After a challenging year for speculative assets, Shiba Inu has once again captured investor attention with a familiar question: Can SHIB reach $1 in 2026? Brokers from Unirock Gestion have taken a deep dive into the numbers, market structure, and fundamentals behind the meme token, and the conclusions may surprise even seasoned crypto traders.

Shiba Inu’s Speculative Roots Still Define Its Trajectory

Shiba Inu was launched in 2020 by an anonymous developer known as Ryoshi, deliberately positioning itself as a high-risk, community-driven alternative to Dogecoin. While originally created to ride the wave of meme culture, SHIB quickly exceeded expectations during the 2021 crypto boom.

At its peak, Shiba Inu delivered a staggering 45,278,000% annual gain, briefly turning small retail positions into life-changing sums. However, brokers point out that such explosive rallies are rarely sustainable. Since that peak, SHIB has trended steadily lower, declining 66% in 2025 alone and sitting roughly 90% below its all-time high.

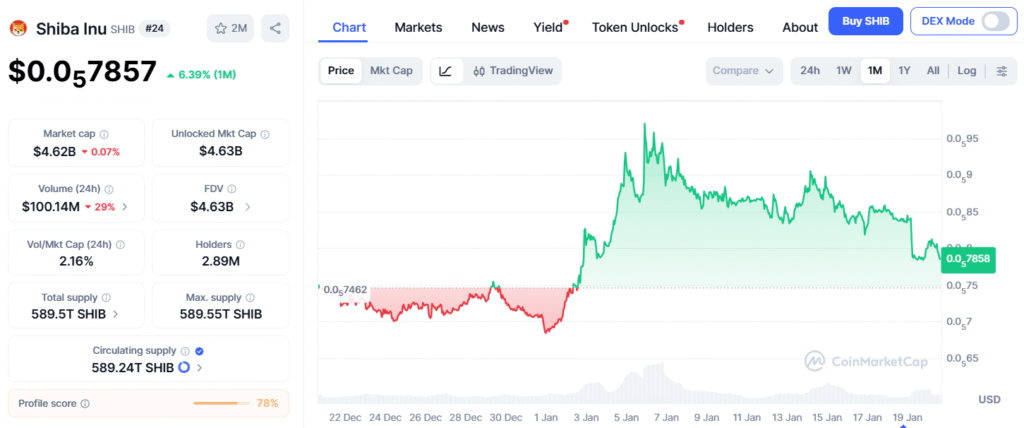

As of now, Shiba Inu trades near $0.0000083, far removed from the $1 milestone that continues to circulate in speculative discussions.

Adoption Remains the Core Challenge

According to brokerage analysis, sustained value creation in any currency depends on demand driven by utility. For example, Bitcoin has gained recognition as a store of value, while XRP benefits from its role in cross-border payments infrastructure.

Shiba Inu, by contrast, was not originally designed with a clear use case. It is neither widely adopted as a payment solution nor viewed as a reliable store of value. The token has not set a new high in nearly five years, a critical signal for long-term investors.

Developers have attempted to stimulate demand through projects such as a Shiba Inu metaverse, a digital card game, and a Layer-2 blockchain aimed at reducing transaction costs. However, brokers note that none of these initiatives have meaningfully increased real-world adoption or transactional demand.

The Supply Problem Makes $1 Mathematically Extreme

Perhaps the most significant obstacle to a $1 price target lies in Shiba Inu’s supply structure. The token has a circulating supply of approximately 589.2 trillion tokens. At the current price, this translates into a market capitalization of roughly $4.9 billion.

