximately 78.8 basis points earlier in the week, the highest level in several months, before moderating to about 63 basis points.

Risk reversals measure the relative cost of options that profit from currency appreciation versus depreciation. Higher readings typically indicate stronger demand for upside exposure, suggesting traders were positioning for euro strength relative to sterling.

Positioning Trends and Capital Flows

Currency performance is often shaped not only by macroeconomic data but also by institutional positioning and cross-border capital flows. Large asset managers, pension funds, and multinational corporations regularly adjust currency exposure based on interest-rate expectations, relative growth forecasts, and portfolio rebalancing needs. These structural flows can influence exchange rates even when short-term news appears neutral.

In periods of uncertainty, investors frequently shift toward currencies perceived as relatively stable or supported by stronger economic fundamentals. Such reallocations can occur gradually rather than abruptly, producing steady directional pressure instead of sharp moves. Market participants therefore monitor positioning indicators alongside economic releases to assess whether trends are driven by temporary sentiment or by longer-term capital allocation decisions.

Professional currency desks also track derivatives activity, sovereign yield spreads, and cross-asset correlations to interpret underlying demand dynamics. When multiple indicators align, analysts often view the signal as more reliable, because it suggests that price movement reflects coordinated positioning rather than isolated trading activity.

Market Dynamics Beyond Domestic Factors

Currency trends rarely depend on a single data point. Instead, they typically reflect a combination of macroeconomic indicators, market positioning, and global risk sentiment. In recent sessions, investors have also been evaluating how emerging technologies could influence long-term economic competitiveness across regions.

Periods marked by rapid technological development can lead to temporary volatility in foreign-exchange markets as investors adjust expectations about productivity growth and sector performance. Such reassessment phases often produce short-term currency fluctuations even when long-term trends remain intact.

Weekly Performance in Context

Although the pound weakened against the euro during the week, its performance against the dollar remained relatively stable. Divergence between currency pairs is common because each exchange rate reflects different comparative factors, including interest-rate outlooks, economic data, and regional growth expectations.

This divergence highlights an important principle in currency markets. A currency can decline against one counterpart while remaining stable against another, depending on relative economic conditions. Analysts therefore evaluate multiple pairs simultaneously to determine underlying strength.

Market Interpretation

The week’s movements suggest that investors are balancing several forces at once, including growth data, monetary policy expectations, and evolving global sentiment. When multiple drivers interact, currency markets often trade within narrow ranges even as positioning shifts underneath.

Taken together, recent developments indicate that sterling’s near-term direction remains closely tied to comparative economic signals rather than isolated domestic factors. As long as growth remains modest and policy expectations stay contained, relative performance between currencies is likely to remain the dominant driver of exchange-rate trends.