The Pound Sterling (GBP) staged a strong rebound against its major currency peers on Tuesday, driven by a combination of robust UK economic data and a softening US Dollar (USD). Stronger-than-expected UK wage growth, improving business activity indicators, and cautious positioning ahead of the US Nonfarm Payrolls (NFP) report have collectively pushed Sterling to the forefront of FX market performance.

Orbisolyx experts present a detailed and well-researched analysis of the subject.

UK Employment Data Sparks Sterling Strength

The initial catalyst for the GBP upside move came from the latest UK labour market report for the three months ending in October. According to the data, Average Earnings Excluding Bonuses, a closely watched measure of underlying wage inflation, rose by 4.6% year-on-year, beating market expectations of 4.5%. Adding further support, the previous reading was revised higher to 4.7%, reinforcing the narrative of persistent wage pressures.

Meanwhile, Average Earnings Including Bonuses increased by 4.7%, also surpassing expectations of 4.4%, although this marked a modest slowdown from the prior 4.9% print. Despite the slight deceleration, the data still signals elevated income growth, a factor that complicates the Bank of England’s (BoE) policy outlook.

However, the report was not without concerns. Labour demand continued to weaken, with the ILO Unemployment Rate rising to 5.1%, in line with expectations but higher than the previous 5.0%. Additionally, the UK economy recorded 17,000 job losses, extending the trend of workforce contraction, albeit at a slower pace than the prior 22,000 layoffs.

PMI Data Reinforces Growth Optimism

Further momentum for the Pound Sterling followed the release of the UK preliminary S&P Global Purchasing Managers’ Index (PMI) data for December. The Composite PMI climbed to 52.1, outperforming both the forecast of 51.4 and November’s 51.2 reading. Importantly, a reading above 50.0 indicates economic expansion.

The improvement was broad-based. The Services PMI advanced to 52.1, while the Manufacturing PMI rose to 51.2, signaling a return to modest growth in a sector that has struggled in recent months. This synchronized expansion across sectors helped underpin confidence in the UK growth outlook, further supporting Sterling.

Pound Sterling Jumps Against the US Dollar

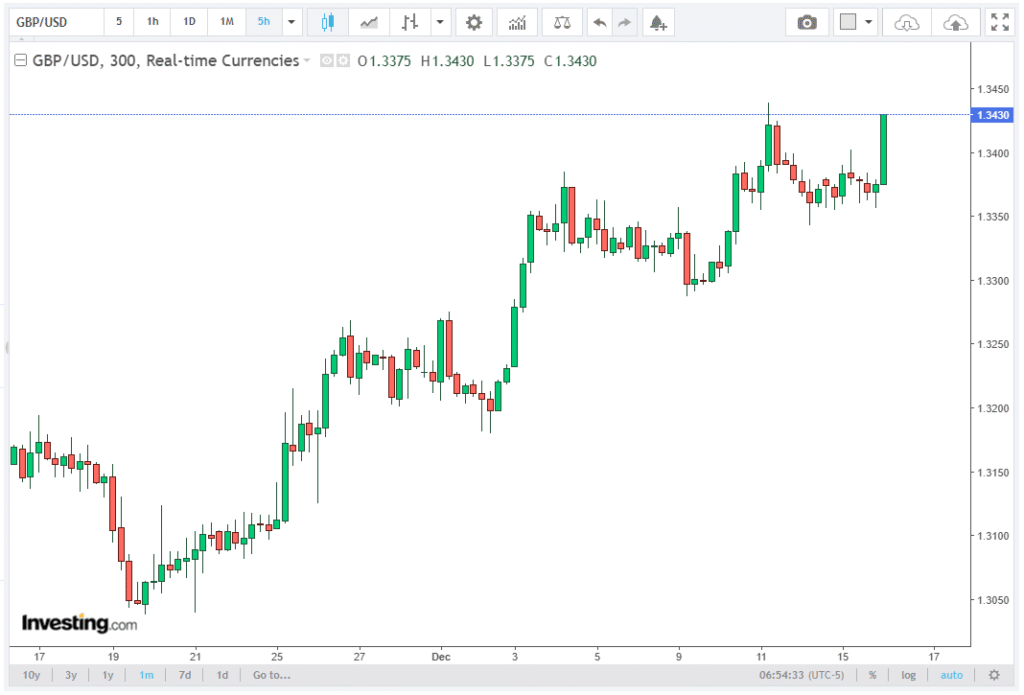

The GBP/USD pair, commonly referred to as Cable, extended its rally during European trading hours, climbing toward 1.3425. Sterling strength has been amplified by a broadly weaker US Dollar, as traders position ahead of the highly anticipated US NFP report scheduled for 13:30 GMT.

At the same time, the US Dollar Index (DXY) hovered near its eight-month low around 98.15, reflecting declining confidence in the Greenback. Market participants are increasingly betting that the Federal Reserve (Fed) will adopt a more accommodative policy stance over the medium term.

US NFP in Focus as Fed Outlook Evolves

The upcoming US employment report is expected to show that the economy added 40,000 new jobs in November, while the Unemployment Rate is forecast to remain steady at 4.4%. Any downside surprise could reinforce expectations of further Fed rate cuts, adding pressure on the USD.

According to the CME FedWatch Tool, markets assign a 74% probability that the Fed will deliver at least two rate cuts by the end of 2026. This contrasts with the Fed’s latest dot plot, which projects the Federal Funds Rate falling to 3.4% by 2026, implying just one additional cut from the current 3.50%–3.75% range.

Alongside NFP, investors will closely watch U.S. Retail Sales (October) and the flash S&P Global PMI (December), as these key releases may shape short-term USD movement.

Technical Analysis: GBP/USD Extends Advance Above 1.3400

From a technical perspective, GBP/USD maintains a bullish near-term bias. The pair trades comfortably above the rising 20-day Exponential Moving Average (EMA), currently positioned near 1.3300, signaling continued upward momentum.

The 14-day Relative Strength Index (RSI) hovers around 66.00, indicating positive momentum without entering overbought territory. Measured from the 1.3783 high to the 1.3008 low, the pair is attempting to sustain a break above the 50% Fibonacci retracement at 1.3395.

A confirmed move higher could open the path toward the 61.8% Fibonacci level at 1.3488, reinforcing the bullish structure. Conversely, failure to hold above the 50% retracement may trigger consolidation back toward the 20-day EMA. A decisive drop below 1.3286 would expose downside risk toward the December low at 1.3180.

Conclusion

In summary, the Pound Sterling’s outperformance reflects a complex mix of strong UK wage data, improving business sentiment, and a softer US Dollar ahead of crucial US employment figures. With BoE and Fed policy expectations finely balanced, upcoming CPI and NFP releases are likely to set the tone for the next major move in GBP/USD.