Simple arithmetic illustrates the challenge:

- At $1 per token, SHIB’s market cap would reach $589.2 trillion

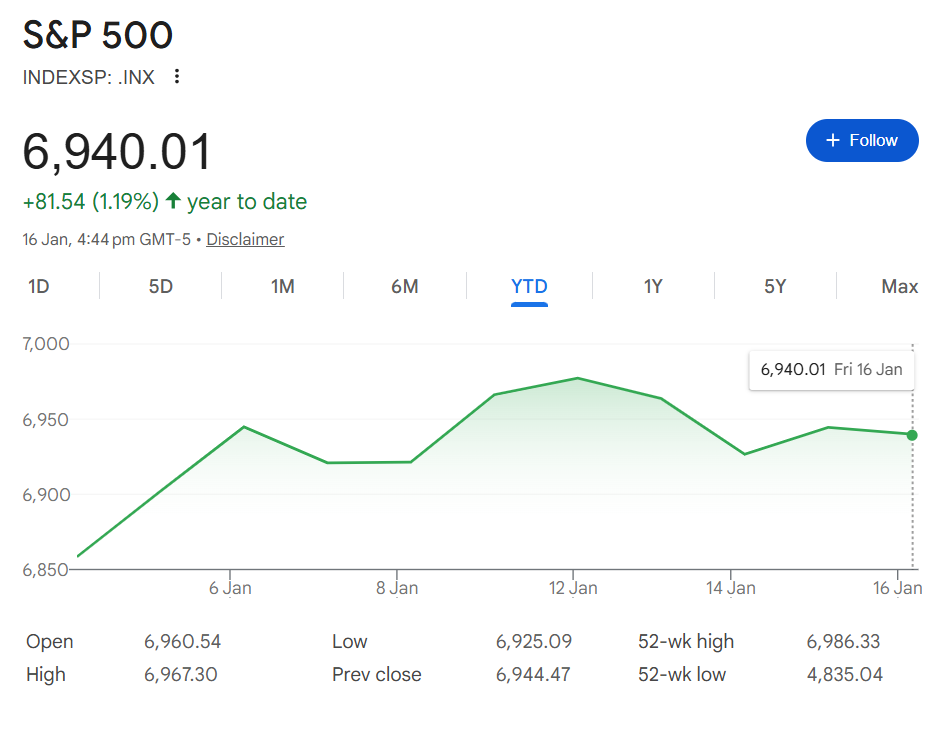

- That would be nearly 10 times larger than the combined value of the S&P 500

- It would also exceed the annual output of the entire U.S. economy by a wide margin

From a macro-financial perspective, brokers consider such valuations structurally unrealistic under current market conditions.

Token Burns: A Head-Spinning Thought Experiment

Supporters often point to SHIB’s token-burning mechanism as a potential solution. In theory, reducing supply should increase the value of remaining tokens. To justify a $1 price at today’s market cap, however, more than 99.99998% of tokens would need to be destroyed, leaving roughly 4.9 billion tokens in circulation.

This is where reality intervenes.

Recent data shows that only 110 million tokens were burned last month, equating to an annual burn rate of roughly 1.3 billion tokens. At that pace, it would take over 450,000 years to reduce supply to levels compatible with a $1 valuation.

Even more importantly, analysts highlight a critical flaw: burning tokens does not create economic value. Investors would own fewer tokens in direct proportion to the supply reduction, leaving their net financial position unchanged, and inflation over such time frames would further erode purchasing power.

What Would Actually Need to Change

According to brokers, the only credible pathway for Shiba Inu to reverse its long-term decline involves meaningful utility adoption. That would require:

- Integration into widely used payment ecosystems

- Sustainable transaction demand

- Real-world use cases that generate consistent token flow

Without these fundamentals, price appreciation relies almost entirely on speculative momentum, a fragile foundation in an increasingly regulated and valuation-conscious crypto market.

Final Verdict

The idea of Shiba Inu reaching $1 by 2026 is not grounded in financial reality under current conditions. While short-term volatility and speculative rallies remain possible, structural challenges tied to supply, adoption, and value creation are significant.

For investors, SHIB remains a high-risk speculative asset, better suited for short-term trading strategies than long-term portfolio allocation. As brokers emphasize, sustainable crypto investments are ultimately built on utility, scarcity, and real demand, not viral price targets.

In practical terms, this means Shiba Inu’s future depends less on community enthusiasm and more on execution. Unless developers can drive measurable adoption metrics, such as rising active wallets, consistent on-chain activity, and growing merchant acceptance, investor interest is likely to fade during periods of market stress. Without tangible progress on these fronts, SHIB risks remaining a sentiment-driven asset rather than evolving into a durable digital ecosystem.