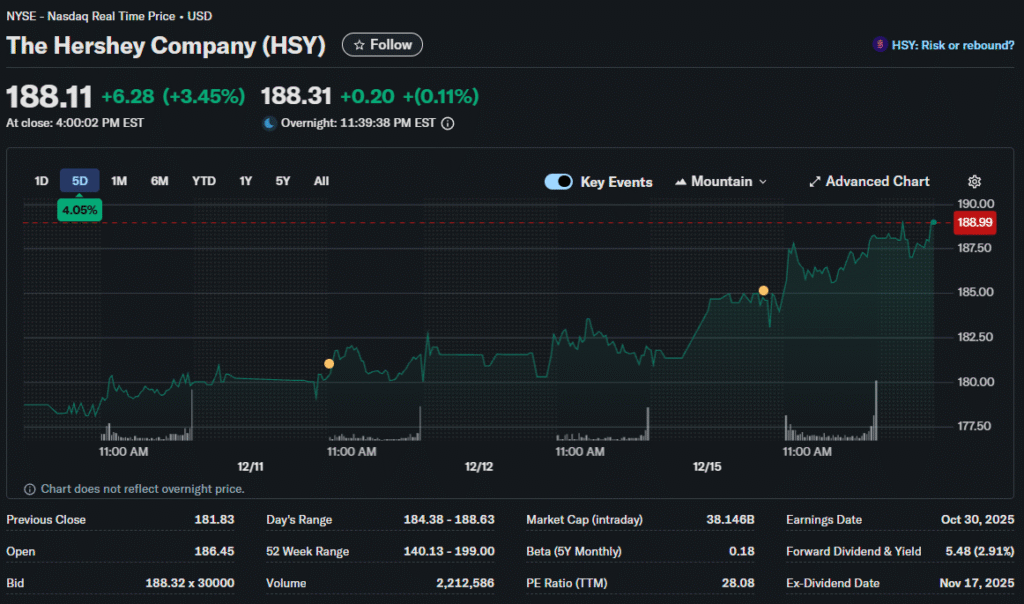

Wall Street’s renewed confidence in the chocolate giant reflects easing cocoa costs and improving market share dynamics. Morgan Stanley’s bullish call highlights a sector rotation into consumer staples.

A senior financial analyst at Fimatron walks you through why Hershey shares offer compelling value after brutal cost headwinds. The investment bank upgraded the stock to overweight from neutral while raising the price target to $211 from $195.

The Cocoa Crisis Eases

Hershey faced severe margin pressure as cocoa prices surged to record highs. The company implemented double-digit price increases across its confection portfolio to offset the commodity spike.

Those aggressive hikes risked alienating price-sensitive consumers during an inflationary period. However, the brand loyalty proved resilient enough to maintain volumes despite higher shelf prices.

Recent months showed cocoa costs moderating from peaks. While still elevated historically, the direction of change matters as much as absolute levels. Declining input costs allow margin expansion without further price increases.

Market Share Stabilizes

Category momentum improved across chocolate segments. Total candy consumption grew as consumers treated themselves despite economic pressures. Small indulgences offer affordable luxury during uncertain times.

Hershey’s share trends stabilized after periods of erosion to private labels and smaller brands. The company’s product innovation and marketing investments appear to be paying off in shelf space battles.

Seasonal performance remains critical for confectioners. Halloween and holiday periods generate disproportionate annual sales. Strong execution during these windows compounds throughout the year.

Earnings Revision Cycle Turns

Morgan Stanley analysts noted Hershey endured “one of the most significant periods of negative revisions in its history.” Earnings estimates fell repeatedly as cost pressures exceeded expectations.

The revision curve now turns decisively upward. Improving fundamentals drive analyst upgrades that create positive momentum. Companies emerging from downgrade cycles often outperform as sentiment shifts.

EPS growth should accelerate above consensus over coming quarters. The combination of moderating costs and pricing power creates operating leverage that flows directly to bottom-line results.

Valuation Opportunity

The stock trades at 10-year relative lows versus broader market multiples. This discount reflects the pain of recent years but underappreciates improvement ahead.

Implied upside of 16% to Morgan Stanley’s target provides compelling risk-reward. Defensive consumer staples rarely offer double-digit return potential, making Hershey attractive relative to alternatives.

Dividend yield adds to total return prospects. The company maintained distributions through difficult periods, demonstrating commitment to shareholder returns.

