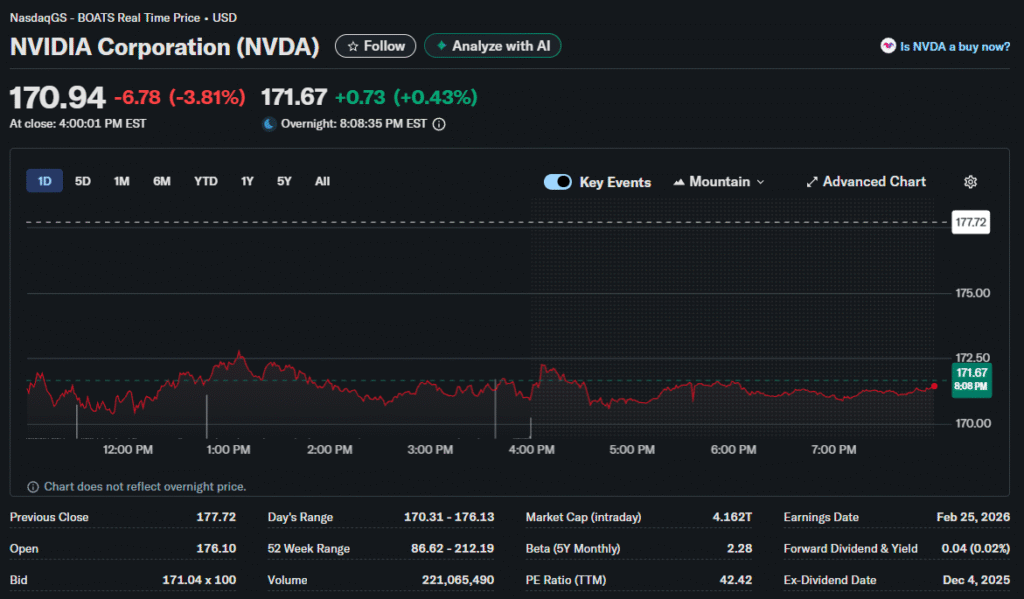

Nvidia shares plunged 3.8% Wednesday to their lowest level since September, extending a brutal stretch for the semiconductor giant. The stock has now declined in eight consecutive trading sessions. This represents the longest losing streak for the company in over two years.

Logirium‘s senior financial advisor explores Nvidia’s slide to September lows as the AI infrastructure trade faces its harshest test since the rally began. The chip manufacturer’s market capitalization has evaporated by approximately $400 billion from recent peaks, with Wednesday’s session alone erasing roughly $140 billion in shareholder value.

Valuation Gravity Returns

Nvidia trades at approximately 30 times forward earnings despite the recent selloff. This multiple remains elevated compared to historical semiconductor industry averages. The premium valuation assumes continued explosive growth in AI-related chip demand.

Revenue growth rates have begun decelerating from unprecedented levels. While still impressive by normal standards, the moderation raises questions about sustainability. Investors who paid premium prices now question whether growth justifies current multiples.

Options market activity shows dramatic shifts in sentiment. Put buying has accelerated sharply across near-term expiries. The put-call ratio reached levels typically associated with significant investor anxiety. This positioning could amplify volatility in either direction.

Competitive Threats Emerge

Advanced Micro Devices has gained market share in data center graphics processors. The company’s latest products offer competitive performance at lower price points. Hyperscale customers increasingly diversify chip sourcing rather than relying solely on Nvidia.

Custom silicon development by major cloud providers poses longer-term threats. Amazon, Google, and Microsoft have invested billions in proprietary AI accelerators. These efforts aim to reduce dependence on external suppliers while optimizing for specific workloads.

Nvidia’s gross margins face pressure from multiple directions. Component costs remain elevated despite broader semiconductor price weakness. Competition forces more aggressive pricing to maintain design wins. The combination squeezes profitability metrics that justified previous valuations.

