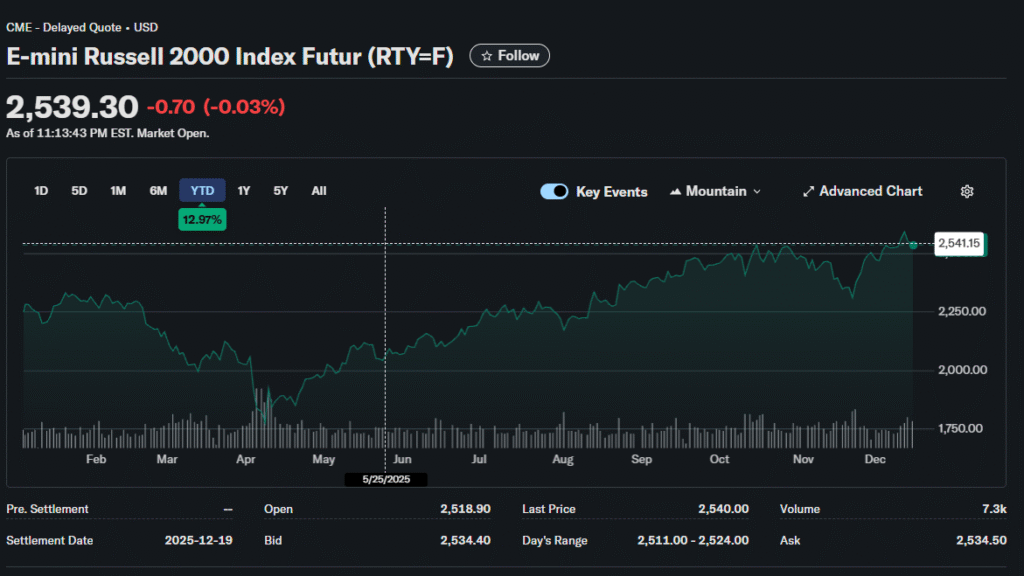

A financial expert at Rineplex analyzes the Russell 2000’s surge to all-time highs in December, capping a remarkable 12% rally over 15 trading days. The small-cap benchmark’s breakout marked a dramatic reversal after years of underperformance versus mega-cap technology.

The Great Rotation Begins

Small-cap stocks finally claimed the attention that investors lavished on the Magnificent Seven throughout 2024-2025. The Russell 2000 climbed while the Nasdaq consolidated. This divergence signaled a meaningful style shift rather than a temporary blip.

Value-oriented investments outpaced growth strategies significantly. Large-cap value benchmarks finished 0.6% higher weekly while growth counterparts dropped 1.5%. This spread demonstrated investors seeking opportunities outside expensive technology.

Market breadth improved noticeably as more stocks participated in advances. The concentration risk from a handful of mega-caps dominating returns diminished. Portfolio managers welcomed diversification of performance drivers across the market capitalization spectrum.

Rate Sensitivity Plays

Small-cap companies demonstrated heightened sensitivity to interest rate expectations. These businesses typically carried more variable-rate debt than large corporations. Fed rate cuts directly improved their financing costs and profitability outlooks.

Many analysts emphasized that regional banks, substantial Russell 2000 components, benefited from yield curve dynamics. Steeper curves between short and long rates enhanced net interest margins for traditional lending businesses.

Commercial real estate exposure among smaller companies created both risk and opportunity. Property valuations stabilized as financing costs declined. However, office sector challenges persisted regardless of monetary policy shifts.

Domestic Focus Advantage

International exposure became a liability in 2025 as trade tensions flared. Small-cap companies generated 70-80% revenue domestically, insulating them from tariff uncertainties and currency fluctuations plaguing multinationals.

This geographical focus provided relative predictability, missing from global giants navigating geopolitical complexity. Investors valued simpler business models during periods of macro uncertainty.

Manufacturing reshoring trends particularly benefited domestic-oriented industries. Government incentives for local production created tailwinds absent in previous decades. Supply chain security considerations trumped pure cost optimization.

M&A Activity Resurgence

Private equity firms accumulated substantial dry powder seeking deployment opportunities. Smaller public companies trading below intrinsic values attracted buyout interest. Premium valuations from acquisitions supported index performance.

Strategic buyers from larger corporations also hunted targets. Technology giants sought specialty capabilities through acquisitions rather than internal development. This dynamic compressed small-cap discounts relative to large-caps.

However, antitrust scrutiny intensified under the current administration. Regulatory approval timelines have been extended significantly. Deal breakage risk increased, creating volatility around announcement spikes.

Earnings Leverage

Smaller companies demonstrated greater operating leverage in economic improvement. Fixed cost bases meant incremental revenue dropped more directly to the bottom line. This characteristic attracted investors anticipating a cyclical recovery.

