Artificial intelligence darlings faced sharp selling pressure as investors shifted capital into economically sensitive sectors. The move signals growing confidence in broader economic growth despite Big Tech’s recent dominance.

Fimatron‘s lead financial expert explores why mega-cap technology names lost favor heading into December’s final weeks. The Nasdaq Composite dropped 0.59% on Monday, underperforming both the S&P 500 and Dow Jones Industrial Average as AI-related stocks gave back recent gains.

Broadcom and Oracle Lead Declines

Broadcom shares plunged more than 5% following concerns about debt-driven AI infrastructure spending. The semiconductor giant had rallied strongly before last week’s earnings report, making it vulnerable to profit-taking once results failed to justify stretched valuations.

Oracle extended its multi-session selloff, down another 2% after disappointing quarterly revenue. The database software company missed the $16.21 billion consensus estimate despite strong AI infrastructure demand. Investors questioned whether hyperscale cloud providers might internalize more database functions rather than licensing Oracle’s products.

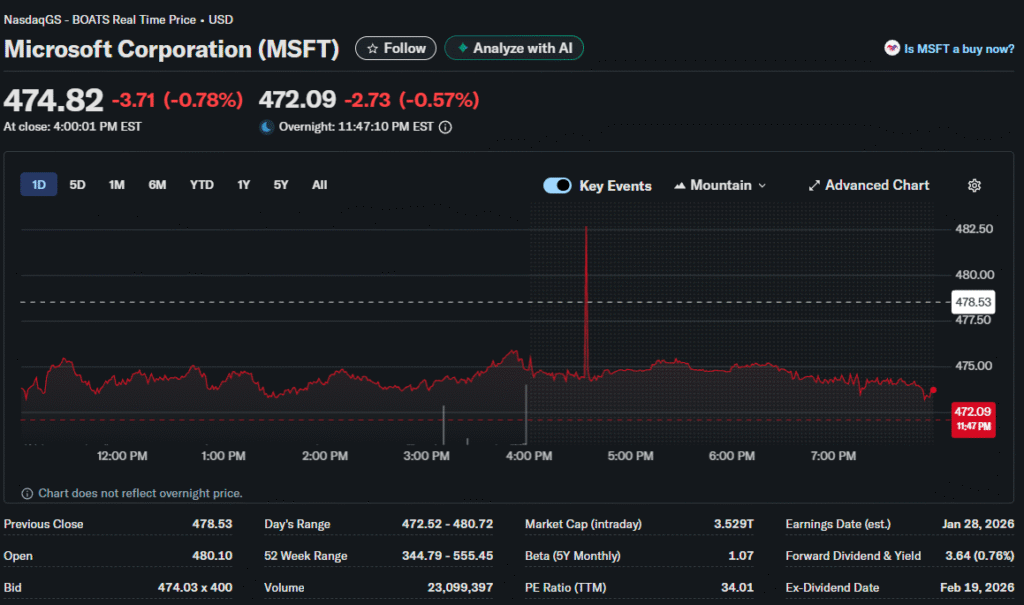

Microsoft also declined as the rotation away from technology accelerated. Even companies with solid fundamentals faced selling pressure as capital flowed toward previously lagging sectors.

Where Money Is Moving

Consumer discretionary stocks attracted buying as investors bet on resilient holiday spending. Industrials also gained ground on expectations that economic growth will drive demand for capital equipment and commercial services.

Healthcare shares rose as the sector offers defensive characteristics plus exposure to pharmaceutical innovation and medical device advances. This combination appeals when technology valuations appear stretched.

Financials benefited from higher interest rates that expanded net interest margins for banks. The 10-year Treasury yield climbed more than 15 basis points from recent lows, making lending more profitable.

The AI Spending Question

Markets grapple with whether massive AI capital expenditures will generate sufficient returns. Cloud providers and semiconductor manufacturers have invested hundreds of billions developing AI infrastructure. Revenue growth must eventually justify these outlays.