Competitive Landscape

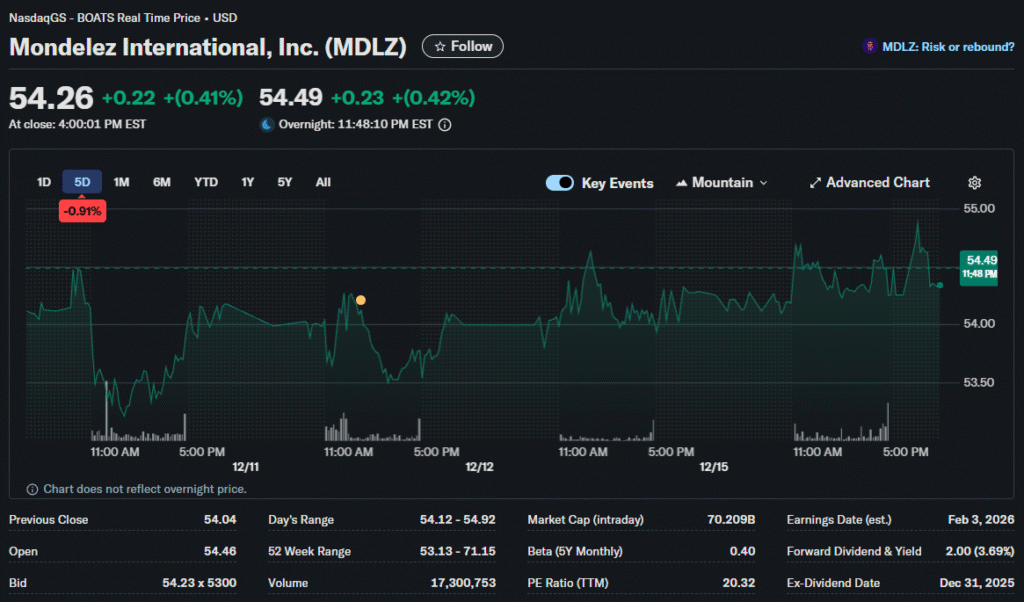

Mars, Mondelez, and Ferrero compete intensely for premium shelf space. Each company emphasizes different strategies ranging from mass market to premium positioning.

Hershey’s broad portfolio spans price points and consumption occasions. This diversification reduces dependence on any single product category or consumer segment.

Private label competition intensified during inflation as shoppers traded down. However, chocolate enjoys stronger brand loyalty than many categories. Consumers often splurge on preferred brands even while economizing elsewhere.

Consumer Behavior Shifts

Health consciousness trends created headwinds for traditional candy. However, portion control and dark chocolate variants address these concerns while maintaining premiums.

Experiential spending competed with packaged goods during pandemic recovery. Restaurants, travel, and entertainment captured wallet share that previously flowed to at-home consumption.

Recent quarters suggest rebalancing as experiential inflation exceeds goods pricing. Consumers substitute back toward products when services become prohibitively expensive.

Supply Chain Improvements

Sourcing flexibility increased as Hershey diversified cocoa origins. Depending on single regions created vulnerability to weather and political disruptions.

Manufacturing efficiency gains offset some inflation impact. Capital investments in automation and process improvements reduce unit costs structurally.

Distribution optimization through direct-to-consumer channels complements traditional retail. Online ordering and subscription models create higher-margin revenue streams.

M&A Speculation Persists

Hershey’s controlling trust structure complicates potential acquisitions. The Hershey Trust controls voting shares and prioritizes Pennsylvania employment and community commitments.

Mondelez previously pursued the company unsuccessfully. Strategic logic remains compelling for global food conglomerates seeking U.S. confection exposure.

Depressed valuations make the company more attractive to potential acquirers. However, the trust’s governance makes hostile transactions virtually impossible.

Sector Rotation Benefits

Consumer staples attract capital during market uncertainty. Investors seek predictable cash flows and dividend income when growth stocks face pressure.

Defensive characteristics include stable demand regardless of economic conditions. People buy chocolate during booms and busts, though volumes might shift slightly.

Bond proxies describe high-dividend stocks that substitute for fixed income. Staples offer equity upside potential with income closer to bonds than typical growth companies.

Looking Forward

2026 guidance should reflect improved cost structure and pricing stability. Management credibility rebuilds through consistent execution after difficult quarters. Innovation pipeline drives growth beyond core products. Limited edition flavors, functional ingredients, and format variations keep brands relevant.

International expansion offers long-term upside. Developed markets show maturity, but emerging economies provide growth runways as incomes rise.

The upgrade signals broader consumer staples strength rather than Hershey-specific developments. Investors rotate into defensive sectors when economic uncertainty rises.

Fundamentals appear aligned with improving earnings trajectory. The combination of easing input costs and operational excellence creates margin expansion potential.

Patient investors willing to hold through volatility could capture upside as the story unfolds. The risk-reward appears favorable for those believing in the turnaround thesis.