The US Consumer Price Index (CPI) is forecast to rise 3.1% year-on-year (YoY) in November, slightly higher compared with September’s 3% reading. The inflation report will not include monthly CPI figures, making the annual CPI and core CPI prints even more significant for investors.

The Servelius team presents a comprehensive and well-organized overview of the topic. The upcoming CPI data is expected to influence the US Dollar (USD) valuation and shape expectations for a potential Federal Reserve (Fed) rate cut in January 2026.

Upcoming US CPI Release: Timing and Context

The United States Bureau of Labor Statistics (BLS) is set to release the November CPI data on Thursday at 13:30 GMT. Due to the recent government shutdown, the report will exclude CPI figures for October and monthly CPI prints for November.

Consequently, investors and analysts are placing greater emphasis on the annual CPI and core CPI, which excludes the volatile food and energy sectors. These metrics are critical to gauge the inflation trajectory and determine whether the Fed will maintain its current monetary policy or implement a rate adjustment.

CPI Forecast: Inflation Expected to Rise Slightly

According to market expectations, headline inflation in November is projected to increase 3.1% YoY, marginally above September’s 3%.

Meanwhile, core CPI, which removes food and energy price volatility, is expected to hold steady at 3%. Analysts at TD Securities suggest a slightly higher forecast of 3.2% YoY for headline CPI, driven primarily by rising energy costs, while core inflation remains stable at 3%.

TD Securities analysts noted that the US CPI is likely to post its fastest pace since 2024, reflecting ongoing energy price pressures and the persistent resilience of core inflation. This data could provide early signals about whether inflation pressures are easing or remaining stubborn, which is a key factor influencing monetary policy decisions.

Monitoring these trends is crucial for investors, policymakers, and market participants seeking to anticipate shifts in the economic landscape.

Implications for the US Dollar and Fed Policy

Ahead of the release, the CME FedWatch Tool shows a ~20% chance of a 25-basis-point Fed rate cut in January 2026.

Recent employment data has offered mixed signals. The delayed Nonfarm Payrolls report showed a decline of 105,000 jobs in October, followed by a 64,000 increase in November, while the Unemployment Rate climbed to 4.6% from 4.4% in September.

These figures have had a muted impact on market expectations for the January Fed decision, as the October job loss was largely driven by the government shutdown.

Atlanta Fed President Raphael Bostic emphasized that despite the mixed jobs report, inflation pressures remain present. According to Bostic, firms are raising prices to preserve margins, reflecting ongoing input cost pressures.

Market Scenarios: CPI Impact on USD

The CPI report could significantly influence the USD. In a high inflation scenario, a headline CPI print of 3.3% or higher could reinforce expectations of a Fed policy hold in January, potentially boosting the USD immediately. Conversely, a soft CPI reading of 2.8% or lower might encourage market participants to anticipate a rate cut, putting downward pressure on the USD.

