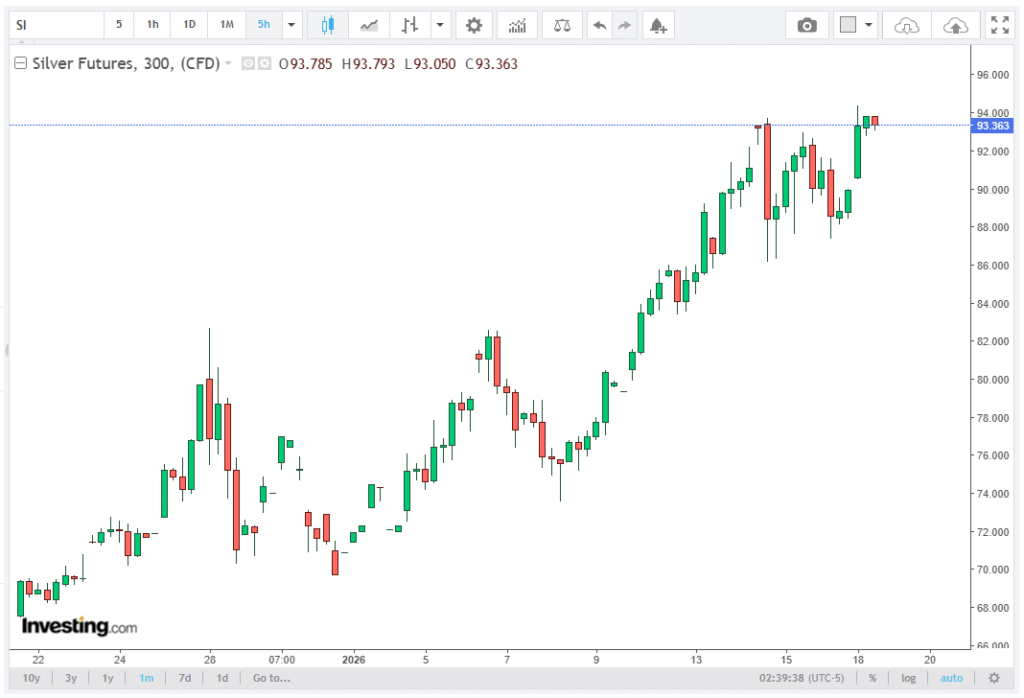

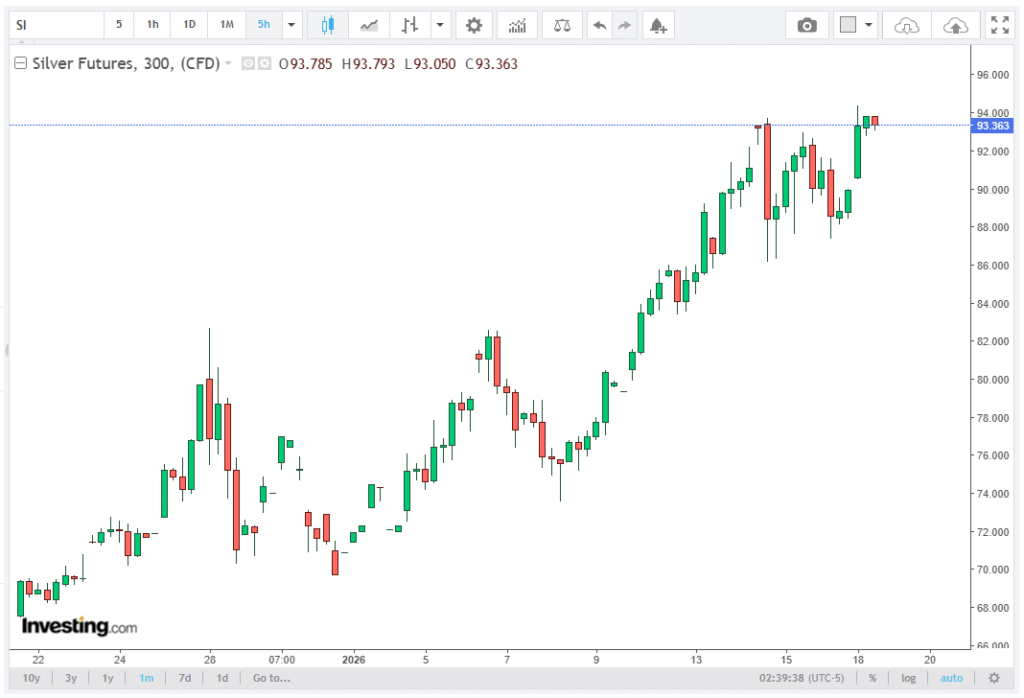

Silver price (XAG/USD) continued its meteoric rise on Monday, reaching a fresh all-time high of $94.15 per troy ounce during early European trading hours. This represents a significant rebound after two days of minor losses, signaling a continuation of the long-term bullish trend that has dominated the precious metals market.