Margin expansion potential exceeded large-cap peers already operating efficiently at scale. Cost-cutting initiatives from recent years positioned many small-caps for profitability inflection points.

However, earnings volatility worked both ways. Economic softening would hit small-caps harder than diversified giants with stable cash flows. This risk-reward asymmetry attracted traders more than conservative long-term holders.

Valuation Gap Narrows

Small-caps traded at persistent discounts to large-caps throughout the technology-dominated rally. The Russell 2000 forward P/E multiple approached 15 times, below the Nasdaq 100’s 30 times. This spread compressed as rotation accelerated.

Value investors argued the gap was unjustified given the relative growth prospects. While tech giants boasted impressive margins, smaller companies offered cyclical recovery potential and M&A optionality.

Historical analysis showed small-cap outperformance typically persisted 12-18 months once initiated. Current moves potentially mark early innings rather than an exhausted rally nearing completion.

Sector Leadership Shifts

Industrials and financials led small-cap advances. These economically sensitive sectors benefited from stable growth expectations and easing financial conditions. Energy names rebounded from oil price weakness on valuation support.

Healthcare biotechnology components showed mixed performance. Clinical trial results and regulatory decisions drove individual stock outcomes more than broader market trends. Portfolio concentration risks remained elevated in this segment.

Consumer discretionary small-caps faced crosscurrents. Restaurant chains and retailers grappled with cautious consumer spending. However, specialty concepts with differentiated offerings outperformed generic competitors.

Technical Breakouts

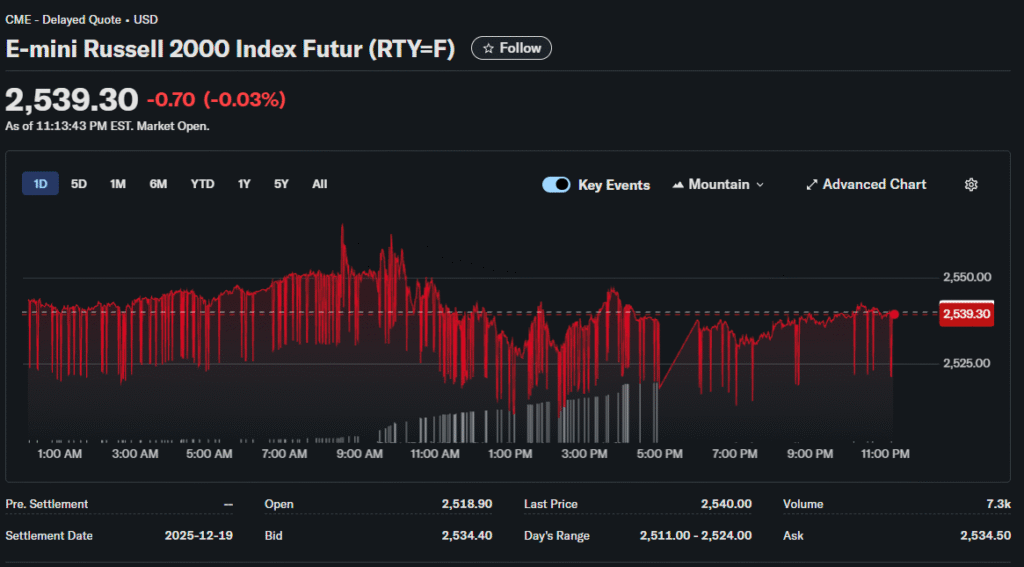

The Russell 2000’s decisive move above resistance around 2,400 triggered technical buy signals. Momentum indicators turned positive after extended neutral periods. Volume expansion confirmed conviction behind advances.

Options markets showed increasing call activity at out-of-money strikes. This positioning suggested traders anticipated additional upside rather than fading moves. Implied volatility remained elevated, reflecting uncertainty about sustainability.

Short interest declined across the small-cap universe as bears covered positions. This short squeeze element accelerated price advances beyond fundamental justifications initially. Subsequent follow-through would determine whether rallies had staying power.

Risk Factors Loom

Economic slowdown would disproportionately impact smaller companies lacking fortress balance sheets. Credit access could tighten while refinancing walls approached. Liquidity remained challenging with thin trading volumes making large position management difficult.

Small-cap inefficiency created fertile ground for stock selection. Index funds owned questionable businesses alongside quality names. Active managers differentiated through rigorous analysis, though fees mattered given lower return expectations.

Strategic Positioning

Small-cap rally sustainability depended on the economic trajectory. Soft landing scenarios favored continued rotation, while hard landings would reverse gains given sector sensitivity.

Portfolio diversification made sense for most investors rather than concentrated small-cap bets. The Russell 2000’s breakout potentially marked regime change after years of mega-cap dominance, though sustainability remained unproven entering 2026.