The precious metals sector is showing unusual disparities today. Silver is performing strongly, yet mining stocks are failing to follow suit. This disconnect is becoming more pronounced, raising critical questions for traders and investors.

Understanding the broader macro context, including USD movements and cryptocurrency signals, is essential to decipher what’s happening. Orbisolyx brokers outline the most important details of the topic with precision.

Bitcoin: The Canary in the Gold Mine

Bitcoin is often referred to as an anti-USD asset, and recent price action may be sending an early warning. After failing to sustain gains above $120,000, bitcoin formed a monthly flag pattern, which now appears to be completing. Technical analysis suggests that bitcoin is likely to slide, potentially falling to around $60,000.

Why does this matter for precious metals? A declining anti-dollar asset signals that the US dollar could strengthen in the near term. Since silver and gold often move inversely to the USD, this could pressure the broader precious metals sector, even as silver continues to show strength.

It’s Not the Dollar: It’s the Reaction That Matters

The USD Index (DXY) is currently trading sideways, hovering near its April low. After reversing in September, the index now appears to be forming the right shoulder of an inverse head-and-shoulders pattern, with a broad July-September head.

Yet the key takeaway is not the USD’s level itself but rather how markets react to it. Miners are declining despite silver’s gains, highlighting a disconnect. This is crucial because it demonstrates that investor sentiment, risk appetite, and positioning can diverge from raw index levels, creating trading opportunities for astute market participants.

