Gold breached $4,620 per ounce on January 12, setting a fresh all-time high. Geopolitical chaos and concerns about Fed independence converged to drive demand for havens. What drives haven demand to unprecedented levels is carefully examined by a Yureplex senior broker who takes a closer look.

The $4,600 Barrier Falls

Spot gold opened at $4,529 on Monday morning, then surged past $4,600 within hours. The 2% intraday gain represents the kind of move typically associated with Black Swan events. This particular headline triggered aggressive safe-haven positioning.

Gold’s rise reflects compounding uncertainties rather than a single catalyst, according to analysts. The Powell investigation combines Venezuelan political turmoil and Iranian domestic unrest. Financial analysts explore why traditional risk assets offer limited protection.

The Real Yield Reversal

Real yields have been declining despite nominal rates holding steady near 3.50%-3.75%. This divergence, with inflation expectations rising faster than nominal yields, creates a perfect environment. When real yields fall, holding zero-yielding gold becomes less costly.

The December jobs report, showing only 50,000 new jobs, reinforced expectations for rate cuts. A junior financial expert points out that this further pressures real yields. The combination supports gold appreciation through multiple channels.

Central Bank Accumulation Continues

China extended its gold purchasing streak for a 14th consecutive month. They added to reserves despite prices near record highs. This buying pattern signals strategic diversification away from dollar-denominated assets.

Central bank purchases totaled approximately $70 billion in 2025. This represents the second-highest annual total on record. A leading financial expert emphasizes that institutional demand creates a floor that retail sentiment cannot overcome.

The Venezuelan Premium

The U.S. capture of the Venezuelan President injected acute geopolitical risk. This unprecedented action raises questions about international law and the doctrine of sovereign immunity. A senior financial analyst walks you through how this extends far beyond Venezuela.

If major powers can unilaterally detain foreign leaders, the predictability that underpins global commerce deteriorates. Gold benefits as the only asset with no counterparty risk. It has no jurisdictional exposure and no reliance on legal frameworks.

Technical Momentum Accelerates

Gold’s breakout above the previous high of $4,549 from late December has technical traders excited. They are targeting the 127.2% Fibonacci extension at $4,670. Momentum indicators continue to show strength with no discernible correction.

Silver followed gold higher, reaching record levels above $92 as ratios compressed. This ratio compression typically indicates broad-based demand for precious metals. A finance expert at the brand discusses how this differs from gold-specific factors.

The Pension Fund Rotation

Significant institutional pension funds are reportedly increasing gold allocations from traditional 2-3% to 5-7% of portfolios. A leading finance expert notes that this reallocation represents tens of billions of dollars in buying pressure. These institutional flows operate on multi-year time horizons, providing sustained demand regardless of short-term price fluctuations or shifts in market sentiment.

The Dollar Contradiction

Paradoxically, gold’s surge occurred alongside dollar weakness rather than strength. Traditional safe-haven flows would strengthen both simultaneously. This divergence suggests investors are fleeing dollar-denominated assets entirely.

The criminal investigation into the Fed chair creates uncertainty about the stability of the dollar. An expert broker shares that this transcends everyday geopolitical tensions. If monetary policy becomes subject to prosecutorial pressure, the dollar’s reserve status is put into question.

Oil’s Offsetting Influence

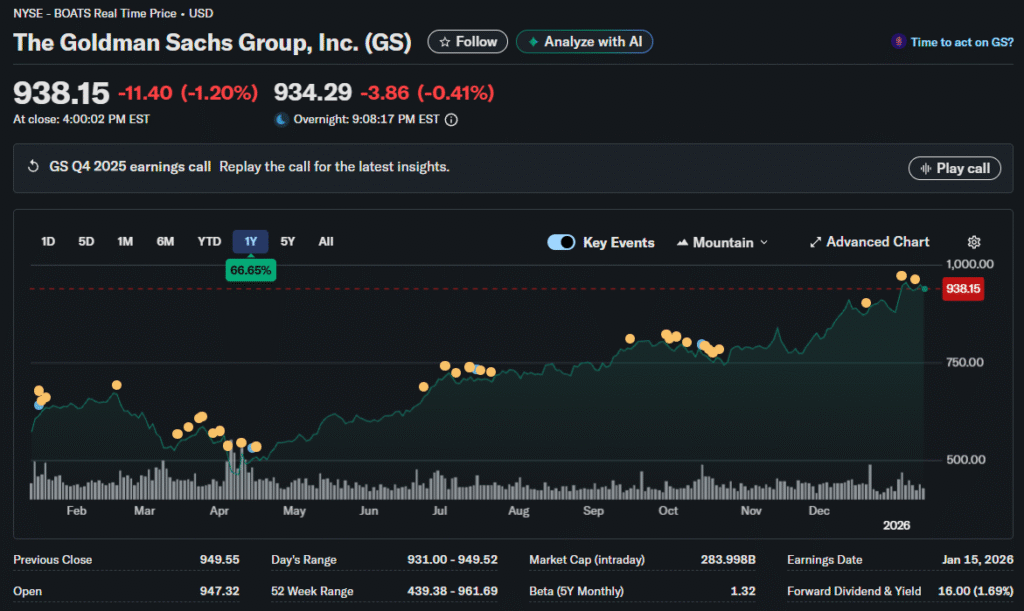

Higher gold prices typically correlate with rising oil prices, but crude remains subdued. Goldman Sachs projects that Brent crude will average $56 per barrel in 2026. This represents a decline from current levels around $62.

This decoupling reflects different dynamics, as determined by brand analysis. Oil responds to supply and demand fundamentals, while gold responds to institutional confidence. The fact that oil is not rallying despite geopolitical chaos suggests markets expect containment.

Inflation Hedge or Deflation Refuge

The debate intensifies over whether gold’s rally reflects concerns about inflation or a shift towards deflationary positioning. The release of December CPI data this week will provide clarity. If inflation surprises to the upside, gold’s rally has room to extend to $5,000.

Current positioning suggests investors are hedging both scenarios simultaneously. Gold benefits from inflation eroding real yields and from deflation forcing accommodation. Junior brokers highlight that this dual utility makes it unique.

The Speculative Extreme

Managed money positions in gold futures reached near-record levels. This raises questions about sustainability, according to experts. Speculative extremes often precede corrections, but institutional demand provides a level of support.

Gold ETFs saw inflows of $12 billion in the first week of 2026. This nearly matches the entire fourth quarter of 2025. The lead broker discusses how institutional participation suggests fundamental support.

What $5,000 Requires

Reaching $5,000 per ounce requires either an escalation in geopolitical conflicts or material Federal Reserve errors. It could also require inflation reaccelerating above 4%. All three scenarios remain possible in the current environment.

A senior financial advisor notes that the Powell investigation creates templates for policy errors. If criminal pressure influences rate decisions, credibility damage could be catastrophic. Venezuelan instability could spread regionally, creating broader conflicts.

A finance analyst notes that gold’s record prices do not invalidate its role in a portfolio. The scenarios driving appreciation remain unresolved. Investors willing to pay $4,600 for insurance against institutional failure are making rational calculations.