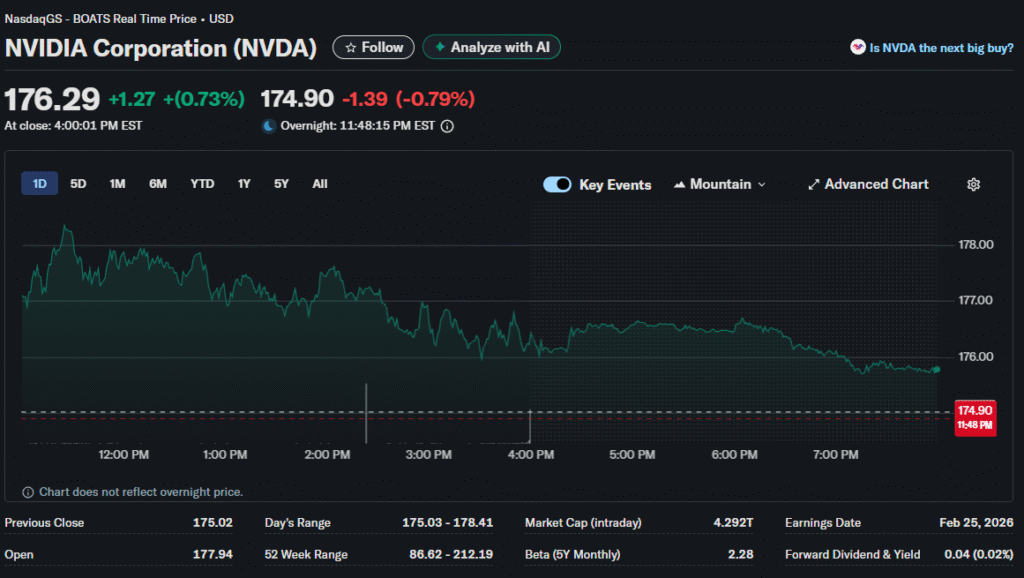

Nvidia attempted a comeback, rising 1.2% in premarket trading after nearly 4% losses last week. The chipmaker remains central to AI infrastructure buildouts, but investors question sustainability after shares tripled over 18 months.

The PHLX Semiconductor Index dropped 5% Friday in its worst single-day performance since April. Despite this setback, the index remains up more than 30% year-over-year, reflecting strong secular demand for chips powering AI workloads and data centers.

Valuation Concerns Surface

Technology stocks trade at elevated multiples compared to historical averages and the broader market. The Nasdaq recently traded at roughly 30 times forward earnings, well above the S&P 500‘s 20 times multiple.

These premium valuations require consistent earnings growth to justify. Any slowdown in revenue expansion or margin compression quickly pressures stock prices when investors reassess risk-reward tradeoffs.

Broadcom‘s margin commentary during its earnings call sparked concern that competition and customer negotiations might squeeze profitability. Even small margin decreases matter when companies trade at high earnings multiples.

Historical Context

The S&P 500 has generated 17.5% returns in 2025, with technology stocks contributing disproportionately to that performance. This concentration in a handful of mega-cap names resembles patterns seen before previous market corrections.

Rotation into cyclical sectors actually strengthens the market foundation if it occurs gradually. Broadening participation reduces dependence on a small group of stocks and creates healthier market structure.

The challenge arises when rotation accelerates into forced selling rather than orderly rebalancing. Momentum unwinds can create overshooting in both directions as algorithmic trading amplifies moves.

Interest Rate Impact

Rising bond yields create headwinds for growth stocks whose valuations depend on discounting distant cash flows. Higher discount rates mechanically reduce present values, making long-duration assets less attractive.

The Federal Reserve cut rates three times in 2025, yet the 10-year yield has climbed. This reflects inflation concerns and fiscal debt worries that supersede monetary policy easing. Technology companies face particular pressure from this dynamic.

What Analysts Say

Wedbush raised its price target for Micron Technology ahead of the memory chipmaker’s earnings. Jefferies and Wells Fargo increased targets for Applied Materials. These upgrades suggest analysts still see value in semiconductor equipment makers despite recent volatility.

Bank of America upgraded Visa to overweight, calling the payment processor’s valuation attractive at 10-year relative lows. This highlights opportunities emerging as capital rotates away from hyper-growth technology into stable compounders.

The December Effect

Historical patterns show December often brings year-end rallies as institutional managers adjust positions and holiday sentiment prevails. However, 2025 has already delivered strong returns that may reduce remaining upside.

Tax-loss selling could pressure lagging stocks while winners face profit-taking before capital gains reset in January. These technical factors sometimes overwhelm fundamental developments during the year’s final weeks.

Investment Implications

The rotation from technology into cyclicals doesn’t necessarily signal a bear market. Instead, it might reflect healthy broadening as investors recognize value beyond mega-cap growth stocks that dominated recent years.

Diversification becomes more important when sector leadership shifts. Portfolios concentrated in last year’s winners often underperform when market dynamics change, even if overall conditions remain constructive.

Technology will likely remain important for long-term growth. The question is whether valuations accurately reflect reasonable expectations versus extrapolating unsustainable trajectories. Current repricing might create better entry points for patient capital.