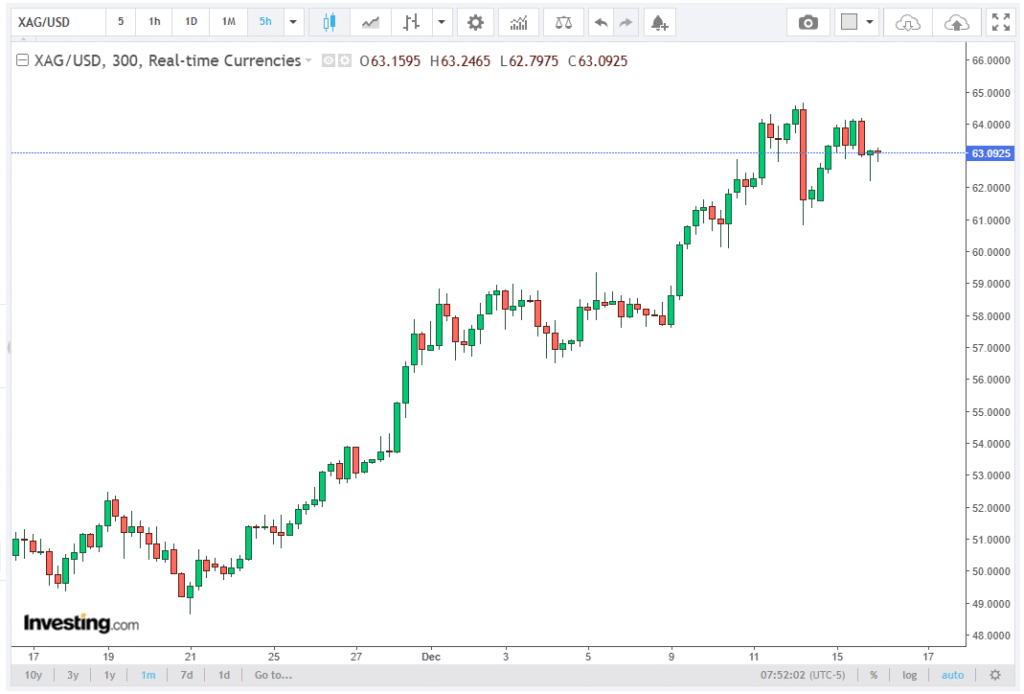

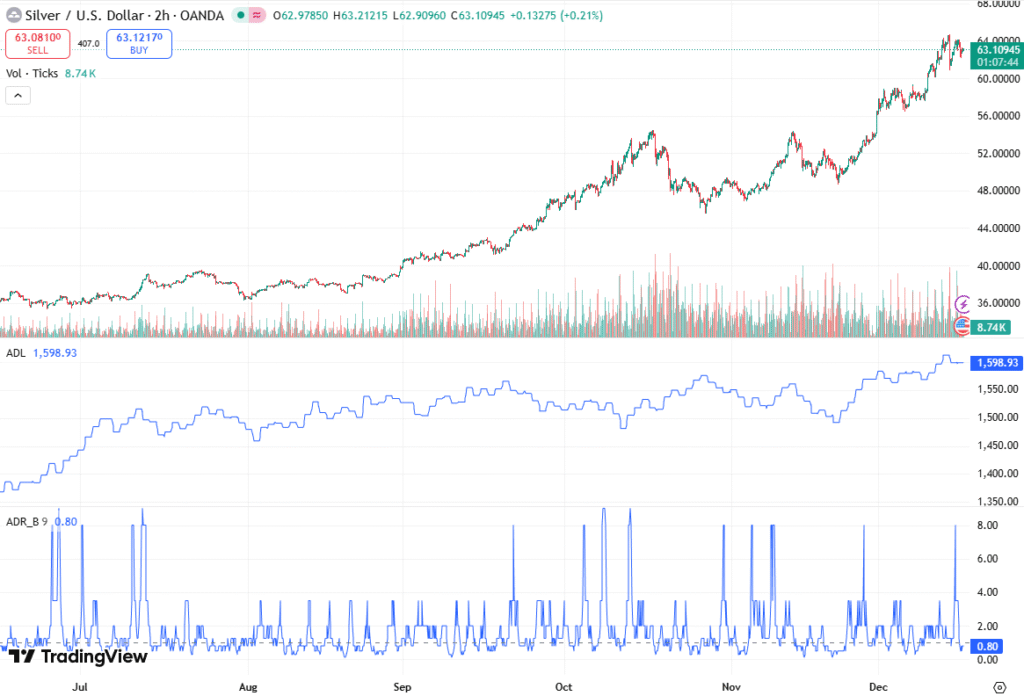

Silver: Strength Amid Weakness

Silver is currently rallying, supported by a multitude of factors ranging from industrial demand to inflation hedging considerations. The metal seems to be disconnecting from miners, who are under pressure despite higher silver prices.

This divergence is unusual: historically, silver miners tend to move in tandem with the spot metal. Today’s strength in silver alongside weakness in miners could indicate short-term profit-taking or concerns about margins and operational costs affecting mining equities.

Meanwhile, platinum has soared, likely influenced by its proximity to technical resistance and the 2011 highs. Traders may have self-fulfilling expectations that the metal will test these historical highs, adding momentum to the rally.

Platinum: A Special Case

While silver is attracting attention, platinum’s recent surge highlights how historical levels can influence trader behavior. The metal’s 2011 highs are just ahead, creating a potential psychological target. Such technical targets often act as catalysts for momentum trading, which may explain today’s strong performance.

Crypto Flashes a Warning Signal

Returning to Bitcoin, the sell signal is noteworthy. Completing a monthly flag pattern often precedes a price continuation in the previous trend, which, in bitcoin’s cas,e was a decline from $120k to $80k.

If bitcoin repeats a similar 35% drop, the asset could reach $60k, reinforcing the idea of a strengthening USD environment. For traders in precious metals, this is a critical signal: anti-dollar assets underperforming can precede pressure on gold and silver miners, even if spot silver continues to rally.

Miners: Vulnerable Despite Silver’s Rally

The disconnect between silver and miners is stark. While the white metal benefits from multiple supporting factors, miners are vulnerable, likely to underperform without further sustained rallies in the broader sector.

This highlights an important trading principle: not all assets in a sector move together, and technical divergences can provide both warning signals and short-term opportunities. For instance, long silver positions may remain profitable in the short term, but exposure to miners requires caution.

Strategic Implications

Strategic implications suggest closely monitoring Bitcoin as a leading indicator of USD strength and tracking miner reactions to silver movements to identify sector divergences. Attention should be paid to technical patterns, such as the inverse head-and-shoulders in the USD Index, which could influence broader market dynamics.

Platinum’s resistance levels and historical highs may trigger momentum-driven rallies. Overall, while silver remains strong, other precious metals equities and miners are still exposed, and macro and technical signals indicate that traders should watch both metals and crypto to anticipate potential shifts in the USD environment.

Conclusion

The disconnect between silver and miners is real and significant. Silver’s upward momentum contrasts sharply with miner weakness, and the USD’s sideways trading alongside bitcoin’s sell signal adds a cautionary tone.

For traders, this is a complex landscape where divergences can indicate short-term opportunities or warnings. The key is to remain vigilant, analyze technical patterns, and understand how interconnected assets like crypto, USD, and precious metals influence one another.

Silver may enjoy its rally for now, but miners and other sector components could face headwinds without additional catalysts. Understanding these relationships is essential for navigating today’s volatile markets.