Currently, XAG/USD is trading near $93.70, reflecting sustained upward momentum. Zeyphurs brokers outline the essential details of the topic with precision and insight.

Technical Overview: Ascending Channel Maintains Bullish Bias

A review of the daily chart shows that the Silver price remains entrenched within an ascending channel, a classic indicator of ongoing bullish momentum. The channel structure suggests that buyers continue to maintain control, keeping XAG/USD on a trajectory toward new highs.

The 14-day Relative Strength Index (RSI), currently reading 72.65, signals overbought conditions. While the RSI confirms the strength of the momentum, it also warns that the market may face short-term consolidation before advancing further. Traders should note that a sustained RSI above 70 often indicates limited immediate upside, though it does not necessarily imply an imminent reversal in a strong trend.

Moving Averages Confirm Entrenched Uptrend

The nine-day Exponential Moving Average (EMA) is sloping sharply higher and remains well above the 50-day EMA, confirming the entrenched uptrend in Silver prices. The separation between the short-term and medium-term averages indicates strong bullish control, as XAG/USD continues to respect both moving averages as dynamic support levels.

Price action staying above the short- and medium-term EMAs demonstrates that buyers remain firmly in control. This alignment suggests that any pullbacks are likely to be shallow and provide potential buying opportunities rather than a reversal of the overall trend.

Key Resistance Levels

On the upside, XAG/USD faces its first notable resistance near the upper boundary of the ascending channel at $96.80, followed closely by the psychological level of $97.00. These levels are critical for traders targeting further capital gains, as a sustained breakout above $97.00 could trigger additional momentum, potentially opening the door to a new all-time high above $100.00.

Technical traders often monitor these resistance zones to identify potential profit-taking areas or to anticipate temporary pauses in the trend. A breakout supported by strong volume could confirm the continuation of the rally, whereas a failure to breach these levels might lead to short-term consolidation.

Support Levels and Pullback Scenarios

On the downside, immediate support lies at the nine-day EMA, currently around $87.05. A breakdown below this level could encourage a pullback toward the lower boundary of the ascending channel at $79.10. Such a retracement would not necessarily indicate a trend reversal, but rather a healthy consolidation within a larger bullish framework.

If the Silver price were to close daily below the ascending channel, it could then test the 50-day EMA base at $69.23, a critical long-term support level. Traders and investors often use these support zones as risk management benchmarks, adjusting their positions to balance exposure against potential downside.

Momentum Indicators Suggest Cautious Optimism

Despite the overbought RSI, other momentum indicators support continuing strength in XAG/USD. The sharp angle of the nine-day EMA reflects bullish conviction, while the widening gap between the short-term and 50-day averages underscores the trend’s robustness.

Market participants should remain alert to potential corrections, particularly after such an extended bull run, but the technical setup suggests that the Silver price is likely to maintain its upward bias over the coming weeks. Short-term pullbacks could offer strategic buying opportunities, especially near key moving averages and lower channel boundaries.

Broader Market Implications

The surge in Silver price above $94.00 carries broader implications for both commodity markets and investor portfolios. Precious metals often act as a hedge against inflation and macroeconomic uncertainty, meaning sustained strength in XAG/USD could signal continued demand for safe-haven assets.

Additionally, the ongoing bullish trend in Silver may influence correlated assets, including mining stocks, ETFs, and other metals like gold, which often move in tandem during periods of heightened market volatility.

Conclusion

In summary, Silver price (XAG/USD) remains firmly in a bullish trend, supported by an ascending channel, rising moving averages, and robust momentum indicators. The all-time high of $94.15 underscores the strength of the current rally, though traders should remain mindful of overbought conditions, as indicated by the RSI at 72.65.

Overall, the technical outlook favors continued bullish momentum, with potential consolidation or minor pullbacks offering strategic entry points for traders seeking to capitalize on the precious metal’s historic rally. As long as XAG/USD remains above its short- and medium-term averages, bulls retain control, and Silver may test new record highs in the near term.