The S&P 500 recorded its fourth consecutive losing session on Wednesday, falling 1.16% to 6,721.43. The traditional “Santa Claus rally” appears missing in action despite historical patterns suggesting strength during late December. Year-end optimism has given way to persistent selling pressure.

Logirium‘s junior financial expert explores the conspicuous absence of year-end strength as markets struggle through what should be their most reliable seasonal period. The phenomenon typically occurs during the last five trading sessions of the old year and first two of the new year, producing positive returns in roughly 79% of instances since 1950.

Historical Context Matters

Market folklore attributes the Santa rally to multiple factors. Thin trading volumes amplify moves in either direction. Institutional portfolio managers finish positioning before holiday breaks. Tax-loss selling concludes, removing pressure. Retail investors deploy year-end bonuses.

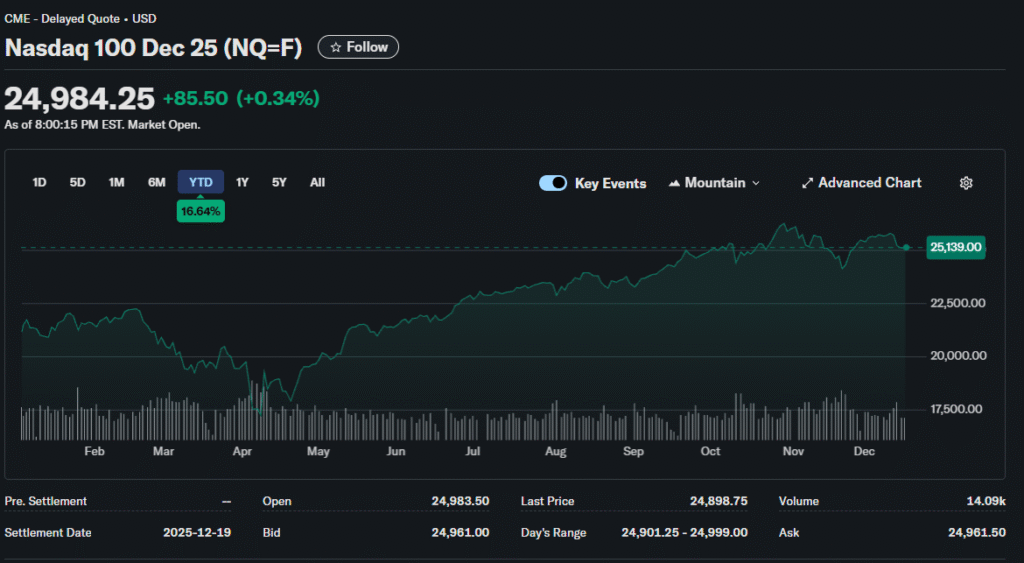

This December has defied seasonal tendencies across multiple timeframes. The month ranks among the weakest in recent years. Technology-heavy indexes have performed especially poorly relative to historical December patterns.

Previous instances when Santa failed to arrive often preceded challenging periods. The 2000 and 2008 bear markets both featured absent year-end rallies. While past performance doesn’t guarantee future results, the pattern commands attention.

Technical Damage Accumulates

The S&P 500’s breach of its 50-day moving average carries significance beyond simple chart watching. This level had provided consistent support since early autumn. Its failure suggests a weaker underlying market structure.

Trading at 6,721 represents the lowest close in three weeks. The index has now given back approximately 4% from recent all-time highs. While modest in absolute terms, the timing and character of the decline warrant concern.

Market breadth statistics show deterioration across multiple measures. Declining stocks have outnumbered advancers substantially. The advance-decline line has rolled over from previous strength. These internal indicators often lead to price action.

Sector Rotation Dynamics

Technology shares bore the brunt of recent weakness. The Nasdaq Composite lost 1.81% Wednesday to close at 22,693.32. Eight consecutive sessions of underperformance have damaged the sector that led markets higher for most of 2025.

Financial stocks have shown relative strength during the tech selloff. Regional banks and major money centers both outperformed broader indexes. This rotation suggests investors seek value and cyclical exposure over growth.

Healthcare advanced modestly despite weak overall markets. Defensive sectors typically attract capital during uncertain periods. The shift from offense to defense signals a change in investor psychology.

Volume Patterns Reveal Intent

Trading volume has remained elevated throughout the December weakness. Heavy selling volume indicates genuine distribution rather than illiquid markets creating false signals. Professional money appears to be reducing equity exposure.

The Nasdaq showed particularly heavy volume on Wednesday with decliners outnumbering advancers by roughly 2.1-to-1. This overwhelming negative breadth on high volume suggests institutional conviction behind the selling.

End-of-year window dressing typically creates buying pressure as fund managers boost holdings of winners. The absence of this traditional support removes an important technical pillar for markets.

Macro Headwinds Intensify

Federal Reserve policy uncertainty weighs on sentiment despite Wednesday’s rate cut. The central bank’s cautious guidance disappointed investors hoping for more aggressive easing. Fewer projected 2026 rate cuts reduce support for risk assets.

Inflation persistence complicates the Fed’s decision-making. Core measures remain above target despite recent progress. Sticky services inflation suggests the final mile toward 2% may prove challenging.

Labor market data has sent mixed signals. Job growth slowed considerably, but unemployment hasn’t spiked dramatically. This lukewarm deterioration creates uncertainty about recession risks and appropriate policy response.

Political Calendar Pressure

Approaching political transitions creates additional uncertainty. New administration policies remain unclear across multiple dimensions. Investors dislike ambiguity and often reduce exposure until clarity emerges.

Tariff policy presents particular concern for multinational corporations. Previous trade tensions disrupted supply chains and pressured margins. The possibility of renewed conflicts keeps portfolio managers cautious.

Tax policy changes could affect after-tax earnings substantially. Speculation about corporate rate adjustments influences valuation assumptions. This uncertainty discourages aggressive positioning ahead of potential changes.

Year-End Positioning

Institutional investors have largely completed annual rebalancing. This removes a potential source of buying demand. Many fund managers now focus on January positioning rather than late December trading.

Retail investor sentiment has soured from earlier enthusiasm. Survey data shows declining bullishness and rising concern. Individual investors often provide marginal buying power during quiet holiday periods.

Hedge funds face performance pressure with limited time to improve annual returns. This urgency can drive volatile trading as managers chase gains or cut losses. The resulting volatility creates challenging conditions.

International Market Weakness

European indexes have underperformed U.S. counterparts substantially. Economic growth concerns plague the continent. Political instability in several countries adds to investment risks.

Asian markets show mixed performance, with China particularly weak. Property sector problems continue weighing on confidence. Government stimulus measures have disappointed in scale and effectiveness.

Strategic Assessment

The missing Santa rally doesn’t guarantee disaster ahead. Markets can consolidate healthily after strong advances. Current weakness may simply reflect the need for digestion of gains.

However, the seasonal failure combined with technical deterioration warrants attention. Investors should monitor whether support levels hold or additional weakness emerges. The character of any recovery attempt will provide important information about underlying strength.