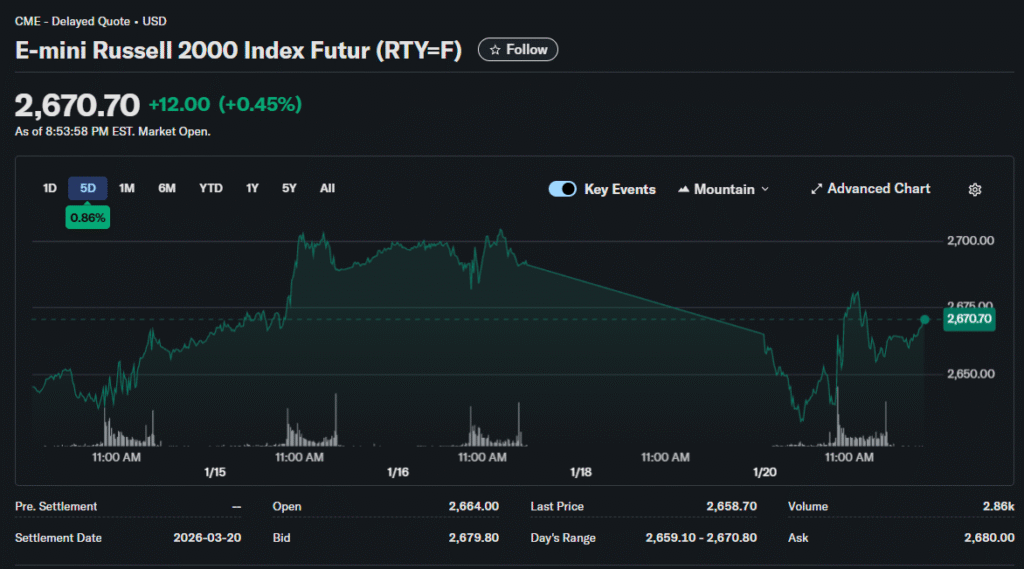

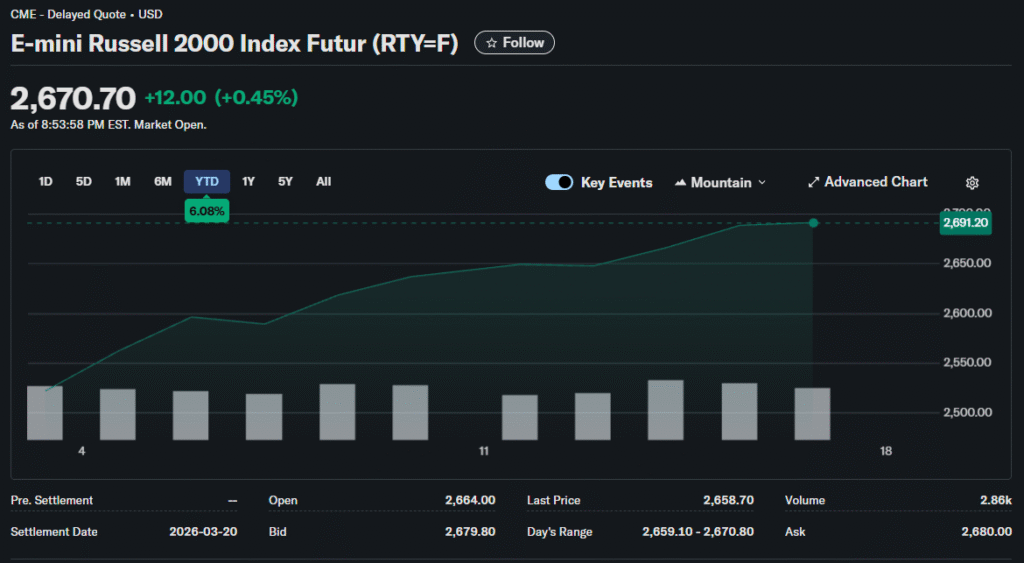

Smaller companies continued outperforming their large-cap counterparts for an impressive 12th consecutive session. The Russell 2000 has surged over 7% in 2026 while the S&P 500 trades flat. Finance analysts at Rivonsphere take a closer look at the domestic focus driving superior returns.

Historic Outperformance Streak

Tuesday marked the longest period of small-cap leadership since the June 2008 financial crisis. The index fell just 0.4% while the S&P 500 dropped 1.3% during the session. Relative strength persists despite broader market turbulence.

This pattern defies conventional wisdom that small caps suffer more during risk-off periods. Traditional defensive characteristics seem inverted as investors rotate from mega-cap tech. The shift suggests fundamental reassessment of relative valuations.