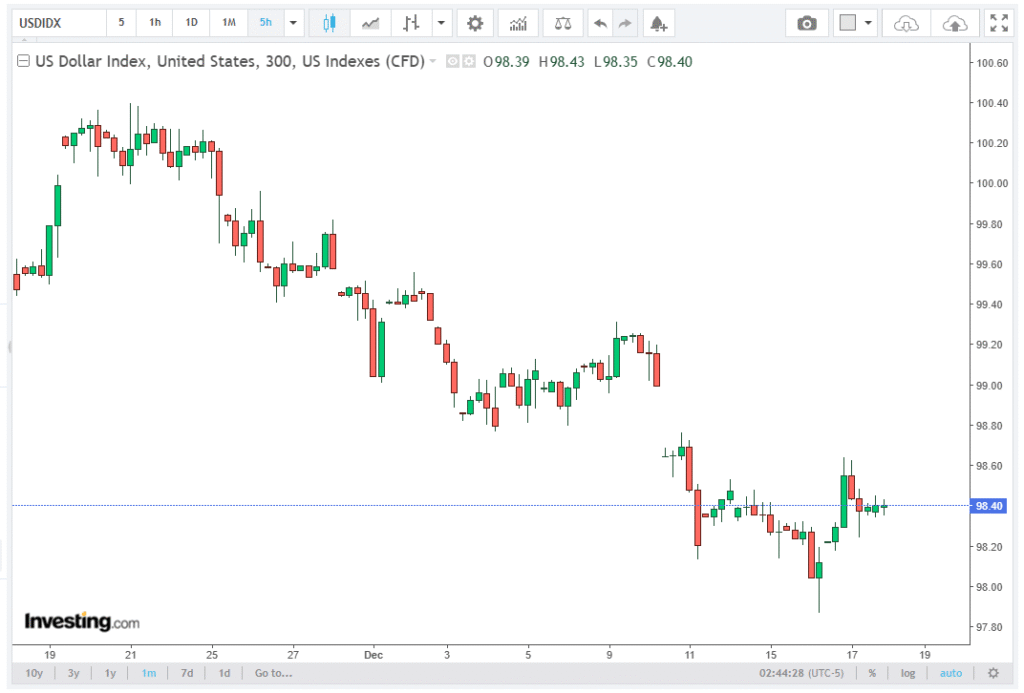

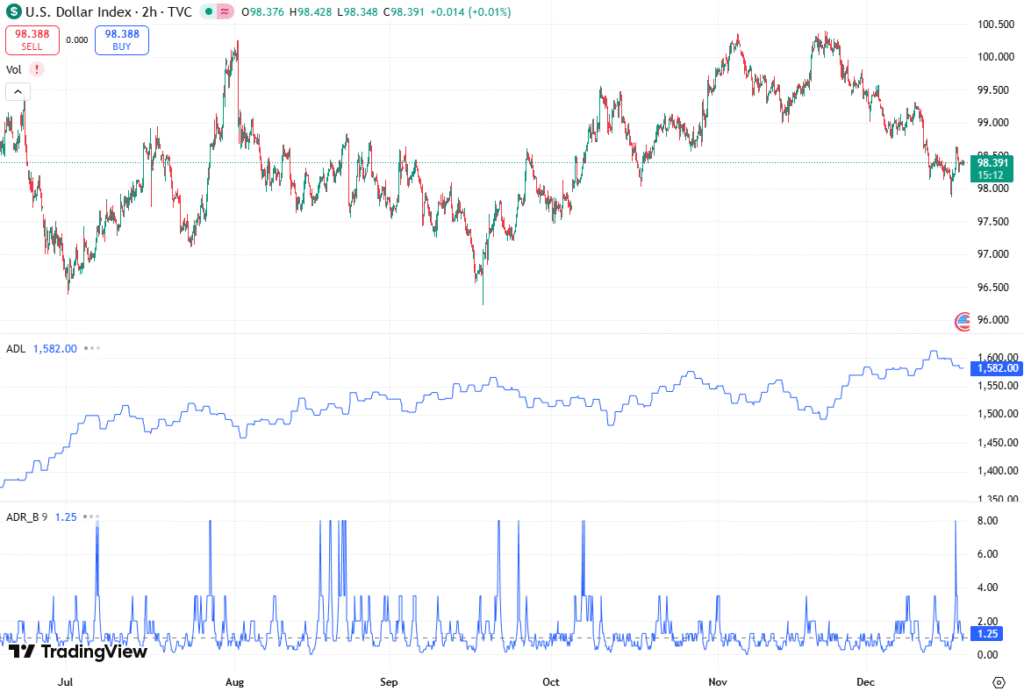

The technical outlook for the USD Index supports a cautiously bearish bias, although some indicators suggest a loss of negative momentum. The Relative Strength Index (RSI) on the daily chart has recovered above 40, signaling potential stability. The Fibonacci 50% retracement of the September-November uptrend acts as support, while the 100-day Simple Moving Average (SMA) at 98.60 is a key pivot level.

On the upside, resistance levels include the Fibonacci 38.2% retracement at 98.85 and the 200-day SMA near 99.25-99.40. Downside support levels are defined at the Fibonacci 61.8% retracement at 98.00, followed by 97.40 (78.6% retracement) and the 97.00 round level.

Conclusion

The November CPI report is set to be a pivotal release for US inflation monitoring, the Fed’s monetary policy outlook, and USD market positioning.

Investors will focus on annual CPI and core CPI figures, given the absence of monthly CPI prints, to assess whether inflation pressures are persistent or easing.

A higher-than-expected CPI could reinforce the Fed’s current stance, supporting a stronger USD, while a softer print might increase market bets on a January rate cut, potentially weakening the USD in the near term.

Technical traders will watch key Fibonacci retracement levels, SMA support/resistance, and RSI momentum, all of which could guide USD Index movements following the CPI announcement.

With headline inflation projected at 3.1% YoY and core CPI steady at 3%, markets remain alert for any signs that the Fed might adjust its policy path, making Thursday’s CPI release a critical market event.