Demand Questions Intensify

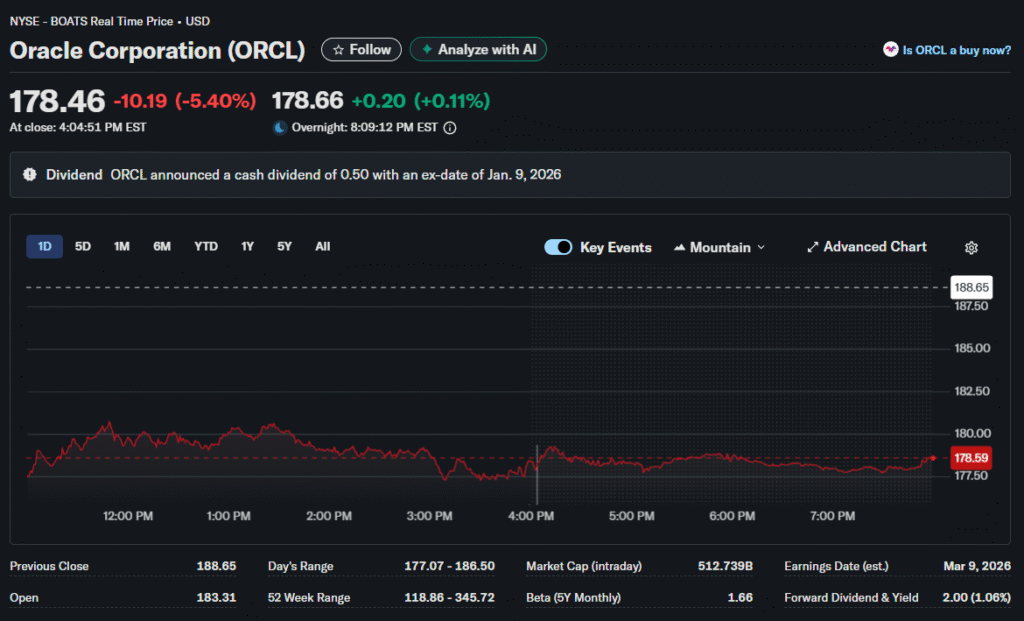

Oracle’s collapsed data center financing deal sparked broader questions about AI infrastructure spending sustainability. If major projects struggle to secure funding, chip demand forecasts may prove too optimistic. This uncertainty has infected semiconductor investor sentiment.

Hyperscale customers have built substantial AI chip inventories throughout 2025. Digestion of these stockpiles could slow near-term orders. Management teams signal more cautious capital expenditure approaches for 2026, given uncertain returns on AI investments.

Enterprise AI adoption has proceeded more slowly than enthusiasts projected. Many companies experiment with models but struggle to deploy at scale profitably. The gap between hype and commercial reality may constrain processor demand growth.

Technical Breakdown Analysis

The 50-day moving average provided support throughout autumn but failed on Tuesday. Nvidia now trades well below this key technical level. Algorithmic trading programs often use moving averages as risk management triggers.

Momentum indicators have rolled over sharply from overbought territory. The Relative Strength Index plunged from near 70 to below 40 in just two weeks. This rapid deterioration suggests strong conviction behind selling pressure.

Volume patterns show distribution rather than consolidation. Heavy trading on down days, combined with light volume on bounces, indicates professional money reducing exposure. Retail investors typically display opposite behavior, buying dips with increasing urgency.

Broader Sector Contagion

Nvidia’s weakness has infected the entire semiconductor complex. The Philadelphia Semiconductor Index has declined approximately 15% from recent highs. Individual chip stocks show high correlation, moving in tandem regardless of specific fundamentals.

Taiwan Semiconductor Manufacturing Company trades near six-month lows despite strong foundry demand. ASML Holding has given back gains from its earlier lithography equipment strength. Memory chip producers face margin compression from oversupply.

Equipment manufacturers that supply chip production tools have underperformed. Applied Materials and Lam Research both trade down double digits from peaks. These stocks typically lead semiconductor cycles, suggesting institutional pessimism about the sector outlook.

Fund Positioning Shifts

Mutual funds and ETFs have reduced semiconductor overweights substantially. Technology sector allocations have fallen from extreme levels toward neutral positioning. This deleveraging creates sustained selling pressure independent of fundamental news flow.

Hedge funds that concentrate on AI-related names face difficult decisions. Maintaining conviction requires tolerating significant drawdowns. Cutting positions to preserve capital admits timing errors. The psychological pressure intensifies as performance deteriorates.

Earnings Expectations Reset

Analyst consensus estimates have begun moderating from previously aggressive levels. Revenue growth projections for 2026 have declined approximately 10% from peak forecasts. Earnings per share expectations face similar haircuts.

Management’s next quarterly guidance will face intense scrutiny. Any indication of slowing momentum would likely trigger additional multiple compressions. The market has shifted from rewarding growth beats to punishing any disappointments.

Strategic Considerations

Long-term investors must decide whether the current weakness represents an opportunity or risk. Historical semiconductor cycles typically feature boom-bust patterns. Determining cycle position proves critical for entry timing.

The AI infrastructure buildout may require years to fully develop. Patient capital could weather current volatility for substantial long-term gains. However, distinguishing between cyclical correction and structural shift challenges even experienced investors.

Portfolio construction requires careful risk management around concentrated positions. Nvidia’s weight in popular indices creates passive exposure. Active decisions to be overweight or underweight carry significant performance implications.