Domestic Revenue Advantage

Russell 2000 constituents derive most income from American operations. International exposure remains minimal compared to multinational corporations. This insulation provides critical protection during trade war escalations.

Tariff threats primarily impact companies with complex global supply chains. Small domestic firms avoid these complications through localized operations. The advantage compounds as geopolitical tensions intensify.

Rate Cut Expectations

Federal Reserve policy changes disproportionately benefit smaller companies. These firms typically carry higher debt loads at floating interest rates. Even modest rate reductions significantly improve financial flexibility.

Markets price in two cuts during 2026 despite recent hawkish commentary. Small caps rally in anticipation of this eventual easing. The sensitivity to monetary policy creates both opportunities and risks.

Valuation Gap Closing

Large-cap tech stocks trade at premium multiples despite slowing growth. Small caps offer better value on traditional metrics. The disparity reached extreme levels prompting smart money rotation.

Earnings growth among smaller firms actually exceeds mega-cap comparisons. Revenue expansion combined with modest valuations creates attractive risk-reward profiles. Investors tired of paying for past performance seek new opportunities.

Economic Growth Resilience

Strong domestic data supports companies focused on American consumers. Employment remains robust while consumer spending holds steady. This backdrop particularly benefits domestically-oriented businesses.

Infrastructure investments and manufacturing reshoring provide tailwinds. Government policies explicitly favor American production over imports. Small firms positioned in these sectors capture disproportionate benefits.

Regional Bank Strength

Community and regional banks comprise significant portions of small-cap indices. These institutions benefit from steeper yield curves and loan demand. Net interest margins expanded as rate cuts remained limited.

Real estate exposure in bank portfolios stabilized after 2025 concerns. Commercial property values found floors supporting asset quality. Credit metrics improved across most lending categories.

Healthcare Innovation

Smaller biotechnology and medical device companies attract venture capital funding. Innovation happens disproportionately at firms outside mega-cap pharma. Breakthrough therapies often originate from nimble research-focused operations.

Acquisition activity by large pharmaceutical companies supports small-cap healthcare valuations. Strategic buyers pay substantial premiums for promising drug candidates. This provides exit liquidity for early investors.

Merger and Acquisition Activity

Strategic buyers view current market conditions as opportune for deals. Small-cap valuations became attractive after underperforming large caps for years. Private equity firms accumulated record capital seeking deployment opportunities.

Consolidation accelerated across fragmented industries as scale advantages become apparent. Regulatory approval processes move faster for smaller transactions. This creates steady bid support under quality small-cap names.

Take-private transactions increased as public market valuations lagged private market assessments. Management teams partnered with financial sponsors to capture value gaps. The trend removes companies from public markets, reducing available investment options.

Sector Composition Differences

Technology dominates large-cap indices creating concentration risk. Small-cap indices offer broader sector diversification. This reduces exposure to any single industry downturn.

Industrials, materials, and regional banks comprise larger portions of small-cap benchmarks. These sectors benefit from different economic drivers than big tech. The diversification naturally smooths returns.

Liquidity Considerations

Trading volumes in small caps increased substantially during the rally. Institutional participation grew beyond traditional levels. This improved market depth reduces execution costs.

However, liquidity still lags large-cap markets during stress periods. Bid-ask spreads widen when volatility spikes. Investors must size positions accordingly to maintain flexibility.

Active Management Opportunities

Small-cap inefficiency creates alpha potential for skilled stock pickers. Less Wall Street coverage means genuine mispricings persist longer. Active managers justify fees more easily in this segment.

Index-tracking strategies face higher turnover costs in small caps. Reconstitution events create temporary price distortions. Informed traders exploit these predictable patterns.

Historical Precedents

Previous small-cap rallies often preceded broader economic acceleration. The current move suggests optimism about domestic growth prospects. Whether this proves prescient remains uncertain.

Extended outperformance streaks eventually reverse as leadership rotates. Timing these shifts challenges even experienced investors. Current momentum could persist for weeks or reverse tomorrow.

International Comparison

American small caps outperform international peers by wide margins. Developed market small-cap indices show modest gains. Emerging market small caps actually declined year-to-date.

This divergence reflects unique characteristics of the American economy. Deep capital markets and entrepreneurial culture support smaller firms. Other nations lack comparable ecosystems.

Risks to Monitor

Credit market stress would disproportionately impact leveraged small companies. Rising default rates could trigger broad selloffs. Current benign credit conditions may not persist.

Recession fears would likely hit economically-sensitive small caps hardest. Revenue concentration creates vulnerability to demand shocks. Investors must balance return potential against elevated risks.