A senior financial analyst at Rineplex explores how the 2025 holiday shopping season entered unprecedented territory with projected sales between $1.01-$1.02 trillion, marking 3.7-4.2% growth over 2024’s $976 billion. However, this aggregate strength masked stark divergence between retail winners and laggards.

Upper-income households drove spending while lower-income families pulled back sharply. This wealth effect benefited TJX Companies and Ross Stores as shoppers traded down. Conversely, Target plunged 35% year-to-date, Bath & Body Works dropped 62% and CarMax fell 57%.

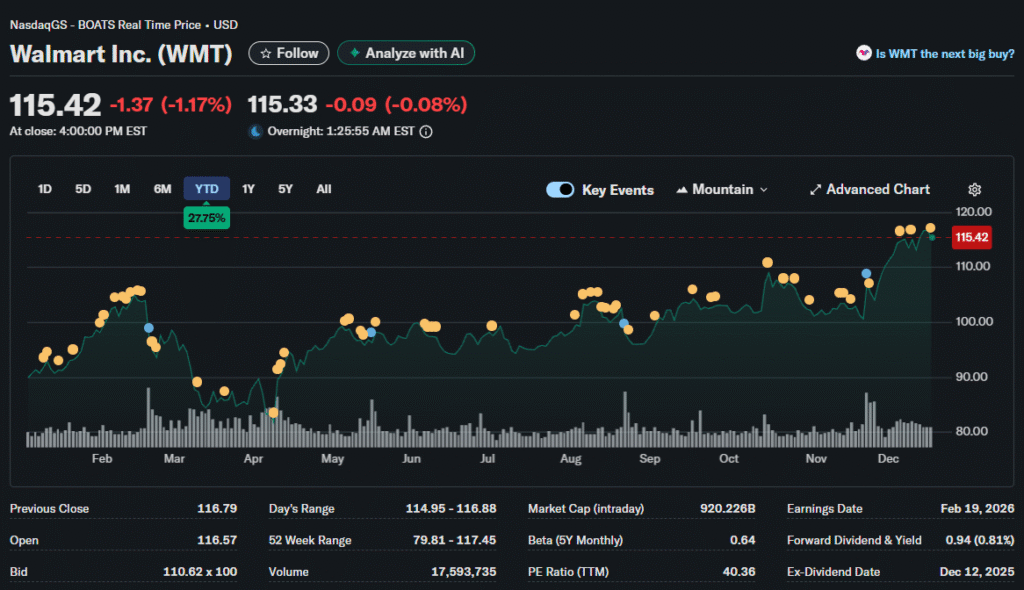

Walmart’s Strategic Victory

Walmart emerged as the season’s bellwether success story. The company’s $169.59 billion quarterly record demonstrated superior execution across multiple operational fronts. E-commerce sales surpassed $100 billion annually as years of digital transformation investments reached maturity.

The retailer’s advertising segment exploded 53% year-over-year in Q3 fiscal 2026. While still modest relative to total revenue, this growth trajectory suggested ads could become a meaningful margin contributor within a few years. Online advertising typically generated significantly higher profitability than traditional retail operations.

10,000+ physical locations provided an unmatched competitive advantage for same-day delivery fulfillment capabilities. Stores doubled as distribution centers, enabling rapid order processing impossible for pure-play e-commerce competitors. This omnichannel integration proved exceedingly difficult to replicate.

However, many trading brokers emphasized that Walmart’s strength came disproportionately from groceries and value-seeking customers trading down from premium alternatives. This indicated defensive consumer behavior rather than exuberant spending confidence.

Amazon’s Cloud Cushion

Amazon posted $180.2 billion in Q3 revenue with 13% growth. AWS cloud services generated $33 billion quarterly, while Prime memberships contributed $12.6 billion. This diversification insulated Amazon from retail headwinds.

Analysts upgraded targets to $260 per share, reflecting confidence in cloud and AI infrastructure. Black Friday saw 1 billion items sold, with half from independent sellers generating high-margin marketplace fees. Q4 guidance projected $206-$213 billion in revenue.

Department Store Distress

Macy’s and traditional department stores faced existential pressures. The S&P Retail Select Industry Index traded flat year-to-date. Foot traffic declined materially as consumers migrated online. High lease costs and maintenance expenses eroded profitability.

TJX Companies delivered $4.26 earnings per share in fiscal 2025, up from $2.97 in fiscal 2023. The company operated 5,000+ stores globally with decentralized pricing empowering local merchants. Analysts raised price targets to $155-$170. Ross Stores exhibited similar strength as the off-price model proved resilient.

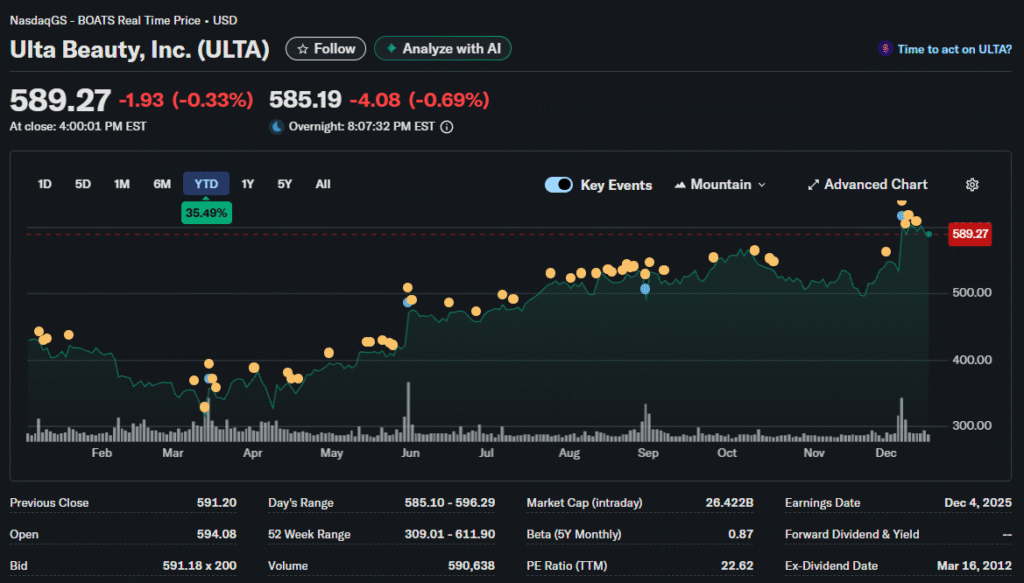

Beauty Sector Resilience

Ulta Beauty navigated headwinds with 7.3% projected revenue growth to $2.71 billion despite a 12.3% earnings per share decline. The beauty category demonstrated relative spending stability even as discretionary budgets tightened elsewhere.

Comparable sales rose 6.7% in Q2 fiscal 2026 with gains across both physical and digital channels. Strategic partnerships, including serving as the official beauty partner for major entertainment events, elevated brand visibility substantially.

The company hosted tens of thousands of in-store beauty events throughout the year, reinforcing community engagement. This experiential retail approach made it difficult for pure e-commerce competitors to match effectively. However, aggressive promotional activity required to drive traffic pressured operating margins.

Analysts maintained Buy ratings with Zacks Rank #2 reflecting cautious but constructive optimism heading into 2026. The $570 price level represented a key technical breakout point, while $500 support held firm through volatility.

Costco’s Membership Moat

Costco shares traded at $908 with valuations at 45 times 2026 earnings. Membership fees represented 73% of operating profit despite a modest revenue portion. Four-week sales showed 8.6% growth to $21.75 billion, with gift baskets and electronics driving traffic.

Online retail continued gaining share, but growth rates decelerated. Amazon dominated with unmatched logistics, while Walmart’s e-commerce surge demonstrated that major retailers could compete effectively. Social commerce through TikTok and Instagram disrupted traditional channels.

Inventory Management Critical

Retailers navigated delicate balancing acts. Promotional intensity remained elevated with gross margins compressed. Supply chain improvements from pandemic disruptions provided relief, though China tariff uncertainty complicated planning.

The traditional Santa Claus rally period, running December 24 through January 5, faced skepticism despite historical patterns showing 70 of the past 97 years produced December gains. Lower trading volumes could amplify volatility, while economic data releases might override seasonal patterns.

January returns and exchanges tested retailer operations. Inventory clearance determined spring season positioning. Gift card redemption rates indicated brand health with strong usage suggesting customer enthusiasm.

Investment Takeaways

The $1 trillion holiday season milestone masked significant sector bifurcation. Value-oriented retailers with strong execution thrived while premium discretionary and department stores struggled.

E-commerce leaders with diversified revenue streams outperformed pure retail plays. AWS for Amazon and advertising for Walmart provided crucial profitability drivers beyond merchandise sales.

Consumer stratification by income level dominated spending patterns. Understanding demographic exposure became critical for stock selection. Middle and upper-income-focused retailers showed resilience while lower-income dependent names faced pressures.